KANSAS CITY — Formulators seeking sweeteners to aid in sugar reduction efforts should know the sweeteners themselves are changing. Structural changes, fermentation research and growing methods for plants that contain sweetener extracts are bringing new ingredients to market. Even the sugar molecule itself may be altered, as evidenced by research from Nestle S.A., Vevey, Switzerland.

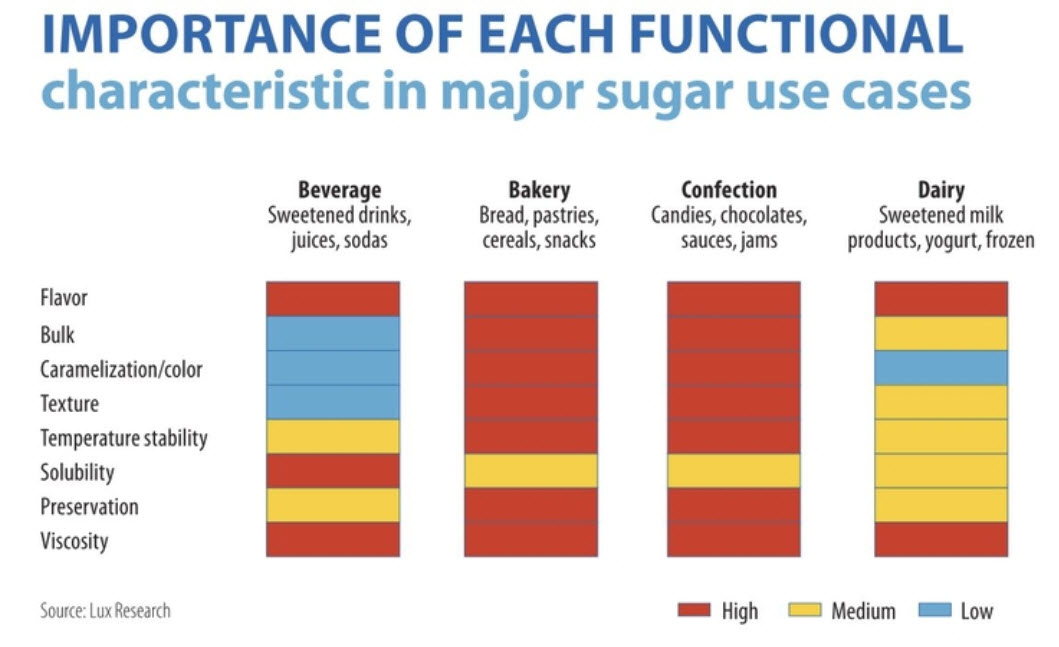

Yet one ingredient alone may not lead to successful sugar reduction. A blend of bulking agents and high-intensity sweeteners may be required. A report from Boston-based Lux Research called “The state of innovation in sugar reduction: 2018 edition” promotes the blended approach. Lux Research evaluated 20 alternative sweeteners.

“Our analysis reaffirms that there is no clear front-runner solution,” the report said. “Clients will need to choose sugar reduction technologies thoughtfully, potentially in combination, to achieve their strategic goals.”

A breakthrough in restructuring sugar was announced late in 2016 by Nestle S.A. The company’s researchers transformed the structure of sugar through a process using natural ingredients. The aerated, porous particles of sugar dissolve more quickly in the mouth, which allows people to perceive the same level of sweetness as before while consuming less sugar.

Nestle U.K. and Ireland in March of this year unveiled Milkybar Wowsomes containing the restructured sugar. With 30% less sugar than similar chocolate products, Milkybar Wowsomes contains no artificial sweeteners, preservatives, colors or flavorings.

Nestle U.K. and Ireland in March of this year unveiled Milkybar Wowsomes containing the restructured sugar. With 30% less sugar than similar chocolate products, Milkybar Wowsomes contains no artificial sweeteners, preservatives, colors or flavorings.

Novel approaches like physical modifications hold promise, according to the Lux Research report.

