CHICAGO — The International Dairy Deli Bakery Association (IDDBA), Madison, Wis., recently released “What’s in store 2019,” the 33rd installment of the association’s annual report containing data on retail/market trends, growth and category changes shaping the food industry. This secondary research report is developed through interviews with industry experts and sourcing of third-party data and trends.

CHICAGO — The International Dairy Deli Bakery Association (IDDBA), Madison, Wis., recently released “What’s in store 2019,” the 33rd installment of the association’s annual report containing data on retail/market trends, growth and category changes shaping the food industry. This secondary research report is developed through interviews with industry experts and sourcing of third-party data and trends.

“The shopper landscape is continuously shifting and ‘What’s in store’ is designed to help food industry professionals better understand today’s retail world,” said Jeremy Johnson, vice-president of education at IDDBA and managing editor of the report. “Consumer trends give insights on how to engage with shoppers’ desires, lifestyles and trip missions, which are critical toward ensuring a prominent role for fresh categories in today’s changing food roadmap.”

Food Business News: How has the shopping landscape changed in the past few years?

Jeremy Johnson: Our research shows that today’s consumers increasingly seek personal, self-betterment while also looking for public, civic or global improvement. They want both self-satisfaction and selflessness. These interests are carried through all aspects of life, including grocery shopping. While clean labels, sustainability efforts and environmentally conscious practices remain very important, there’s growing interest by consumers in upcycled products and “self-care” through companies touting positive messages and practices. Dairy, deli and bakery manufacturers — namely fresh players in the store perimeter – have the opportunity to expand integrity, credibility and accountability by leading in being good, by doing good.

What are the key trends driving food purchases?

Mr. Johnson: There continues to be an increase in shoppers across generations that are interested in “alternate value propositions.” Sometimes called the “conscious consumer,” these shoppers value food origin, sourcing, company missions and clean labeling over price. Retailers and manufacturers should continue to refine their messaging to appeal to this growing consumer segment.

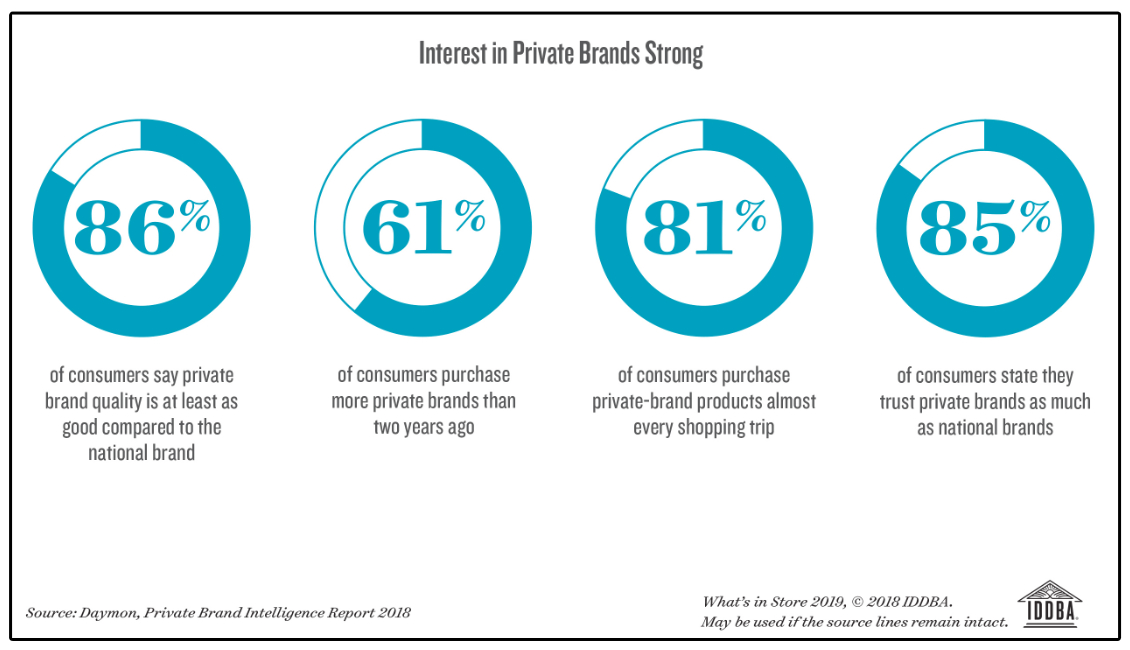

At the same time, private label products continue to be a source of interest for consumers. Often times that’s because many store brands are taking the extra step to tell their story to the conscious consumer. Brand experiences are built on relationships with customers who feel connected to each other while expressing who they are as individuals. They want to be part of the conversation. Conversation is collaborative: engaging, connecting, interactive and integrative force. Conversation is also about listening; listening builds trust.

