KANSAS CITY — Plant protein has a place — or maybe it’s places — in the grain-based foods industry. Potential applications include sports nutrition bars, gluten-free items, snacks and frozen pizza. Marketing claims could center around protein content or environmental benefits. Among the various protein sources are peas, chickpeas, wheat, soybeans and almonds, and supply is increasing.

Health is one reason people seek plant protein. In the 2019 Food and Health Survey from the International Food Information Council Foundation, Washington, more than 70% said they perceived protein from plant sources as healthy.

The environment is another reason.

“Across society over the last few years, there’s been a real shift and growth in consumer awareness of plant proteins and particularly pea protein as a more sustainable protein source,” said Johann Tergesen, president and chief executive officer of Burcon NutraScience Corp., Vancouver, B.C. “Climate change is changing personal consumption habits. One major transformation is that many more people today understand the value of plant proteins and why changing one’s diet to consume less meat and more plants is an important personal step in addressing climate change.”

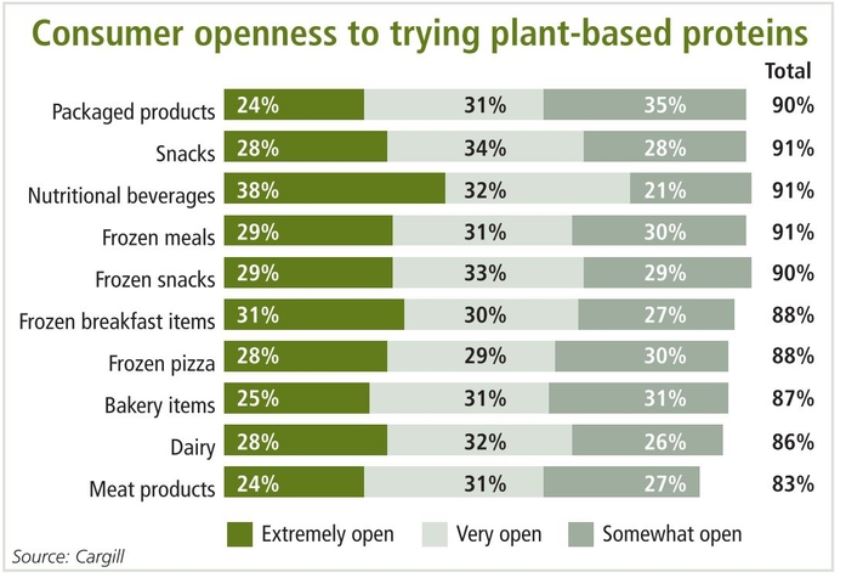

Proprietary research from Cargill, Minneapolis, in partnership with Decision Analyst, Arlington, Texas, dug more deeply into consumer attitudes by plant protein type and food product category. The research conducted last October involved 1,923 U.S. grocery shoppers of the ages 18-78.

When asked how open they were to plant-based protein products by category, 91% said they were open to it in snacks, 90% said they were open to it in packaged products, 88% said they were open to it in frozen pizza and 87% said they were open to it in baked items. In an aided response, meaning respondents were given a list of items to choose from, the researchers asked them to point out which plant protein sources they had tried. The answers were 68% for corn, 58% for peas, 50% for chickpeas, 48% for soy, 43% for quinoa, 35% for flax and 27% for canola.

When asked how open they were to plant-based protein products by category, 91% said they were open to it in snacks, 90% said they were open to it in packaged products, 88% said they were open to it in frozen pizza and 87% said they were open to it in baked items. In an aided response, meaning respondents were given a list of items to choose from, the researchers asked them to point out which plant protein sources they had tried. The answers were 68% for corn, 58% for peas, 50% for chickpeas, 48% for soy, 43% for quinoa, 35% for flax and 27% for canola.

Cargill invested in plant protein last year in the form of a joint venture agreement with Puris, the largest North American producer of pea protein.

Other companies are expanding in plant protein, too.

Burcon NutraScience Corp. and an investor group have created a joint venture partnership to build a C$65 million commercial production facility for pea protein and canola protein in Western Canada. The facility initially should process about 20,000 tonnes of peas per year to produce the company’s Peazazz and Peazac pea proteins. Burcon’s Supertein, Puratein and Nutratein canola proteins also will be produced at the facility.

