KANSAS CITY — That the grain-based foods industry is losing market share to other food categories isn’t new. The pace at which the losses are transpiring and the urgency with which the industry is exploring ways to boost business definitely is a major concern. The weak trends have fueled varied numerous industry changes over the past year.

Volume of many major grain-based foods categories has been declining in recent years, but data from Information Resources, Inc. for the 52 weeks ended Aug. 11 indicate an acceleration. The industry’s flagship product — fresh bread — experienced a 4.8% unit volume decline over the past year, to 3,523,484,271 units. Dollar sales for the year were down, too — by 0.8%, to $8,923,613,663.

Other grain-based categories on the defensive over the past 12 months included hamburger and hot dog buns, unit sales down 2.4%; other rolls, down 1.8%; pita bread, down 7%; crackers, down 1.7%; crackers with fillings, down 0.6%; saltine crackers, down 1.9%; graham crackers, down 3.1%; breadsticks, down 8.3%; ready-to-eat cereal, down 3.1%; popcorn, down 0.8%; hot cereal, down 4%; pretzels, down 3.9%; granola bars, down 5%; and pasta, down 0.7%.

A few grain-based categories, many of which are more indulgent, enjoyed sales gains, including bakery snacks, up 0.8%; frozen pizza, up 1.5%; cookies, up 0.5%; and salty snacks, up 3%.

Drilling deeper into the figures for fresh bread, most major companies experienced declines in unit sales of branded bread, but private label sustained the greatest losses. At 1,083,012,714 units, sales of private label bread were down 9.8% for the year. Even with another year of share loss, private label accounted for 31% of bread sales volume but dropped to just under 20% of dollar sales. The Horsham, Pa.-based U.S. business of Grupo Bimbo S.A.B. de C.V. remained the largest bread baker in the United States over the past year but continued to lose market share, with a 6.1% decline in unit sales. Flowers Foods, Inc., Thomasville, Ga., experienced nearly flat unit sales (up 0.8%), but gained considerable share in a falling market. Campbell Soup Co., Norwalk, Conn., enjoyed a sales jump of 2.5% during the year.

The declining sales volume has exacerbated an excess in baking industry production capacity, and numerous plants were closed over the past year. For example, in November 2018, Flowers Foods announced plans to shutter a baking plant in Brattleboro, Vt., and in October 2019, the company said it was planning to cease production at a plant in Opelika, Ala. Bimbo in September 2019 announced plans to close a plant in West Hazelton, Pa. Smaller companies have consolidated production as well. Early in 2019 Aunt Millie’s closed its baking plant in Coldwater, Mich., and Schwebel Baking Co. in March said it was closing its plant in Solon, Ohio.

Even companies that have avoided a focus on traditional sliced bread have experienced challenges in recent years. Aryzta L.L.C., which enjoyed rapid growth for many years in the 2000s, has experienced great challenges. Unit sales over the past 52 weeks were down 4.6%. Difficulties faced by the North American business of Aryzta were blamed in October for a steep share price drop of the parent company, which is headquartered in Zurich. Commenting on the weak revenue trends, Aryzta chief executive officer Kevin E. Toland said the effort to stabilize revenues in North America was “challenging, and the recovery will take time and be bumpy.”

Weakness in sales of grain-based foods has been attributed, in part, to the increasing popularity of gluten-free dieting. Reflecting a desire to participate in this trend, Flowers Foods in late 2018 acquired Canyon Bakehouse, a leading producer of gluten-free bread.

Also a major change at Flowers during the past year was a “changing of the guard” at the company’s helm. At mid-year, A. Ryals McMullian Jr. was elected president and c.e.o. of Flowers, succeeding Allen L. Shiver, who retired following a career dating back 41 years.

