Many food start-ups are selecting Amazon.com as a first route to market and rewriting the rules of retail as a result. Digitally native brands, as they’re known, sidestep the slotting fees, limited shelf space, merchandising resets and other hurdles of brick-and-mortar grocery, while enjoying a number of strategic advantages that have unsteadied the competitive landscape for conventional brands.

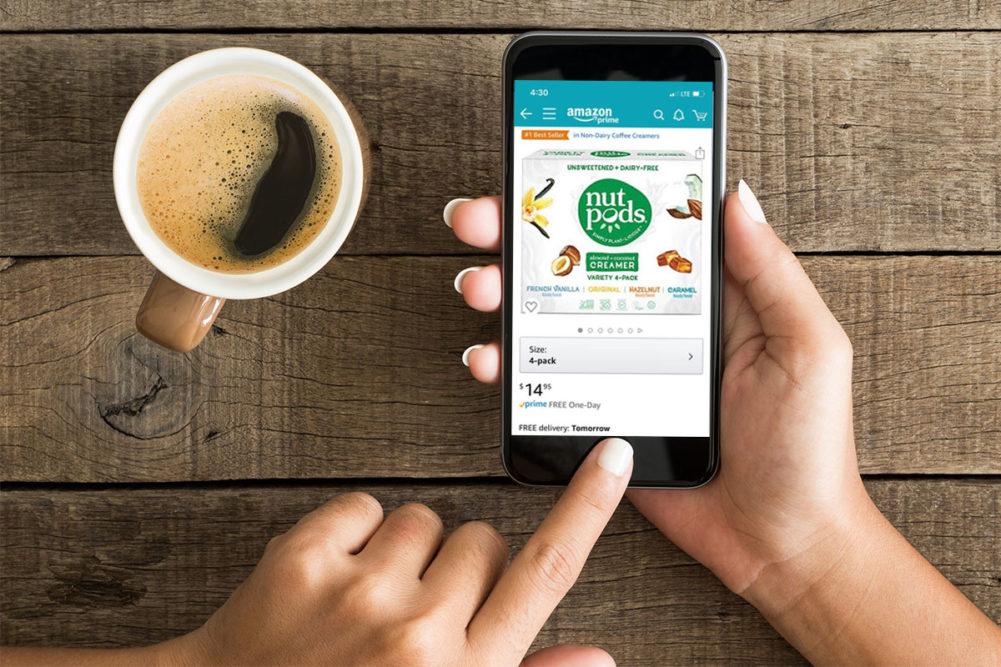

Nutpods, a line of unsweetened, non-dairy creamers, has soared to the top-selling spot in its category on the site, besting bigger brands like Nestle’s Coffee-Mate and Danone’s International Delight. In 2019, the Bellevue, Wash., start-up was named Amazon’s Small Business of the Year, selected among 1,300 candidates. Its sales on the site have surged 5,500% since launching in 2015.

Nutpods already had generated buzz from a crowdfunding campaign a couple years before, said Madeline Haydon, founder and chief executive officer. The effort helped demonstrate demand for the concept, a shelf-stable replacement for half-and-half based on a combination of coconut and almond with natural flavors and no added sweeteners.

Last year, the brand landed in the No. 13 spot (No. 2 of all food and beverage companies) on the 2019 Inc. 5,000 list of fastest-growing companies, with three-year growth of 11,623% and $19.1 million in revenue in 2018. The company achieved this with 24 employees.

“The ability to scale (on Amazon versus traditional retail) cannot be overstated,” Ms. Haydon said. “If you wanted to launch on Amazon, you can launch it with one person who can support your sales when you’re selling $100 a day. But that one person is doing the same work when you’re selling $100,000 a day.”

Gathering feedback and data from online shoppers prepared Cali’flour Foods for a broader move into retail stores. The Chico, Calif.-based company offers a range of frozen pizzas and pizza crusts formulated with cauliflower, eggs and cheese.

“Going online allowed me to get all the kinks out,” said Amy Lacey, founder and c.e.o. of Cali’flour Foods. “It’s more forgiving than a grocery store … You’ll never get back in once a grocery store kicks you out.”

Cali’flour products are available nationwide in top retailers, including Kroger, Whole Foods Market (a business unit of Amazon) and Walmart, but Ms. Lacey said Amazon’s reach is unmatched, particularly for emerging brands.

“We literally went from negative $269,000, which is getting started — there’s a lot of fees in the beginning of launching a new product — to $20 million online within 24 months,” Ms. Lacey said. “And Amazon was a big part of that.”

The size of the online prize

By some estimates, online sales are predicted to capture 20% of total retail grocery sales, or $100 billion, by 2025 in the United States. A recent forecast by Nielsen pegs that figure at $143 billion. In 2019, 54 million households purchased food and beverages online in the United States, up 14% from two years earlier, according to Nielsen.