The joint venture will be called the Burcon Functional Foods Corp.

Food companies already have performed trials of their products with canola protein or pea protein ingredients from Burcon, Mr. Tergesen said. The protein content in the ingredients exceeds 90%.

“We expect you will see products incorporating Burcon pea and canola proteins to start appearing on store shelves shortly after our processing facility has been commissioned, which we currently estimate to be around the middle of 2020,” he said. “Customers who are interested in using our proteins can now move forward with confidence that our protein ingredients will be available next year.”

Plant protein was found in booths at IFT19, the Institute of Food Technologists’ annual meeting and exposition held June 2-5 in New Orleans.

Ingredion, Inc., Westchester, Ill., now offers a Vitessence Pulse 1803 organic pea protein isolate. With a minimum protein content of 80%, the ingredient assists food companies in achieving protein source claims and organic claims in items like snacks, nutrition bars and baked foods as well as alternative meat and dairy products. Ingredion at IFT19 sampled organic noodles containing Vitessence Pulse 1803 organic pea protein that contained eight grams of protein per serving.

Ingredion, Inc., Westchester, Ill., now offers a Vitessence Pulse 1803 organic pea protein isolate. With a minimum protein content of 80%, the ingredient assists food companies in achieving protein source claims and organic claims in items like snacks, nutrition bars and baked foods as well as alternative meat and dairy products. Ingredion at IFT19 sampled organic noodles containing Vitessence Pulse 1803 organic pea protein that contained eight grams of protein per serving.

Representatives of Cosucra USA at IFT19 explained how the company’s Pisane pea protein may work in grain-based foods like gluten-free bread and protein bars as well as other items like plant-based burgers and almond-based milk alternatives. Cosucra USA is part of Cosucra Group, Warcoing, Belgium.

Peas, chickpeas, lentils and beans all are pulses. They are a low-fat source of protein with a high-fiber content and low-glycemic index. Minerals in pulses include iron, potassium, magnesium and zinc.

Archer Daniels Midland Co., Chicago, sampled items with its ProFam soy protein isolate at IFT19. Protein levels per serving reached 10 grams in a shawarma bite, a Middle Eastern food; 5 grams in kimchi vegetable chips, a Korean item; and 5 grams in cacio e pepe vegetable chips, a snack with an Italian twist.

Blue Diamond Almonds Global Ingredients Division, Sacramento, Calif., featured its almond protein.

“Blue Diamond almond protein powder has a clean taste and an extra-fine texture,” said Jeff Smith, director of marketing for Blue Diamond Almonds Global Ingredients Division. “These are important differentiators from other plant-based proteins and ones that developers find especially appealing as they look to formulate new products.”

Almond protein is an excellent source of biotin, phosphorous, copper, magnesium and manganese and a good source of calcium, potassium, zinc and iron. It is compatible with complementary proteins, including plant-based sources and dairy sources, which allows for the creation of products with complete amino acid profiles.

“These features make Blue Diamond almond protein powder an incredibly versatile ingredient, perfect for nutritional supplements, protein bars, breakfast cereals, protein smoothies and shakes, and protein-enhanced snack and bakery products,” Mr. Smith said. “Within blends, almond protein powder can also aid in neutralizing unpleasant flavors, creating a well-rounded product with good flavor and nutrition and a simpler label.”

“These features make Blue Diamond almond protein powder an incredibly versatile ingredient, perfect for nutritional supplements, protein bars, breakfast cereals, protein smoothies and shakes, and protein-enhanced snack and bakery products,” Mr. Smith said. “Within blends, almond protein powder can also aid in neutralizing unpleasant flavors, creating a well-rounded product with good flavor and nutrition and a simpler label.”

Grand View Research, Inc., San Francisco, forecasts the global almond protein market to expand at a compound annual growth rate of 5.8% to reach $491.2 million by 2025. The United States stands as the dominant player in the production and consumption of almonds while the United Kingdom, Germany and China are other major consumers of almond products, according to Grand View Research.

