CHICAGO — Just when product developers thought they had gained an understanding of consumers’ expectations of clean label — simple ingredients, nothing artificial and minimal processing — plant-based foods started becoming more popular. In many instances, plant-based foods defy clean label logic, as they are not minimally processed. Think of converting a solid nut into a liquid or making a vegan burger out of genetically modified ingredients, among a lengthy list of other ingredients; whereas milk is milk and a hamburger is simply beef.

The definition of clean label has become increasingly blurred. In many instances, it has nothing to do with being simple, rather it’s about transparency. Other times, it’s sustainability. Traceability plays into the story, too.

The concept of clean label, however it is defined, remains a priority for food manufacturers who want to be competitive in today’s food space.

“There is a lot of clamor about clean label these days,” said Pam Stauffer, global marketing programs manager, Cargill, Minneapolis. “It has become a sweeping term encompassing a convergence of trends surrounding health, diet and sustainability of products that influence how some consumers think about and decide on the products they purchase.

“Because clean label has no agreed upon definition, it is difficult for manufacturers to determine how these various trends translate to the development of food and beverage products. The concept has gained so much relevance that many consumers are actually seeking products positioned as clean label without having a strong idea of what the term means.”

Soumya Nair, director of marketing insights, Kerry, Beloit, Wis., said, “Consumers are at differing levels of clean label adoption, from the forward-looking label seekers who are quick to adopt new claims, the cautious investigators who seek to learn more before jumping on the wagon, to those that are indifferent to clean label.”

Soumya Nair, director of marketing insights, Kerry, Beloit, Wis., said, “Consumers are at differing levels of clean label adoption, from the forward-looking label seekers who are quick to adopt new claims, the cautious investigators who seek to learn more before jumping on the wagon, to those that are indifferent to clean label.”

A recent Kerry survey found that while similarities in clean label opinions exist, there is no one-size-fits-all solution. There are multiple consumer segments, each having different nutritional and functional priorities that drive their purchase behavior.

Clean label is evolving to mean a “better food future,” Ms. Nair said.

“This can include organic, natural, free-from artificial ingredients and G.M.O.s, low sugar, added functional ingredients and sustainable manufacturing,” she noted.

The Safe + Fair Food Co., Chicago, is all about non-G.M.O., clean label and allergy-friendly foods. The company offers snacks, desserts and meals, many of which are gluten-free.

“As a company, we believe we have a responsibility to the millions of families with food allergies to make the safe food choice the easy and affordable choice,” said Will Holsworth, chief executive officer.

Allergies are one example of why someone seeks clean label foods. Having a better understanding of clean label behavioral drivers may help formulators develop targeted solutions that align with different consumer priorities and need states.

A gluten-free consumer may be much more accepting of a lengthier ingredient statement knowing that to replace wheat in bread requires multiple ingredients. A diabetic is likely more open to artificially sweetened to not sacrifice taste, while someone on a weight-loss diet may have no issue with titanium dioxide being used to provide a creamy, opaque appearance to fat-free ranch dressing.

“To some, clean label is about a simpler ingredient list,” said Vicky Fligel, senior product manager — beverages, Glanbia Nutritionals, Chicago. “The challenge is that most ingredients have a functional purpose so it’s not as easy to just take them out of a formulation.”

Pure Organic, Solana Beach, Calif., a manufacturer of fruit and nut bars, believed being organic was not enough for its target consumer. Earlier this year, the company reformulated its bars to contain no more than eight recognizable, kitchen cupboard ingredients, including dates, nuts, dried fruits and nut butters. All tapioca syrup, agave nectar and processed proteins were removed.

“The updated bars’ improved taste, better texture and clean ingredients make mindful eating easy for everyone,” said Veronica Bosgraaf, founder.

Exploring mindful eating

Mindful eating is more about what one is consciously avoiding putting into their body. Attributes not associated with clean label include chemical-sounding ingredients (55%), highly processed products (52%), and anything that contains artificial ingredients (45%), G.M.O.s (44%) or artificial sweeteners (43%), according to Cargill research.