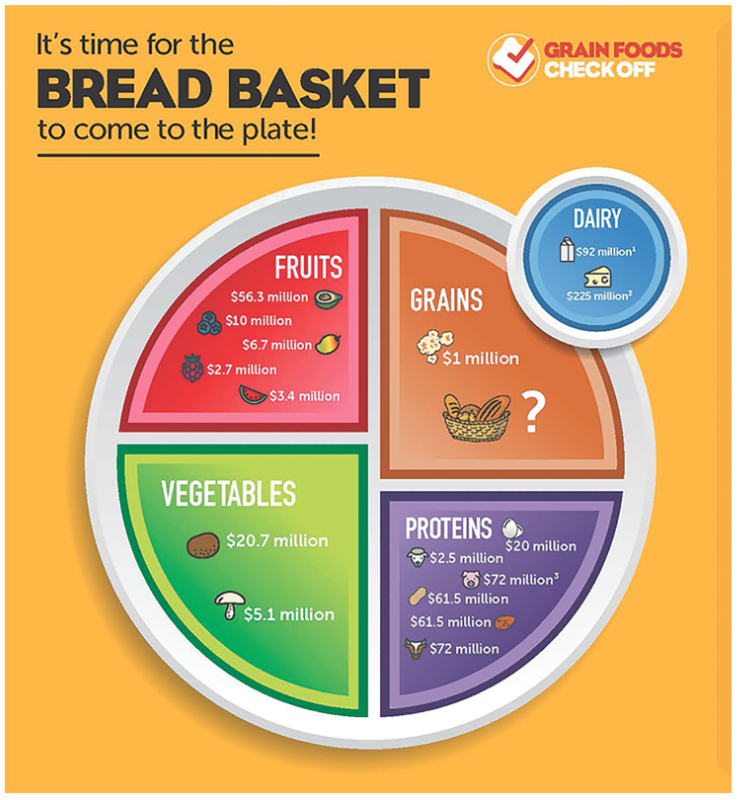

Even before the drop in flour-based product sales over the past year, millers and bakers had begun to explore whether there is more to do as an industry to stimulate demand for flour-based foods. Spearheaded by the Grain Foods Foundation, the industry has been considering investing in a checkoff program to be overseen by the U.S. Department of Agriculture. From dairy and meat to produce, most other dietary staples have such a program to help educate consumers with the objective of allowing individual products and product categories to boost demand.

Even before the drop in flour-based product sales over the past year, millers and bakers had begun to explore whether there is more to do as an industry to stimulate demand for flour-based foods. Spearheaded by the Grain Foods Foundation, the industry has been considering investing in a checkoff program to be overseen by the U.S. Department of Agriculture. From dairy and meat to produce, most other dietary staples have such a program to help educate consumers with the objective of allowing individual products and product categories to boost demand.

Specifically under consideration by the grain-based foods industry is a checkoff program that promotes “bread basket” products, including bread, rolls, bagels, English muffins, etc. Such a program would be far larger than those currently executed by the G.F.F. and the Wheat Foods Council. While it has gathered full-throated support from leading baked foods and milling companies, a number of bakers with businesses focused principally on the food service sector have expressed skepticism or even opposition. Checkoff programs from other industries have endured for years, even decades because of their success in generating positive return on investments. Still, the compulsory nature of such programs and the presence of government involvement in activities with businesses that often resist such involvement have meant that checkoff programs, even longstanding ones, rarely escape controversy.

Reflecting the mix of opinions about the program, the G.F.F. has reduced the size of the proposed program to $15 million per year from $23 million tentatively suggested early in 2019. Costs for the program would be borne 85% by bakers and 15% by flour millers. Costs would be assessed at a rate of 16c per cwt of wheat flour used to bake breadbasket products.

Christine Cochran, executive director of the G.F.F., said millers and bakers should expect a return on investment of between 5 times and 15 times of the program’s cost.

Flour milling companies also have moved in new directions to adjust for shifting consumer eating habits.

In July, Ardent Mills, L.L.C. acquired a grain storage facility in Klamath Falls, Ore., to enhance its ability to source organic wheat and other organic grains. To address changing tastes more broadly, Ardent Mills in 2018 established The Annex as a separate business, offering a portfolio of heirloom wheats, rye, barley, pulses and ancient grains. Earlier this year, the company added specialty grains handling and cleaning capabilities at its Denver mill. Numerous other milling companies, large and small, have announced initiatives around specialty grains. Also dramatic have been steps taken by a new company, Panhandle Milling L.L.C., to make major investments in specialty grains opportunities while minimizing its exposure to more commoditized wheat flour milling.

Bay State Milling Co. has begun marketing a new product stemming from a 2017 partnership with Arista Cereal Technologies, which developed a wheat variety with 10 times more fiber within the endosperm than what is in most wheat harvested today. The new variety has amylose content of about 85%, which compares to 20% or 30% in regular wheat. The higher amylose content leads to a higher resistant starch content. Resistant starch functions like soluble fiber. Bay State has contracted with farmers across a number of states to grow several thousand acres of the wheat. The resulting flour is being marketed as HealthSense high-fiber wheat flour. Arista Cereal Technologies, Bay State Milling and Arcadia Biosciences reached an agreement in August 2019 under which Bay State will become the exclusive commercial partner of Arcadia’s high-fiber wheat under the HealthSense brand. Arista received exclusive rights under Arcadia’s intellectual property in Australia, New Zealand, Europe, Japan and South Korea.

