CHICAGO — Scientific advancements are allowing for innovations throughout the food and beverage supply chain. It is no longer simply a farm-to-table story. It may start with the seed or in a petri dish. Success lies in understanding what consumers will accept and embrace, according to The Hartman Group, Bellevue, Wash., which held the Food Culture Forecast 2019 summit in Chicago on Sept. 12. Navigating the new playing field is not easy, especially with consumers’ evolving opinions.

CHICAGO — Scientific advancements are allowing for innovations throughout the food and beverage supply chain. It is no longer simply a farm-to-table story. It may start with the seed or in a petri dish. Success lies in understanding what consumers will accept and embrace, according to The Hartman Group, Bellevue, Wash., which held the Food Culture Forecast 2019 summit in Chicago on Sept. 12. Navigating the new playing field is not easy, especially with consumers’ evolving opinions.

“Contemporary consumers are spending more on foods for health and wellness, sustainability and social reasons, especially early adopters,” said Shelley Balanko, Ph.D., senior vice-president for business development at The Hartman Group. “These consumers are telling us they want different food choices.”

This includes a variety of proteins, holistic plant-based foods and responsibly grown meat. They also want more accountability from food companies, as well as education. They want to understand how foods affects their bodies, today and long term.

“It starts with soil health,” Dr. Balanko said. “We need to rethink our food chain with regenerative agriculture. The state of our soil impacts everything from human health to climate change. As more stakeholders begin to understand how rebuilding soil and biodiversity can protect our future food systems, more resources will be diverted into transitioning overused landscapes.”

Dr. Balanko explained that many chefs are addressing climate change by using regenerative ingredients, which are believed to be more impactful than energy or waste in reducing a restaurant’s carbon footprint.

An example is Dan Barber, chef and co-owner of Blue Hill in Manhattan and Blue Hill at Stone Barns in Pocantico Hills, N.Y., who is focused on bringing the principles of good farming directly to the table. He is a believer in science. Through experimentation with seed genetics — old-world breeding with modern technology, not genetic modification — Mr. Barber and a team of other chefs, farmers and geneticists have created new breeds of vegetables, from squash to potatoes and peppers, which promise to deliver better flavor and productivity than similar crops in the United States.

Such plant breeders may be the new rock stars of the food world, Dr. Balanko said. Too often, plant breeders are directed to select for yield, shelf life and uniformity at the expense of food quality, nutrition or the environment. Mr. Barber and others believe it should start with selecting for flavor.

Keeping it simple a priority

“Generally, consumers continue to seek signs of minimal processing and natural ingredients and, increasingly, social justice and worker welfare cues,” Dr. Balanko said.

Today’s consumers are food smart and are less likely than previous generations to fall for hype and marketing. They have learned to evaluate food production innovations according to four overlapping arenas: lab, field, factory and kitchen. They are asking more questions and want truthful answers.

“Field and kitchen innovations are most appealing, while those that are more clearly lab-based are the least attractive,” Dr. Balanko said.

A majority of consumers believe food production needs to go back to more traditional ways of producing food in order to heal the environment. They believe food that is more natural is also more environmentally sustainable.

The majority also believe scientific and technological innovations may make food more sustainable and that such innovations may make food healthier. Specifically, they believe we need to find ways to meet society’s nutritional needs with fewer resources like energy, water or carbon.

“Ultimately, consumers weigh a range of factors to determine what is morally acceptable among food tech innovations,” Dr. Balanko said. “We are well past the era of ‘if you build it, they will come,’ so innovations need to withstand the question, ‘Do the ends justify the means?’”

While ag- and bio-tech companies may be the future of food production in the United States, technology innovations alone will not assure success. Innovations that break the boundaries of cultural acceptability will not be embraced, regardless of the benefits offered.

“Food has gotten specific and personal,” said Tamara Barnett, vice-president of strategic insight, The Hartman Group. “More than ever, people see food as being more intimately connected with wellness and their broader system of values.”

She explained that experimentation with different diets reflects interest in personalization and variety. But trends come and go. How can product developers be successful when many consumers change directions often and quickly?

“Demonstrate that you understand that no ‘one size fits all,’” Ms. Barnett said.

She encouraged food marketers to look at the trends and pull little strands from them and weave them into product innovations.

“Look at what’s valuable about the trend and the lifestyle,” she said. “Stay focused on the science.”

She identified five areas to target, including the microbiome, stress and sleep, neuro health, aging and beauty.

“These will continue to be a core focus across consumer segments and occasions,” Ms. Barnett said.

During a panel discussion with several entrepreneurs who embrace food science, Riana Lynn, founder and chief executive officer of Journey Foods, Chicago, emphasized the necessity of infusing more science into the future to feed the world’s growing population.

During a panel discussion with several entrepreneurs who embrace food science, Riana Lynn, founder and chief executive officer of Journey Foods, Chicago, emphasized the necessity of infusing more science into the future to feed the world’s growing population.

Ms. Lynn, a biologist, believes the future of nutrition is micro foods. She started Journey Foods, an artificial intelligence-powered platform that helps support smarter research and development and efficient, data-driven production of plant-derived foods, in 2017. She recently launched her first product: Journey Bites. These are small, nutrient-dense, portable and affordable shelf-stable snacks made from fruit purées and include a range of other better-for-you ingredients, including cayenne, chia, baobab, citrus pectin and marine greens.