“Consumers check ingredient lists to verify claims on product packaging,” said Sharon Chittkusol, associate marketing manager, wholesome innovation — North America, Ingredion Inc., Westchester, Ill. “Ingredients gain acceptance when they are recognizable with names consumers can pronounce. But still, some natural ingredients that are unfamiliar or have scientific-sounding names can face rejection.”

Ingredion’s consumer research showed 62% of U.S./Canadian consumers claim to usually or always check the ingredient labels, while more than 78% said it is important to recognize ingredients. This increased from 66% in 2013.

Ingredion’s consumer research showed 62% of U.S./Canadian consumers claim to usually or always check the ingredient labels, while more than 78% said it is important to recognize ingredients. This increased from 66% in 2013.

So how does Impossible Burger make it on the menu of organic-centric restaurants? The flagship product from Impossible Foods, the Redwood City, Calif.-based biotechnology company, features simple ingredients such as wheat, coconut oil and potatoes, but it also relies on genetically modified yeast, which produces heme, a protein naturally found in plants and animals that gives meat its flavor and aroma. The burger is served in hundreds of restaurants, including “a lot of restaurants that proudly label themselves organic,” said Patrick Brown, c.e.o. and founder, at the Future Food-Tech conference, held March 22-23 in San Francisco.

He said although the Impossible Burger uses genetic modification, the product and brand ethos align with the values of organic consumers.

“In our experience when we’re working with people who label their foods as organic … we fit in perfectly with that because of the integrity of what we’re doing, the fact that we’re dedicated to the health and nutrition of the consumer and we’re dedicated to preserving a healthy environment, which is completely consistent with the motives of most people who are choosing to buy organic products,” he said.

This is a different spin on clean label, one that is about making food for a cleaner global environment. When it comes to plant-based foods, the definition of clean label gets further blurred, and apparently there are many unknowns, as this category is in its infancy. In time, the industry will have a better understanding of what consumers will accept.

This is a different spin on clean label, one that is about making food for a cleaner global environment. When it comes to plant-based foods, the definition of clean label gets further blurred, and apparently there are many unknowns, as this category is in its infancy. In time, the industry will have a better understanding of what consumers will accept.

“Science may say we can, but society questions if we should,” said Charlie Arnot, c.e.o. of The Center for Food Integrity, Kansas City, at the 2018 Faegre Baker Daniels Food & Agribusiness National Conference on May 17 in Minneapolis.

Mr. Arnot explained how transparency has become a part of the clean label platform. Just because something is scientifically feasible does not mean consumers will accept it. If you come “clean” and explain the science, consumers might buy into it. It’s a case-by-case scenario.

Blurred lines

Cargill research supports consumers’ uncertainties of the definition of clean label.

“It is important to understand how consumers define clean label in the context of your brand in order to deliver the optimal solution,” Ms. Stauffer said. “And something to keep in mind, our research found that price premiums were a sticking point; less than half of respondents said they would pay a 10% premium price for products made with familiar ingredients.”

Jean Shieh, marketing manager, Sensient Natural Ingredients, Turlock, Calif., said, “Consider the best path to maximize return. Removing a synthetic component, which likely would reduce performance such as shelf life, and replacing synthetic ingredients with natural ingredients typically results in a higher raw material cost.”

Even within the “non-synthetic” ingredient category, there are differences in costs that must be addressed. Plant-sourced colors, for example, may be 20 to 30 times the cost of caramel colors, said Brian Sethness, executive vice-president of sales and marketing, Sethness Products Co., Skokie, Ill.

Even within the “non-synthetic” ingredient category, there are differences in costs that must be addressed. Plant-sourced colors, for example, may be 20 to 30 times the cost of caramel colors, said Brian Sethness, executive vice-president of sales and marketing, Sethness Products Co., Skokie, Ill.

“Consumers are seldom willing to pay more for clean label,” he said. “They expect products to be clean label at the same cost, which is virtually impossible.

“Class I, or plain caramel colors, have become the fastest-growing segment of caramel colors, as they meet consumer demand for cleaner labels. We are also experiencing increased demand for non-G.M.O. and organic caramel colors, which are more expensive than traditional offerings, but mostly better performing than plant-based colors.”

