CHICAGO — Plants are flourishing in food and beverage launches. Global product introductions with plant-based claims grew at a compound annual rate of 62% between 2013 and 2017, according to Innova Market Insights.

“Plant-based or eating green is probably one of the biggest trends happening right now,” said Barbara Katz, a market analyst for Innova Market Insights, at IFT18, the Institute of Food Technologists’ annual meeting and food exposition in Chicago.

While meat substitutes and dairy alternatives continue to drive new product development, colors, sweeteners and flavors derived from plants are burgeoning. Plant-based food dyes such as carrot concentrate and red beetroot juice concentrate are on the rise as consumers perceive such options as more natural than synthetic colors.

Botanicals are blooming in global product development, with growth seen in herbs and seasonings such as lovage, lavender and chamomile. Plant-based waters including cactus water, birch water and coconut water and floral and fruit infusions are refreshing the soft drink se gment.

gment.

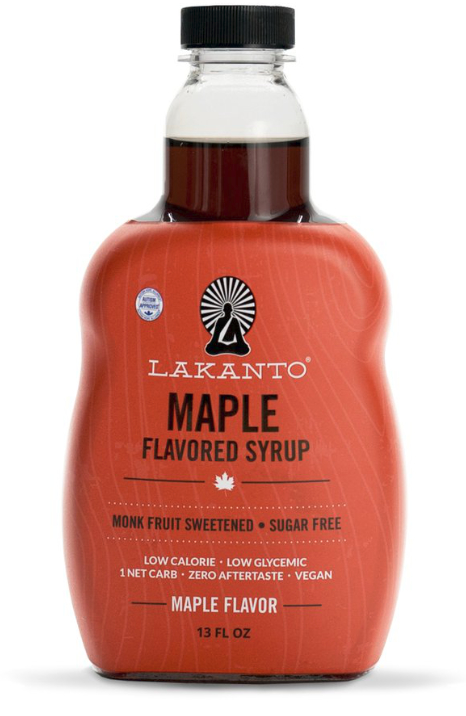

Plant-based sweeteners including stevia and monk fruit are moving further into the mainstream, too.

“Health is obviously one of the key drivers for this plant-based trend we’re seeing,” Ms. Katz said. “For younger people health is one major driver. For older people health is the major driver.”

Sustainability and animal welfare concerns are pushing younger consumers to purchase plant-based alternatives to meat and dairy. One in five U.S. consumers aged 18-25 and more than 30% of U.S. consumers aged 26-35 claim to be vegetarian, according to Innova Market Insights. The global meat substitutes market is predicted to reach $4.2 billion in 2022.

“The bulk of your plant-based consumers are in the sometimes crowd,” Ms. Katz said. “There are people that are trying to increase their intake of grains, they’re trying to reduce their intake of red meat, and they’re trying to be more healthful. They’re not identifying with a vegan or vegetarian lifestyle per se, so this is a massive opportunity because of the flexibility they have.”

Rice protein, pea protein and soy protein tracked strong growth between 2013 and 2017. Emerging plant protein sources include oat, potato and lupin, Ms. Katz said.

“The bulk of your plant-based consumers are ... not identifying with a vegan or vegetarian lifestyle per se, so this is a massive opportunity because of the flexibility they have.” — Barbara Katz, Innova Market Insights

Despite a surge in plant-based product development, dairy and animal protein innovation continues to thrive. Nine in 10 U.S. and European consumers buy meat, fish and egg products on a grocery trip, according to Innova Market Insights.

Meat, poultry and meat snacks retain a 90.5% share of launches in the meat and meat substitutes category. Innova Market Insights tracked significant growth of “no antibiotics” and “grass-fed” claims in global meat and poultry launches.

Global dairy launches offer indulgence and a premium positioning. Yogurt brands are churning out sophisticated flavor profiles including coffee, ginger and vegetables. In cheese, snackable formats are growing.