NEW YORK — Two thirds of consumers increased their spending on the fresh food category over the last two years, according to Deloitte Insights’ new “Future of Fresh” report. More than 60% now spend a third of their monthly grocery budget on the category, and 74% buy fresh foods at least once a week.

The allocation of space devoted to fresh food reflects this rise in consumer demand. Deloitte found that from October 2015 to October 2016, the fresh perimeter of the store grew nearly twice as fast as the total food and beverage space. It is the key driver of growth in the fast-moving consumer goods industry, accounting for 49% of dollar sales growth, according to Nielsen.

Despite increased interest in fresh foods, Deloitte said sales have so far been incommensurate with the space devoted to the category.

“Despite the prominence given to fresh foods in stores, growth rates are not living up to their potential,” said Barb Renner, vice-chairman and U.S. consumer products leader at Deloitte. “Retailers should better understand and centralize management of the fresh food category to help address the issue from not only the consumer demand side, but also the manufacturing and retail side.”

Deloitte surveyed 2,000 consumers and more than 150 food industry executives to better understand how retailers and manufacturers can realize the category’s unlocked potential.

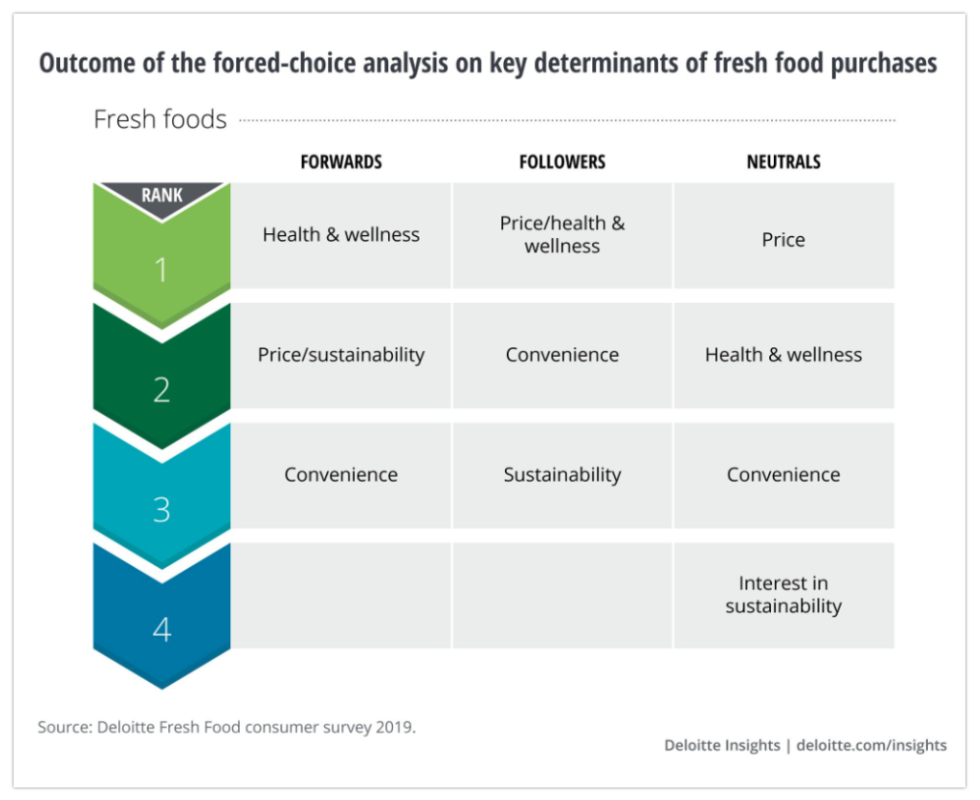

While the industry tends to think of fresh food consumers as a homogenous group of “health conscious” shoppers, Deloitte’s purchasing behavior research revealed three distinct buying personas.

Close to half (47%) of fresh food consumers are middle-aged “followers” who balance health and wellness with price and convenience. About 20% are “neutrals.” This group tends to be older and values price over nutrition. The remaining 31% are “forwards.” This group is younger than the average consumer and is willing to pay a premium for healthy foods, Deloitte said.

Conventional wisdom suggests maximizing forwards’ buying power is the best path to growth. Deloitte’s research suggests that for now, their spending power is limited.

Conventional wisdom suggests maximizing forwards’ buying power is the best path to growth. Deloitte’s research suggests that for now, their spending power is limited.

Efforts to increase fresh food consumption among middle-aged “followers” and older “neutrals” could start with competitive pricing and progress toward consumer education, the report said.

“Retailers and manufacturers have ample opportunity to stimulate consumer demand by targeting ‘followers’ and highlighting value proposition of fresh food through communication on sourcing, safety and healthy eating,” said Stephen Rogers, executive director of Deloitte’s insights consumer industry center.

Key barriers to growth on the manufacturing and retail side include quality of raw materials, storage and processing, spoilage and pricing. Opportunities exist for companies to overcome these barriers by centralizing their fresh food staff and investing in technology. Research shows industry leaders with above-average fresh food sales are more than three times as likely to have a small, centralized fresh food staff. They also tend to invest more in tech and supporting processes.

Key areas for tech investment identified in the report include freshness prediction, advanced analytics and improved supply chain management and store operations.

Tech adoption in these areas remains nascent. Less than 40% of companies have partially or fully implemented artificial intelligence-based warehouse management to monitor fresh food stocks, and only 3% use in-store technologies that allow customers to access product information using their smartphone, according to the report. Just 9% use data analytics to identify actionable insights and trends, and 4% use blockchain technology to track the movement of fresh food through the supply chain.

“As companies create additional demand, they should look to implement technologies and analytics that help to deliver on the fresh promise and improve their costs,” Mr. Rogers said.