KANSAS CITY — The unfolding impact of the novel coronavirus on public health and the global economy has been dramatic. Reaction to the virus by public and private entities will have a significant short-term impact on some sectors of the food and beverage industry as it spreads in the United States and to the rest of the world.

KANSAS CITY — The unfolding impact of the novel coronavirus on public health and the global economy has been dramatic. Reaction to the virus by public and private entities will have a significant short-term impact on some sectors of the food and beverage industry as it spreads in the United States and to the rest of the world.

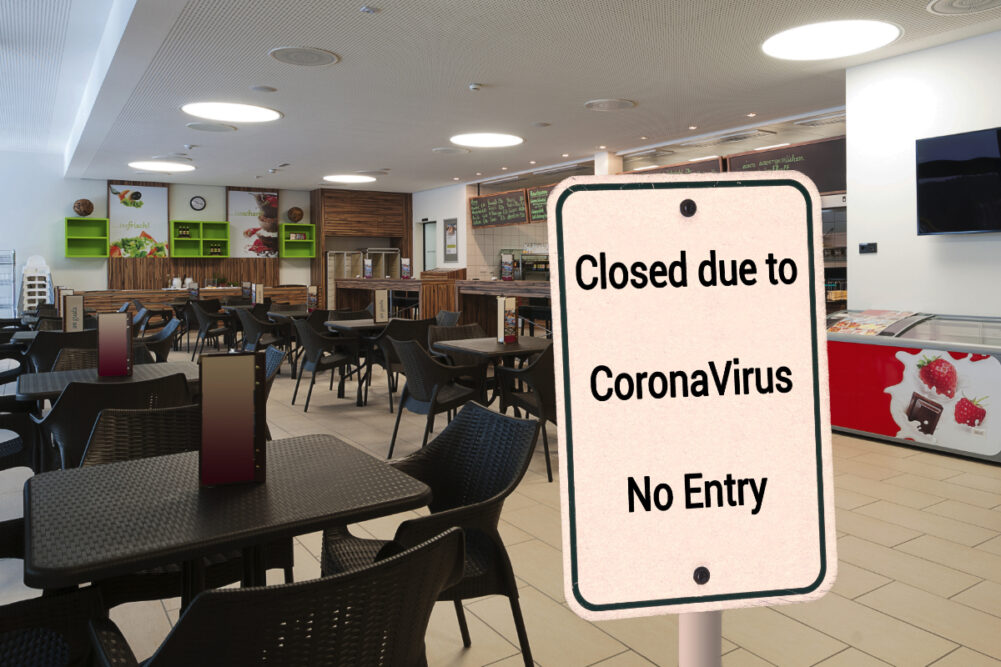

Foodservice will be hardest hit as more consumers work from home or practice social distancing to slow the spread of the virus. Many restaurants are expected to lose breakfast, lunch and dinner traffic, and the fall in demand will ripple through to the distributors and manufacturers who serve those businesses.

A recent survey by the market research company Technomic, Inc. found more than 3 in 10 consumers say they plan to leave the house less often and to go to restaurants less often or order food or beverages at away-from-home venues less frequently. And among those who say they will not go to a restaurant as often, 31 percent say decreased frequency will last between one and three months.

In China, Starbucks Corp. closed half of its stores in response to the virus. Most of the stores have reopened, but same-store sales were down 78 percent in February when compared to the same period of the prior year. While a single data point, Starbucks’ experience indicates foodservice recovery may be slow.

Similar supply chain ripple effects will occur as more schools and universities close for undetermined periods of time. Suppliers to the institutional market will see demand fall as schools shift to online learning programs.

Producers and food manufacturers also may be impacted by China’s inability to fully honor its commodity purchasing obligations under the phase one agreement signed Jan. 15. China agreed to purchase at least $36.5 billion in US food, agricultural and seafood products in calendar year 2020, but those purchases may be delayed as the Chinese economy and the global supply chain recover from the effects of the virus.

Technomic sees the coronavirus as a “boon” for the grocery business, as almost half of the consumers surveyed said they will stockpile grocery foods and beverages as a substitute for away-from-home meals. The scenario is playing out in a variety of ways. On March 4, the Campbell Soup Co. said it is increasing production and distribution of soups in regions of the United States where it is seeing a spike in sales thought to be related to consumers stocking up on shelf-stable goods. Costco Wholesale Corp. said its February sales benefited from an uptick in consumer demand in the fourth week of the month. The retailer attributed the rise to consumer concerns about the coronavirus and estimated the impact to be 3 percent over the comparable period a year earlier.

Of additional concern to marketers and manufacturers is how the impact of the outbreak may affect long-term consumer behaviors. The longer the outbreak persists, the more likely it is people will try new products or services, whether in-store prepared foods, click-and-collect, delivery, etc. While the immediate effects of the coronavirus are dramatic, residual changes continuing after the pandemic passes could prove transformational for some sectors of the industry.