CINCINNATI — A great start to Restock Kroger, including progress on cost controls due to process change and space optimization, contributed to strong earnings and sales at The Kroger Co. in the first quarter of fiscal 2018.

Net earnings attributable to Kroger in the quarter ended May 26 totaled $2,026 million, equal to $2.39 per share on the common stock, up sharply from $303 million, or 33c per share, in the same period a year ago. The most recent quarterly results included a gain of $1,771 million related to the sale of the company’s convenience store business. Excluding adjustments, net earnings totaled $626 million in the first quarter of fiscal 2018, which compared with $546 million in the same period a year ago.

Sales increased 3% to $37,530 million from $36,285 million.

“Our most fundamental strategy remains unchanged,” William R. McMullen, chairman and chief executive officer, said during a June 21 conference call with analysts. “As customers’ tastes change and their shopping habits evolve, we will be there for them. That means we will make the investments needed to provide our customers with the best full-service grocery experience in America. Plus, we are investing in our associates more than ever before and seeing improvements in retention.

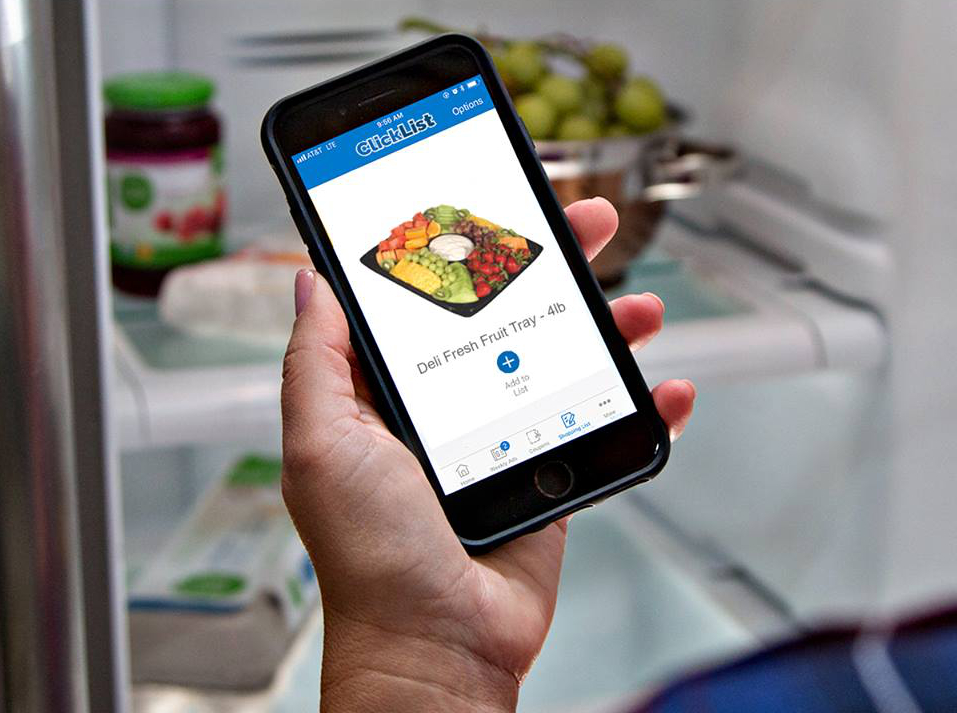

“We are creating a seamless environment where our customers can choose how to engage with us, both in-store and online. We are actively improving the store experience. Our space optimization work is ahead of schedule, and our brands achieved another period of record growth while, at the same time, growing our digital sales by more than 66% in the first quarter, which was due to our ongoing expansion of ClickList, our delivery initiatives and identical growth.”

“We are creating a seamless environment where our customers can choose how to engage with us, both in-store and online. We are actively improving the store experience. Our space optimization work is ahead of schedule, and our brands achieved another period of record growth while, at the same time, growing our digital sales by more than 66% in the first quarter, which was due to our ongoing expansion of ClickList, our delivery initiatives and identical growth.”

Mr. McMullen gave a lot of credit for the solid first quarter to the retailer’s progress with Restock Kroger, a three-year plan designed to create shareholder value. He said the company has made progress against each of the plan’s four main drivers: redefining the grocery customer experience, partnering for customer value, developing talent and living the retailer’s purpose.

“Using our deep insights and experience, Kroger is imagining the future of retail by building on our core business plus adding exciting and innovative partnerships like Ocado and our planned merger with Home Chef,” he said. “We believe the future of retail will include both physical and digital customer experiences. Everything we are doing today will enhance our ability to provide everyone in America with convenience of shopping for anything, anytime, anywhere.”

Mr. McMullen said Kroger’s store brands lineup accounted for 28.7% of unit sales and a record 26.7% of dollar sales during the first quarter. The portfolio of products was led by double-digit growth in Simple Truth and Simple Truth Organic lines, he said.

Mr. McMullen said Kroger’s store brands lineup accounted for 28.7% of unit sales and a record 26.7% of dollar sales during the first quarter. The portfolio of products was led by double-digit growth in Simple Truth and Simple Truth Organic lines, he said.

One of the keys to store brands growth was Kroger’s own analysis of the product lineup versus its competitors’ own brands, Mr. McMullen said. Additionally, he said the retailer conducted taste comparisons and quality comparisons versus national brands.

“One of the things that we had underappreciated was the quality of our product scored incredibly well with our customers and potential customers,” he said.

As a result, Mr. McMullen said Kroger has been more aggressive about telling its customers about the quality of its private label brands, a strategy that has become an integral part of Restock Kroger.