Understand the consumer’s communication needs, then listen and use the brand experience to make it meaningful. Store brands are doing that. The expansions by Aldi and Lidl have helped today’s consumers feel confident about private label and many have no problem abandoning national brands.

How important are brands to today’s shoppers?

Mr. Johnson: It depends on the brand and its messaging. The key is that consumers are interested in the storytelling around products. The national brand alone is no longer the story. Private label, on the other hand, is often a story in itself. It’s a value story, and often more. Eighty-one per cent of consumers purchase private label products almost every shopping trip, according to Daymon Worldwide, with 85% stating they trust private brands as much as national brands. As interest arises, so does opportunity for retailers. Many are looking to the perimeter or fresh sections of their stores to increase private label offerings.

Who is buying private label?

Mr. Johnson: More than three-fourths of shoppers say they buy private label products, according to the Market Track Shopper Insight Survey from Numerator. This research shows that buying private label tends to trend with age, with older consumers more likely to purchase private label versus national brands. But, that does not mean they are the better private label customer. Data from Acosta shows that younger shoppers who buy private label buy more store brands than other generations, mostly to save money. This is very true of millennials, with Gen Z shoppers right behind them.

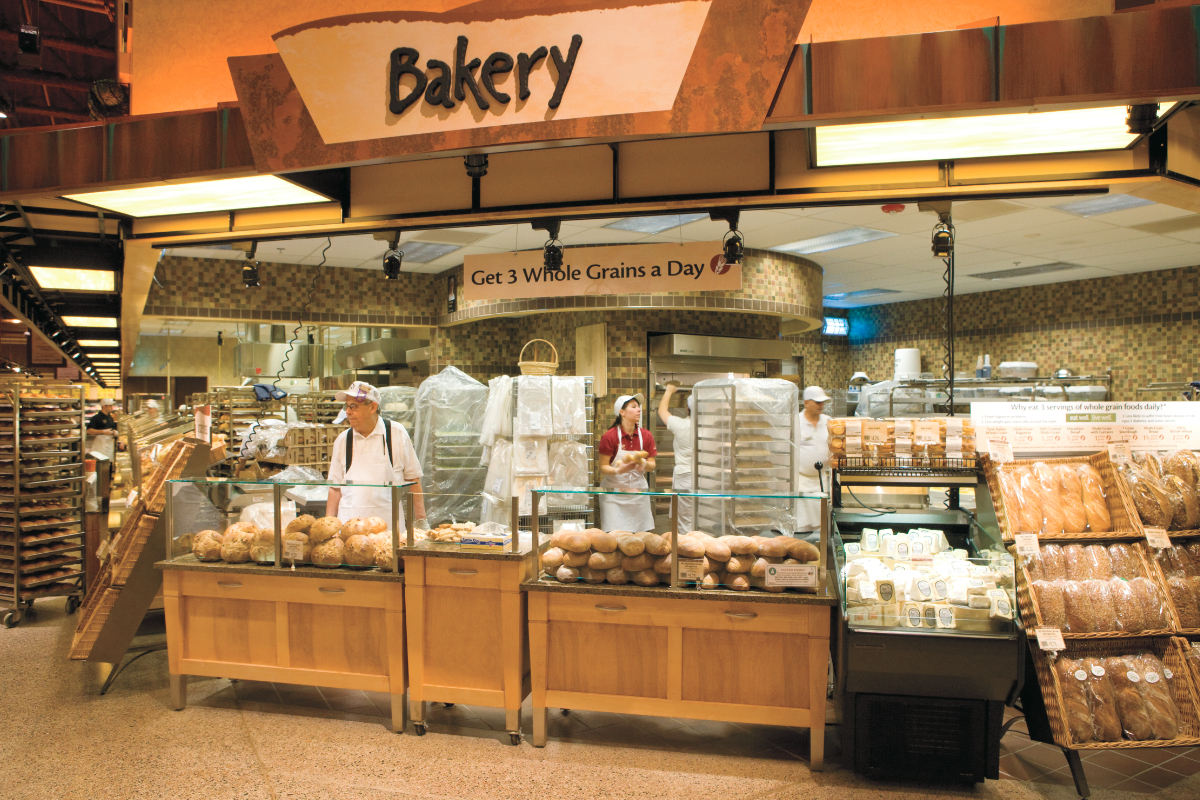

What are the growth opportunities for the in-store bakery department?