R.-T.-E. cereal category eyes growth

Notwithstanding volume declines, executives from the ready-to-eat cereal market have remained optimistic their market will grow, with innovation.

“We don’t think it’s going to be in mid-single digit, but just grow a little bit,” said Jonathan J. Nudi, group president of North America Retail at General Mills, Inc., during Barclays Global Consumer Staples Conference in Boston in September. He attributed some of the weakness over the past year to inventory draw downs by retailers rather than diminished consumer demand.

“We feel confident about our plans to be able to perform well, and it can … drive the category as well,” he said. “In terms of inventory, I mean, we’ve been pretty clear over the last year for sure. We’ve seen, as our retailers focus on reducing working capital, they have drawn down their inventories. And for us, in fiscal ‘19, it was about a point gap between Nielsen and what we reported from a net sales standpoint. We expect that to continue into the coming year. We hope it’s not quite as big of a gap. But clearly, our retailers are still focused on working capital as well.”

At the same conference, Steven A. Cahillane, chairman, president and c.e.o. of Battle Creek, Mich.-based Kellogg Co., acknowledged that R.-T.-E. cereal is a challenging business for the company.

“It’s a highly penetrated category,” Mr. Cahillane said. “It’s a profitable category

for us. And by no means do we think that this category’s best days are behind us. But it’s going through a challenging time right now. As a category, it’s only declining by about 1%. So it’s not falling off the cliff as, if you read some reports, you might think.”

He blamed shifting dietary habits for pressuring the breakfast cereal market.

“(We need to remind) people that cereal can be very important and a great addition to a healthy diet,” he said.

While North America may have the largest share of the breakfast cereal market, its dominance is slowly being challenged by Asia, Europe and Africa, according to a new report from market research firm Packaged Facts.

In its “Global Breakfast Cereals” report, Packaged Facts said the global breakfast cereal market is forecast to expand 3% per year to $40 billion by 2023, led primarily by sales growth outside of North America.

Packaged Facts said North America accounted for $12 billion of the $35 billion global breakfast cereal market in 2018. The region has the highest penetration of breakfast cereals in the world, with per capita consumption of both hot and R.-T.-E. cereals exceeding that of other regions. But increasingly busy lifestyles and a plethora of other breakfast options have contributed to a decline in per capita consumption in recent years, the report noted.

“While breakfast cereal penetration is much lower in the rest of the world, consumption rates are rising as cereal companies target these areas,” said David Sprinkle, research director at Packaged Facts. “In these nations, instead of breakfast cereals being an entrenched product that competes with new breakfast options, cereals are being introduced as an alternative to traditional fare. The Westernization of the diet in many of these areas also makes breakfast cereals a novel and enticing food option.”

To prevent breakfast cereal sales from eroding further, Packaged Facts has identified six trends cereal makers are focused on: harvesting a health halo, creative novel flavors, marketing cereal beyond breakfast, capitalizing on convenience, adding value with add-in ingredients, and paying attention to packaging. The presence of enhanced packaging components, including smart labels, is allowing more interaction with consumers and serving to enhance the breakfast experience.

Cookie sales top $8 billion

Rich flavors and premium ingredients create indulgent snacking experiences for cookies. These key drivers influenced the category, resulting in more than $8.05 billion in sales and steady growth in the U.S. snack market for the 52 weeks ended Aug. 11, according to I.R.I.

“Taste is the biggest driver of choice, and consumers seek out products that offer new exciting tastes and experiences,” Mr. Sprinkle said. “Some consumers, especially younger people, want even more indulgent, decadent and unique choices.”

“Taste is the biggest driver of choice, and consumers seek out products that offer new exciting tastes and experiences,” Mr. Sprinkle said. “Some consumers, especially younger people, want even more indulgent, decadent and unique choices.”

Underscoring the popularity of decadence, Deerfield, Ill.-based Mondelez International’s Nabisco brands launched The Most Stuf Oreos, filled with more than triple the vanilla-flavored crème of a regular Oreo. The brand released three limited-time flavors this summer, including S’mores, Marshmallow Moon, and Baskin-Robbins Mint Chocolate Chip Oreos.

“While categories with claims have done well, good old-fashioned indulgence has influenced consumer cookie purchases,” said Sally Lyons Wyatt, vice-president and practice leader, client insights, I.R.I. “Mass marketing of traditional flavors with innovative combinations have been successful.”