Plant protein in some instances may provide functional benefits as well, as is the case with wheat protein. The wheat protein ingredients in the Arise line from MGP Ingredients, Atchison, Kas., have been shown to reduce fat absorption, increase moisture retention, increase dough extensibility, enhance dough strength, improve processing tolerance and increase volume. MGP Ingredients at IFT19 listed four top trends in the food industry: plant-based protein, fiber, clean label and low-carbohydrate.

Manildra Group USA, Leawood, Kas., offers GemPro Prime-E wheat protein isolate that improves the extensibility of dough with an addition as low as 2% of the formulation.

No matter the source of the plant protein, people appear interested. A 2019 global report from HealthFocus International, St. Petersburg, Fla., that involved people from 22 countries found 61% of respondents said they were interested or extremely interested in plant protein while 48% said they were aware of plant protein. Among the people saying they were interested or extremely interested in plant protein, 29% said they would be willing to pay up to 10% more for products that include plant protein.

---------------

Meat alternatives appear as pizza toppings, taco fillings

Products such as the Impossible Burger and the Beyond Burger have proven meat alternatives sell, and meat alternatives could be used in several grain-based foods categories as well. Think pizza toppings and taco fillings.

Puris sampled tacos with beef alternative fillings at IFT19, the Institute of Food Technologists’ annual meeting and expo held June 2-5 in New Orleans. The beef alternatives contained Puris texturized pea protein and Puris pea flour and provided 20 grams of protein per serving.

“First and foremost, consumers want food that tastes good,” said Tyler Lorenzen, president of Minneapolis-based Puris. “That’s where our texturized pea protein comes in. By turning our great-tasting T.P.P. into something familiar like ground beef, it provides shoppers with another alternative to meat-based products. If something tastes great, is good for the consumer and even better for the environment, it makes the right choice the easy choice.”

PLT Health Solutions, Inc., Morristown, N.J., and innovation partner Nutriati, Inc., Richmond, Va., created pizza at IFT19. Meatless sausage crumbles on the pizza were made with Artesa chickpea protein and Artesa chickpea flour. Cookies, crisps and snacks are other potential applications for Artesa chickpea protein, which has a small, uniform particle size, a white color and a neutral flavor. Environmental benefits of chickpeas include a low carbon footprint and less use of fertilizer, water and pesticides in crop production.

PLT Health Solutions, Inc., Morristown, N.J., and innovation partner Nutriati, Inc., Richmond, Va., created pizza at IFT19. Meatless sausage crumbles on the pizza were made with Artesa chickpea protein and Artesa chickpea flour. Cookies, crisps and snacks are other potential applications for Artesa chickpea protein, which has a small, uniform particle size, a white color and a neutral flavor. Environmental benefits of chickpeas include a low carbon footprint and less use of fertilizer, water and pesticides in crop production.

Pizzas with plant-based meat alternatives already are on the market.

Pieology, a pizza chain based in Rancho Santa Margarita, Calif., offers three toppings: spicy Italian sausage rounds, beef meatball and diced chicken that are vegan and contain no cholesterol. The toppings are made with vegetables and contain soy. The diced chicken topping contains about 20 grams of protein per serving. The spicy Italian sausage rounds provide about 14 grams of protein per serving, as does the beef meatball.

Toronto-based Field Roast Grain Meat Co., a unit of Maple Leaf Foods under Greenleaf Foods SPC, has partnered with Canadian pizza chain Pizza Pizza to design the “Super Plant Pizza” that features plant-based Mexican chipotle sausage from Field Roast. The plant-based sausage contains grains, smoked chipotle peppers, sweet onions, garlic, apple cider vinegar, cumin seed, oregano and chili de arbol.

“When dining out, plant-based options can seem less exciting, but we’re quickly changing that experience,” said Dan Curtin, president of Greenleaf Foods, SPC. “Now Pizza Pizza consumers don’t have to sacrifice taste because we’re bringing innovative and delicious plant-based options to the menu. We’re always looking for ways to introduce more people to plant-based eating. Teaming up with Pizza Pizza will allow us to deliver high-quality, artisanal products in new ways.”