The report praised a patented sugar reduction system from DouxMatok, Petach Tikva, Israel, although it placed DouxMatok in the development stage. Under the system, sugar is loaded onto silica. The silica acts as a transport vehicle to release the sugar onto the sweet taste receptors in the mouth, which means more of the sugar arrives at the site of the sweet taste to enhance the perception of sweetness, said Tom Hayes, research associate for Lux Research. The sweetener works especially well in chocolate, he added.

“There’s no difference in taste,” he said. “Inherently you’re not going to get a lot of off-taste that quite a few of the alternative sweeteners have.”

Sugar reductions of up to 40% may be achieved in products while retaining the same taste profile, according to DouxMatok, which means “double sweet” in Hebrew. The company in September 2017 announced it had received $8.1 million in funding to commercialize the sugar reduction system.

Embracing the perception of natural

Bringing down costs may make stevia extracts, monk fruit extracts and rare sugars like allulose more appealing in sugar reduction efforts, according to the Lux Research report.

“Genetics, agronomy and value chain improvement for alternative sweetener crops like stevia and monk fruit can make these options cheaper and more accessible to food companies,” the report said.

Improving the concentration of the sweeter steviol glycosides in stevia leaves is one example. GLG Life Tech Corp., Vancouver, B.C., and Archer Daniels Midland Co., Chicago, collaborated to add a sweetener product line with a high level of Reb M, a steviol glycoside that has more of a sugar-like taste. The Reb M sweeteners are made from GLG Life Tech’s proprietary high Reb M Dream Sweetener stevia leaf.

The fermentation of baker’s yeast, and not stevia leaves, leads to higher concentrations of Reb M and Reb D steviol glycosides in the new EverSweet sweetener offered by Cargill, Minneapolis. The company collaborated with Evolva, Reinach, Switzerland, in developing the sweetener.

“We are already working with a number of customers — from the largest food companies to small operations — on a wide variety of reduced sugar food and beverage applications,” said Andy Ohmes, global director of high-intensity sweeteners for Cargill. “In particular, we’re seeing high demand in the beverage, nutrition and dairy categories.”

EverSweet may bring more than just cost-reduction benefits, too.

“Our initial evaluation shows that producing our sweetener via fermentation will use significantly less land and emit significantly less CO₂ than producing it by growing acres of plants,” Mr. Ohmes said.

Mr. Hayes of Lux Research said, “We certainly believe that (EverSweet is) going to be able to reduce costs when compared to plant breeding. Just think about the amount of money and time that go into crop breeding. The fermentation should certainly be at a lower cost.”

Inulin from chicory root often is used as a bulking agent with stevia extracts. Branded inulin ingredients on the market are Frutafit inulin and Frutalose oligofructose from Sensus America, Inc., Lawrenceville, N.J.; Orafti inulin and oligofructose from Beneo Beneo, Inc., Parsippany, N.J.; and Oliggo-Fiber from Cargill.

Inulin from chicory root often is used as a bulking agent with stevia extracts. Branded inulin ingredients on the market are Frutafit inulin and Frutalose oligofructose from Sensus America, Inc., Lawrenceville, N.J.; Orafti inulin and oligofructose from Beneo Beneo, Inc., Parsippany, N.J.; and Oliggo-Fiber from Cargill.

“Chicory root fiber does work very well with stevia in that it can mask the off-tastes, as well as enhance the overall sweetness profile,” said Scott Turowski, technical sales manager for Sensus America. “We see this works particularly well in dairy and beverage applications, as well as in tabletop sweeteners.”

Chicory root fiber may replace up to 30% of the sugar in the applications without negatively affecting taste and texture in the finished product, he said.

“When used in combination with stevia, or other high-intensity sweeteners, it is possible to replace all of the added sugar while maintaining a sweetness profile that consumers find acceptable,” Mr. Turowski said.

Sensus has observed the masking and synergy properties of inulin regardless of what stevia product is used, he said.