Amazon.com Inc. is the leading online grocery seller with $8.2 billion in sales, trailed by Walmart at $2.44 billion and Kroger at $1.51 billion. Target, by comparison, has $423 million in online grocery sales, said Betsy McGinn, co-author of “The Amazon Roadmap.”

Amazon offers several platforms for brands to sell finished goods: Vendor Central (product is shipped and sold by Amazon), Seller Central fulfilled by merchant (product is shipped and sold by brand), and Seller Central fulfilled by Amazon (product is shipped by Amazon and sold by brand). Each option offers various benefits and drawbacks, Ms. McGinn said during a Jan. 20 workshop at the Winter Fancy Food Show in San Francisco.

Start-ups also may apply to participate in Amazon Launchpad, which provides education, merchandising and global infrastructure to early-stage businesses. Soylent, the meal-replacement brand, gained marketing exposure and organizational support from the program, said Ben Knox, head of digital retail at parent company Rosa Foods.

Product viability and visibility are central components of a successful Amazon strategy, Ms. McGinn said. Brands should consider pack size, price point (ideally $15 to $40) and packaging that is recyclable, easy to open and protective of the contents. Multipacks and variety packs especially appeal to online shoppers, she said.

A product page should include basic and enhanced product detail, images and videos that effectively explain the product and brand. A product’s description should be concise and include key words that may help the brand stand out in a search. Prior to the recent cauliflower craze, Cali’flour Foods used terms like “gluten-free,” “grain-free” and “low-sugar” to generate traffic to its page.

“Sixty-nine per cent of consumers will abandon a product page for lack of information,” Ms. McGinn said. “So many people think the product gets abandoned because people don’t like the price. That is not really the case. Think about the last time you went on an Amazon page and you couldn’t tell from the title or bullet points or the picture whether you were getting three of something or 30 of something. Were you getting a case or a single unit for $30? It’s so important to have your shelf, your content, looking great.”

Cali’flour Foods features a landing page on Amazon offering recipe inspiration, product descriptions and the founder’s story. The company recently created a video demonstrating the brand’s use of cauliflower roots and stems to reduce waste and improve the product’s nutritional content.

“On Amazon, they’ve developed all kinds of programs to help tell your story,” Ms. Lacey said. “You can upload videos; you can have a whole landing page on Amazon that describes your product. Those are things you can’t do in a store. You can run a coupon and a price reduction in a store. But there’s no way to educate people.”

To be discovered among millions of items, a “constant drumbeat of marketing” is needed, Ms. McGinn said. Brands may use coupons, discount codes, subscribe-and-save options and “lightning deals” to promote products.

“If you don’t do marketing, you don’t have an Amazon business,” Ms. McGinn said. “It’s gotten more competitive, it’s gotten more expensive, and the amazing things that simple pay-per-click marketing can do for you will put you on the map.”

Ready for prime time

Reviews, and how a brand responds to them, are critical for generating sales on Amazon.

“Negative reviews can be a great source of information for you,” Ms. McGinn said. “Don’t think that the consumer just doesn’t know what they’re talking about. Use that information to inform what you do with your brand, how you respond to them, and do not ignore negative reviews. Especially 1-star reviews. You really need to be in touch with them.”

Nutpods has generated more than 10,000 reviews and a 4.5-star (out of 5) rating. Reviews have helped the company refine its offering and go-to-market strategy, Ms. Haydon said.

“Your reviews are a way to learn about what your consumers are saying, and that is something you won’t get in the grocery store,” she said. “You won’t get the feedback. They just won’t buy you again, but you won’t know if it’s because of price or taste or they didn’t like your packaging or what have you…

“You have to embrace the opportunity to learn. You have to risk the market telling you your product is not meeting the need.”

How a company interacts with online shoppers and responds to reviews is key for creating customer loyalty and protecting the brand’s reputation, she added.

“When it’s time to raise capital with investors, they absolutely read all of your reviews,” Ms. Haydon said. “That says something to them if you’re a company and you have negative reviews and you don’t have any replies or acknowledgement. Reviews are a very useful tool.”

Ultimately, brands should offer a product that fills a void in the marketplace. Both Ms. Lacey and Ms. Haydon developed products to meet personal dietary needs when no similar commercial options existed.

“When we launched in 2015, there were people organically looking for a vegan coffee creamer or a paleo coffee creamer or a Whole30 coffee creamer or a gluten-free coffee creamer or a keto coffee creamer,” Ms. Haydon said. “The hard part is not how you get discovered in a digital universe when you’re a small brand. The hard part is creating a product that is hitting all the trends at the same time so people are organically looking for your product.”

This feature ran in the March 3 edition of Food Entrepreneur. Read the full issue here.