KANSAS CITY — As the United States’ top chocolate consuming holiday (Halloween) approaches and International Chocolate Day (Sept. 13) has just passed, the cocoa industry finds itself with plenty of supply, uncertainty about demand and a widely-fluctuating futures market. Meanwhile, the industry continues to grapple with sustainably sourcing cocoa beans often grown and harvested in poor regions under less-than-acceptable circumstances.

The International Cocoa Organization (I.C.C.O.) estimates global 2017-18 cocoa bean production at 4,645,000 tonnes, down 2% from the prior year. World cocoa bean grindings, an indication of demand, were estimated at 4,568,000 tonnes, up 3.9% from 2016-17. Carryover stocks on Oct. 1, 2018 (the beginning of the 2018-19 cocoa bean marketing year), were forecast at 1,757,000 tonnes, up 1.8% from 2017, with a stocks-to-grindings ratio of 38.5% compared with 39.3% the prior year.

Regionally, second-quarter cocoa bean grind (the most recent data available) showed mixed results. North America grind, reported by the National Confectioners Association, was down a disappointing 3.1% from the same period last year. But European grind jumped 7% from April-June 2017, and Asian grind surged 15% from a year earlier.

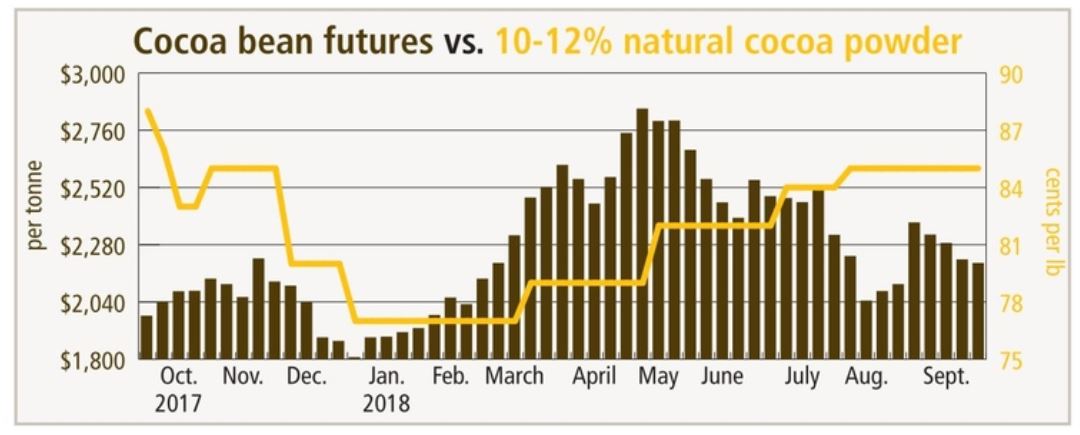

Cocoa powder prices in the United States have shown mixed price moves in 2018 with 10% to 12% natural powder up about 10% since Jan. 1 at 85c to 95c a lb, as quoted by Milling & Baking News. The price of black cocoa powder also was up about 7% so far in 2018. But prices for 10% to 12% alkalized and red alkalized (Dutch) both were down about 5%. Prices for all grades of cocoa powder were slightly below year-ago levels.

Trade sources indicate cocoa powder buyers mostly are well covered into 2019 and some even buying into 2020. With only a minimal carry in New York cocoa bean futures (about $100 per tonne from nearby December to May 2020 last week), and no indication of supply tightness, there has been little incentive to book too aggressively. At the same time, the flat price may have encouraged some booking as a move up in futures appears a bit more likely than a significant move down.

New York cocoa bean futures have been on a rollercoaster ride so far this year. The nearby contract began the year around $1,850 per tonne and experienced a tremendous uptrend of about 55% to near $2,900 per tonne by late April-early May. Prices subsequently tumbled about 20% to below $2,300 per tonne in early June. Following another rebound through early July, prices again turned lower, dipping briefly below $2,050 per tonne in early August, followed by another climb over $2,350 by late August. Nearby prices last week were trading near $2,200 per tonne, up about $200, or 10%, from a year earlier. Sources contend that most of the volatility in the futures market is the result of speculative trading activity rather than major shifts in market fundamentals.

On the sustainability front, Mars Wrigley Confectionery last week announced “Cocoa for Generations,” an initiative to invest $1 billion over 10 years to overhaul the cocoa supply chain. The plan is incremental to Mars “Sustainable in a Generation” plan announced in 2017.

Mars’ Cocoa for Generations plan has two primary pillars: Responsible Cocoa Today and Sustainable Cocoa Tomorrow.

Mars set a goal to make 100% of its cocoa from the Responsible Cocoa program sourced globally and traceable by 2025, with systems in place to address deforestation, child labor and higher incomes for cocoa bean farmers. The company will provide satellite-based GPS locations for farms to ensure that cocoa beans do not come from protected forest areas. Mars plans to work with its partners to ensure the model for premiums paid for responsibly-produced cocoa is overhauled to ensure that farmers get a higher share of the premium. At the same time, Mars said it would maintain its current certified cocoa levels with the Rainforest Alliance and with Fairtrade.

Secondly, Mars hopes to show that a step-change in farmer income and livelihood is possible. It plans to test ways to increase productivity, income, resilience and overall sustainability through crop and income diversification, gender programs, village and savings and loan models and farm development plans.

In instances in the past, industry effort to improve production and income for cocoa bean growers have been frustrated by local governments or resulted in overproduction, which in fact caused prices to decline.

The Hershey Co., Mondelez International and others also have been actively investing in cocoa sustainability. Hershey earlier this year said it plans to invest $500 million through 2030 in “Cocoa For Good,” a program focused on West Africa, where about 70% of the world’s cocoa beans are grown, to address poor nutrition, poverty, at-risk youth and vulnerable ecosystems. Mondelez last year said it had made significant progress in its longer-term commitment to sustainably source 100% of its cocoa supply through its “Cocoa Life” program.