Sarah Marion, director of syndicated research at The Hartman Group, explored the historical role of plants in the human diet — bread is one of the original plant-based foods — and the many definitions of plant based. While plant-based processed foods are not going away — think lentil pasta, pea protein smoothies and veggie burgers — Ms. Marion emphasized today’s consumers are smart and are asking questions and reading labels. She fears the term “plant based” is becoming diluted much like “natural” and even at times, “organic.”

“Plant-based eating is becoming more accessible and more convenient,” Ms. Marion said. “Consumers are slowly discovering that plants shouldn’t need to hide or be snuck into other foods. As delicious plants become more accessible, consumers are becoming more aware of the need for a broader palate.”

The final presenter, Iva Naffziger, director-marketing research and strategic insights at The Hartman Group, explored the many types of protein alternatives in the marketplace. She explained that meat production and consumption continues to grow; however, while small in volume compared to meat, meat substitutes are growing rapidly.

“Many consumers are adding alternative proteins into their diet, not replacing meat,” she said.

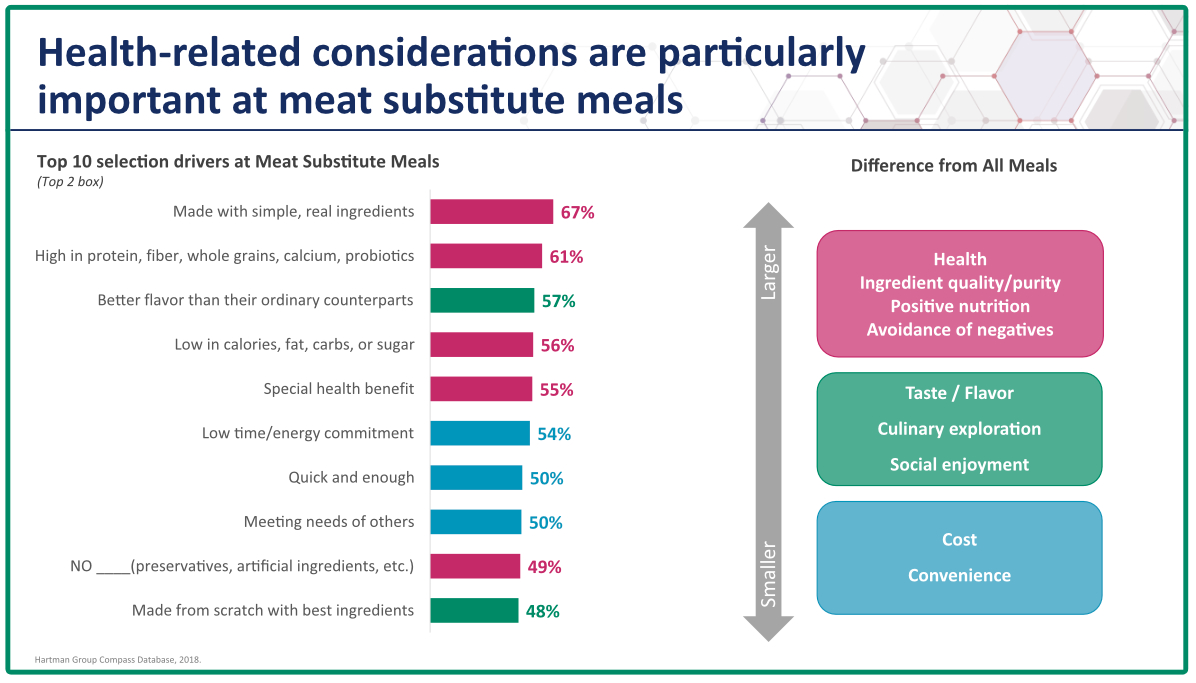

This all comes back to diet personalization and consumers’ attitudes and opinions toward the four overlapping forms of food production. Health-related considerations are particularly important at meat substitute meals.

Two-thirds of consumers consider if a meat substitute is made with simple, real ingredients, according to the Hartman Group’s Compass database, 2018. Being high in important nutrients, such as protein and fiber, influences meat substitute selection for 61% of consumers, and 57% say the meat substitute must have better flavor than its ordinary counterpart.

Traditional plant-based meat substitutes are perceived as healthier options that still compare in taste. And, blended products, such as burgers that are half meat and half plant, resonate with consumers’ approach to reducing animal products.

“Plant-based meat alternatives that mimic real meat are an exciting option for vegans and carnivores alike,” she said. “While the pros and cons of cellular meat are largely unknown due to lack of familiarity.”

She added that insect protein is a sustainable protein option, but the “ick factor” is difficult for most to get past.

In conclusion, Ms. Naffziger said consumers are looking under the hood.

“Consumers are looking for healthier sources of protein and other nutrients,” she said. “They want shorter, cleaner ingredient panels. Alternative proteins need to ensure their ingredients are simple, pure and not too many. They should be avoiding excessive fat and sodium.

“Consumers are concerned about excessive processing. They are skeptical of lab-based innovations and unfamiliar production methods. Positioning production methods as a farm- or kitchen-level approach, rather than lab-made, may be advantageous for all alternative proteins.”