Mr. Johnson: While eating healthy continues to be a factor in consumer food purchase decisions, indulgence is the top driver of shoppers to the in-store bakery. Consumers are not only searching for innovative concoctions and creative takes on traditional bakery products, they are also looking to treat themselves. This includes health and wellness shoppers.

Product claims are also growing in importance in the in-store bakery. Products are seeing success with highlighting nutritional attributes such as whole grain, high protein, high fiber and no preservatives.

Who shops the in-store bakery?

Mr. Johnson: The top shoppers of the in-store bakery are seniors, baby boomers and families with children. They tend to purchase more of the traditional bakery items that correspond with traditional dayparts and eating occasions. These products often do not appeal or resonate with younger, single and childless adults. It is important to continue to appeal to the primary shopping demographics while also focusing on innovation to attract these other shoppers.

What are the trends driving cheese sales?

Mr. Johnson: Snacking is huge. Calling out the protein content on cheese — everything from individually wrapped cheese portions to multi-component snack kits — appeals to the 9-out-of-10 consumers across generations that snack daily. Authentic Hispanic cheeses are also really hot right now. They continue to show up on restaurant menus and shoppers are looking for them at the supermarket.

How about in the dairy department?

Mr. Johnson: It is imperative to provide high-quality dairy products that consumers want, when and where they want them. It is also imperative that manufacturers and retailers market the natural nature of milk — and the dairy products made from milk — to respond to growing consumer interest in real food. While one singular definition of real food does not exist, for many, real means existing, not imitation. Real food then is a food that’s as close to its natural state as possible. Dairy foods are the real deal. Communicate this to shoppers, especially potential dairy super consumers.

Who are dairy super consumers?

Mr. Johnson: Some consumers are heavy users of a particular product. Some are passionate about a product. The sweet spot is super consumers: those who are heavy users and highly involved. These are the most profitable and insightful consumers. In 2017, IDDBA commissioned The Cambridge Group to begin exploring super consumer opportunities. We found dairy super consumers represent 10% of households and drive 22% of the total dairy spend. But what’s even a more important finding is that 20% of households are potential super consumers, people who often really like dairy, but spend less than a super consumer (about $311 per year versus $634). Potentials may need to be taught or given permission to use more of a product.

In the case of dairy, it may be as simple as getting back to the basics, such as pushing the positive nutritional qualities of dairy by amplifying the marketing message that dairy is full of calcium, protein and other healthy vitamins. A number of dairy experts we interviewed thought that the industry has moved away from touting the natural benefits of products made from milk and that consumers are hearing inconsistency in the messaging. Dairy super consumers have clearly retained the messaging that other consumers have lost. Emphasizing these messages may get potentials to increase their dairy spend, which would directly result in an increase in category growth.

Is there a deli department super consumer?

Mr. Johnson: Yes. Deli super consumers are also represented by 10% of households. This group, however, drives 24% of the total deli spend. About 19% of households are potential deli department super consumers. Foods that will draw them to the deli department include alternative proteins, such as whole grain, legume-based side dishes. Flavor-forward prepared foods are also appealing.

Make sure potentials are aware that grocery stores offer a better variety of food and lower prices than traditional fast-casual restaurants. As prepared food store trips increase, shoppers will also visit other parts of the store, all with the potential to grow total basket sales.

What can retailers do to attract shoppers to the dairy, deli and bakery departments?

Mr. Johnson: Showcase daily meals specials plated at the front door during the dinner rush. Set up in-store spotlights on local producers and schedule tasting events. Build private label displays to highlight wellness and sustainability. Social media is a must. Provide mobile-friendly recipes and how-to videos. Post tutorials on how to build a meal using components in the deli. Develop a relationship with shoppers.

As personal beliefs and preferences continue to influence shopping habits, retailers must build trust with customers, both as a brand and by increasing transparency around products within the store. These messages can be as simple as quality or delicious.