The cookie segment is not without its challenges. Lower-priced and private label brands, fresh offerings and competition from other indulgent and/or better-for-you snacks could constrain growth.

Cookies with healthy inclusions satisfy hunger between meals or boost energy after a workout. Quest Nutrition, El Segundo, Calif., has experienced success with the launch of Quest Protein Cookies.

And alternative formats like thin cookies are still in. Camden, N.J.-based Campbell Snacks created the Pepperidge Farm Farmhouse Thin & Crispy cookie lineup, which includes thin, crispy cookies baked with simple ingredients.

The cookie category looks to be strengthening, not just because of protein but also because people will always have a soft spot for the familiar indulgence of a cookie.

Cracking the cracker code

Cracker manufacturers are looking to add value in an effort to boost category sales. In one case, innovation is focused on providing nutrients through the addition of vegetables infused into the crackers. In another instance, crackers are being given a “chip-like” texture to appeal to consumers’ snacking tendencies.

Whatever the case, companies are on the lookout for ways to turn around the unit sales slump in the cracker category and kick-start dollar sales growth.

In the 52 weeks ended Aug. 11, dollar sales in the cracker category totaled $7,000,423,248, down 0.7% from the same period a year ago, according to I.R.I. Unit sales in the period were down 1.7%.

One of the goals at Campbell Soup is to sustain the momentum in its Pepperidge Farm business, which includes the company’s Goldfish brand.

In the 52 weeks ended Aug. 11, Pepperidge Farm’s cracker dollar sales totaled $884,521,380, up 2.1% from the same period a year ago, according to I.R.I. Unit sales, meanwhile, fell 1.7% in the period.

Speaking to investors during the company’s June 13 Investor Day in Camden, Carlos Abrams-Rivera, senior vice-president and president of Campbell Snacks, said Pepperidge is looking to renovate its core, bring new packaging formats to stores, uncover new ways to inspire children to play with Goldfish and extend into areas outside the core demographic.

To that end, Pepperidge plans to introduce Goldfish Veggie crackers, which will be available in two varieties: Cheesy Tomato and Sweet Carrot. This wouldn’t be the first time Pepperidge has looked to infuse Goldfish with vegetables. A decade ago the company introduced Goldfish Garden Cheddar snack crackers, which also contained one-third of a serving of vegetables.

To that end, Pepperidge plans to introduce Goldfish Veggie crackers, which will be available in two varieties: Cheesy Tomato and Sweet Carrot. This wouldn’t be the first time Pepperidge has looked to infuse Goldfish with vegetables. A decade ago the company introduced Goldfish Garden Cheddar snack crackers, which also contained one-third of a serving of vegetables.

The Cheez-It brand continues to reap rewards for Kellogg Co. Kellogg’s cracker dollar sales totaled $1,375,559,479 in the 52 weeks ended Aug. 11, up 0.6% from the same period a year ago, according to I.R.I. The overall category gains were boosted in large part to the strength of the base Cheez-It brand, which posted year-over-year dollar sales growth of 3.4%.

Kellogg also experienced growth in some of Cheez-It’s varietal options, including Cheez-It Grooves. Kellogg will look to continue its success in Cheez-It with the recent launch of Snap’d, which are thin and crispy cheese crackers. The crackers are available in four varieties: double cheese, cheddar sour cream and onion, white cheddar and bacon, and jalapeño jack.

Mondelez is the category’s largest player, with dollar sales of $1,609,025,672, according to I.R.I. The company’s grip on the top spot loosened a bit in the most recent 52 weeks, though, as dollar sales fell 0.5%. A key factor in the decline was a noticeable drop in the company’s biggest brand: Nabisco Ritz. According to I.R.I., dollar sales of Ritz crackers fell 6.1% while unit sales dipped 10.5% in the 52 weeks ended Aug. 11.

Mondelez has been mostly quiet in recent conference calls regarding its cracker business. The company did have one product land on I.R.I.’s Top 10 New Product Pacesetters list earlier this year, though. Ritz Crisp & Thins, which debuted late in 2017, generated $49.1 million in year-one sales, according to I.R.I., placing it No. 9 on the annual list. The Crisp & Thins are available in four varieties: sea salt, cream cheese and onion, bacon, and salt and vinegar. According to Mondelez, the crackers combine potatoes and wheat, rolled thin and oven baked for extra airiness and crunch, with 50% less fat than many regular fried potato chips.