HERSHEY, PA. — The addition of recently acquired snack brands such as Skinny Pop and Pirate’s Booty boosted The Hershey Co.’s top line in the past year and latest quarter, helping the company offset continued softness in its non-chocolate portfolio and sales declines from items related to a planned stock-keeping unit rationalization.

“We expect these headwinds to persist in 2019 as we focus on initiatives to drive growth within our chocolate portfolio and continue to reduce complexity to improve margins,” said Michele G. Buck, president and chief executive officer, during a Jan. 31 earnings call with investment analysts.

Hershey net income for the fiscal year ended Dec. 31, 2018, totaled $1,177,562,000, equal to $5.76 per share on the common stock, up from $782,981,000, or $3.79 per share, the year prior. Adjusted net income was $1,130,072,000, equal to $5.36 per share, up from $1,001,538,000, or $4.69.

Net sales in the fiscal year totaled $7,791,069,000, up 3.7% from $7,515,426,000. Excluding the benefit of acquisitions, organic net sales growth in constant currency was 0.3%.

Fourth-quarter income on a reported basis was $336,791,000, equal to $1.65 per share, up from $181,133,000, or 88c, in the year-ago quarter. Results included a net gain on mark-to-market adjustment for commodity derivatives. Adjusted net income for the quarter was $265,219,000, equal to $1.26 per share, up from $214,969,000, or $1.02.

Net sales increased to $1,987,902,000, up 2.5% from $1,939,636,000. On a constant currency basis, net sales excluding acquisitions increased 0.1%.

“For 2019, we have a balanced plan to build on our second-half 2018 momentum,” Ms. Buck said. “We expect annual net sales growth of 1% to 3% and adjusted earnings per share diluted growth of 5% to 7%. We believe this growth will be driven by improving organic sales growth and profitability within North America.”

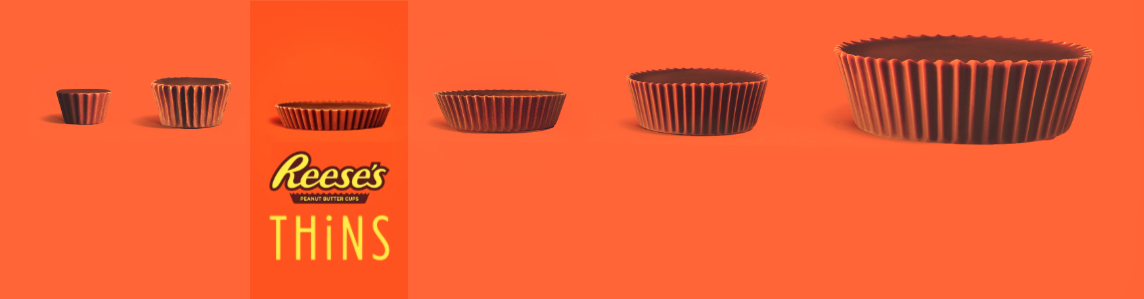

In the U.S. confection business, Hershey expects growth from strength in seasonal sales, a pricing increase, distribution gains and innovation, including the launch of Reese’s Thins in milk and dark chocolate varieties.

“As we rationalize less productive s.k.u.s in the portfolio, we continue to make progress in securing distribution on higher-velocity items to maintain and optimize our shelf space and improve productivity for both Hershey and our retailer partners,” Ms. Buck said. “We are also focused on securing incremental space for the entire category. We are consistently collaborating with our retailers on ways to adapt to this rapidly changing environment and optimize space to drive sales and margin.”

New packaging hitting shelves this spring is expected to drive consumer engagement and increase sales, she said.

“As you think about '19, what I’m really excited about in our innovation plan is that our two big innovations are the chocolate packaged candy packaging reinvention, which is really a better package but the same product, which will drive shelf impact and usability, etc., and then Reese’s Thins, and we’ve got a great track record of innovation on Reese and also anytime we innovate close to the core,” she said.