Sensus has observed the masking and synergy properties of inulin regardless of what stevia product is used, he said.

Stevia also may be paired with monk fruit, another high-intensity sweetener that might bring along cost issues.

Senomyx, San Diego, is working on extracting a sweetener called siratose from luo han guo, also known as monk fruit. Siratose comprises less than 1% of luo han guo, but Senomyx is developing a fermentation strain to make siratose less costly to use as a sweetener.

“Based on our continued progress with siratose, our goal remains achieving a proof of concept for fermentation strain development by mid-2018,” said John Poyhonen, president and chief executive officer of Senomyx, when first-quarter results were reported April 26. “Assuming that we are able to achieve this goal, our next step will be to optimize that strain development process for eventual submission for our GRAS (Generally Recognized As Safe) notification to the F.D.A. by the end of 2019, keeping in mind the feasibility and timeline of these development activities is inherently uncertain.”

Senomyx itself may be changing, however. The company has engaged advisers to explore and evaluate strategic alternatives, including the possible sale of the company.

Rare sugars, which are those that exist in small quantities in nature, may offer bulking properties along with sweet sweetness.

“Rare sugars in general, whether it be allulose or tagatose, certainly hold promise,” Mr. Hayes said.

The rare sugar allulose is about 0.2 calories per gram but still 70% as sweet as sugar, which is 4 calories per gram.

The rare sugar allulose is about 0.2 calories per gram but still 70% as sweet as sugar, which is 4 calories per gram.

“Because you’re having bulk at a reduced caloric content, that’s where I see it’s really promising,” Mr. Hayes said.

Tate & Lyle, P.L.C., London, offers allulose sweeteners under the Dolcia Prima brand. Matsutani Chemical Industry Co. Ltd., based in Japan, offers allulose sweeteners under the Astraea brand.

Mr. Hayes added a hurdle for allulose and other rare sugars may be a high cost brought on by low yields.

Blends still might work best for companies wanting to get back the sweetness and bulk lost when replacing sugar.

“At least for the near term, I think it’s going to be a mix-and-match approach, mixing the high-intensity sweeteners with a bulking agent,” Mr. Hayes said.

Perception of low-calorie sweeteners could improve

Americans are trying to reduce their sugar intake, and some are turning to low-calorie sweeteners, even though a significant percentage have negative views of such sweeteners, according to the International Food Information Council Foundation’s 13th annual Food and Health Survey released May 16.

The online survey of 1,009 Americans of the ages 18 to 80 took place March 12-26. It found 77% of respondents said they were trying to limit or avoid sugars. Among the 77%, more than 20% said they were using low-calorie sweeteners instead of adding sugar, more than 20% said they were ordering or purchasing sugar-free options, and more than 20% said they were switching to low- or no-calorie beverage options.

When asked their opinion of low- or no-calorie sweeteners, 11% said very/somewhat positive and 59% said very/somewhat negative. Other responses were neutral and not sure.

When asked their opinion of low- or no-calorie sweeteners, 11% said very/somewhat positive and 59% said very/somewhat negative. Other responses were neutral and not sure.

Synthetic or artificial sweeteners may be a turn-off for many Americans. The survey asked which of two products the respondents would buy at a store. The first option was the old version of a product they had been using, even though it had artificial ingredients. The second option was a new version, with the artificial ingredients gone. Sixty-nine per cent of the survey respondents selected the second option.

Sugars were the most cited cause of weight gain at 33%, followed by carbohydrates at 25%.

When asked what types of foods and beverages they were eliminating to reduce sugar intake, about 50% said soft drinks and more than 40% said candy. Baked foods, including cookies, cakes and pastries, came in over 30%. The percentage for frozen desserts, including ice cream and frozen yogurt, was over 20%, and the percentage for juice-flavored drinks like fruit punch was about 20%. Other top responses, which came in under 20%, were sweetened teas and coffees, bread (bagels, dinner rolls), and sweet snacks (granola bars, trail mix).