Synthetic ingredients have been used for so long because they are effective and economical. Their removal may impact product quality, which in turn impacts retail price, said Beth Warren, chief commercial officer, Edlong, Elk Grove Village, Ill. To ensure desirable appearance and taste in packaged prepared foods, formulators rely on advanced ingredient technologies.

“If natural ingredients are used, consider if there are other values to call out,” Ms. Shieh said. “For example, where the ingredient is sourced from could also communicate traceability.”

This may help the shopper justify the investment. Clean label is becoming as much about ingredients and processing as it is about trust in the product and the company. That’s where transparency and the brand’s story becomes part of clean label.

This may help the shopper justify the investment. Clean label is becoming as much about ingredients and processing as it is about trust in the product and the company. That’s where transparency and the brand’s story becomes part of clean label.

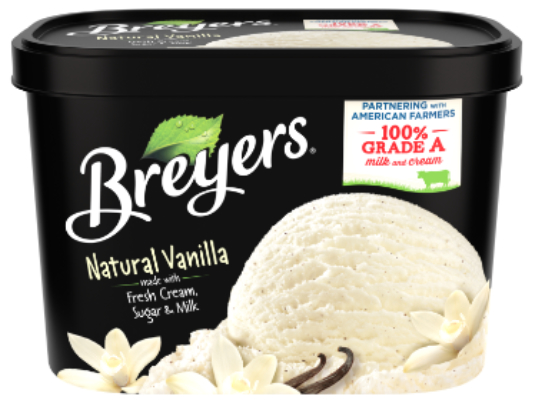

Breyers, a brand of Unilever, Englewood Cliffs, N.J., recently began adding the claim “Partnering with American farmers — 100% Grade A Milk & Cream” to its packaged ice cream as part of its clean label initiative.

“At Breyers, it’s simple,” said Russel Lilly, marketing director. “We care about the ingredients that make our ice cream great. We want everyone who enjoys Breyers ice cream to know that it not only tastes great, but is always made with high-quality ingredients. This new 100% Grade A claim will help people to rest assured that choosing Breyers is choosing quality.”

A window on the supply chain

Ingredient transparency has been part of The Hershey Co., Hershey, Pa., since February 2015, when the company made a commitment to transition to simple ingredients. Today, Hershey offers products that deliver on this promise across its portfolio. By 2020, all everyday Hershey’s brand chocolate confection products will have simple ingredients.

Every day is a key descriptor, as this may not include seasonal and limited-edition products that rely on complex ingredients. That is why transparency is an important part of the clean label process. To be transparent, the company’s web site includes a glossary of all ingredients the company uses in its products.

The fact is that the early definition of clean label — simple ingredients, nothing artificial and minimal processing — may not be realistic, functionally or economically, in today’s food culture. Transparency may be a better approach.

The fact is that the early definition of clean label — simple ingredients, nothing artificial and minimal processing — may not be realistic, functionally or economically, in today’s food culture. Transparency may be a better approach.

“Our consumer and industry insights research has thus far not been able to demonstrate conclusively that products that have been reformulated to be cleaner, such as removing artificial colors, flavors and preservatives or taking stronger actions to remove other perceived unclean ingredients and shorten labels, has resulted in appreciable increases in sales,” said Mark Cornthwaite, marketing manager, DuPont Nutrition & Health, New Century, Kas. “This is not surprising, as there is already a brand value proposition in the minds of the consumer for a particular product and a great deal of product and ingredient attribute changes need to be achieved and communicated, according to our research, in order to make a consumer switch brands.

“There is greater evidence to suggest that brand new clean label products that are specifically formulated to be cleaner have increased share of volume and revenue in otherwise declining or stagnating industries, such as bread for example. Brands in ice cream and yogurt have similarly bucked the industry trend according to sales data.”

It should be recognized some notable product reformulations have not been on the market long enough to gather conclusive evidence.

The concept of clean label will continue to evolve. It is important to identify behavioral drivers for clean label product purchases and remember that many times it’s personal.