WASHINGTON – The US Department of Agriculture’s August Crop Production report offered the first real (survey-based) estimates of 2021 row crop production in a year of many challenges, laying the groundwork for the fall harvest season and commodity prices for the 2021-22 marketing year. Though down from multi-year highs, prices of most key commodities remain well above year-ago levels.

The USDA forecast smaller-than-expected but still historically large corn and soybean crops in its August report, all-wheat outturn topped expectations but varied by class. Corn harvest was underway from Texas to South Carolina but had yet to move into the largest producing states of the Midwest. Soybean harvest was getting underway in a couple Gulf states. Spring wheat harvest was in the home stretch (77% completed as of Aug. 22, ahead of the 55% 2016-20 average for the date), and winter wheat harvest was completed a few weeks ago.

While drought across much of the western half of the country and in the Upper Midwest and extreme heat in several areas have garnered headlines, production estimates and forecasts have not necessarily belied worst case scenarios, in part due to irrigation in the driest areas, and drought-tolerant varieties of some crops.

Drought has devastated many of the non-irrigated agricultural areas west of the Rocky Mountains, especially the Pacific Northwest, and has significantly reduced US durum and hard red spring wheat crops in the Upper Midwest and Canadian Prairies. The USDA forecast US durum production down 50% from 2020 and hard red spring wheat production down 41%. If realized, the average durum yield forecast at 24 bus per acre would be the lowest since 1988 and the average yield for spring wheat other than durum (mostly hard red spring) would be the lowest since 2002. All-wheat production was forecast down 7% from 2020, with winter wheat production up 13% from last year partially offsetting sharp declines in spring wheat and durum.

The picture appears less dire for corn and soybeans, in large part because several of the largest producing states are east of the driest areas.

The USDA forecast 2021 US production of corn at 14,750 million bus, up 4% from 2020, with both average yields and harvested area expected up from a year ago. Production of soybeans was forecast at 4,339 million bus, up 5% from 2020, with slightly lower average yields more than offset by higher harvested area. If realized, 2021 corn production would be the second highest on record and soybean production would be the third highest ever.

Record-high yields were forecast for both corn and soybeans in Illinois, Indiana and Ohio, three of the eight largest-producing states for both commodities.

But as farmers and traders will attest, final crop size isn’t sure until harvest is done. And weather will continue to play an important role, especially for soybeans.

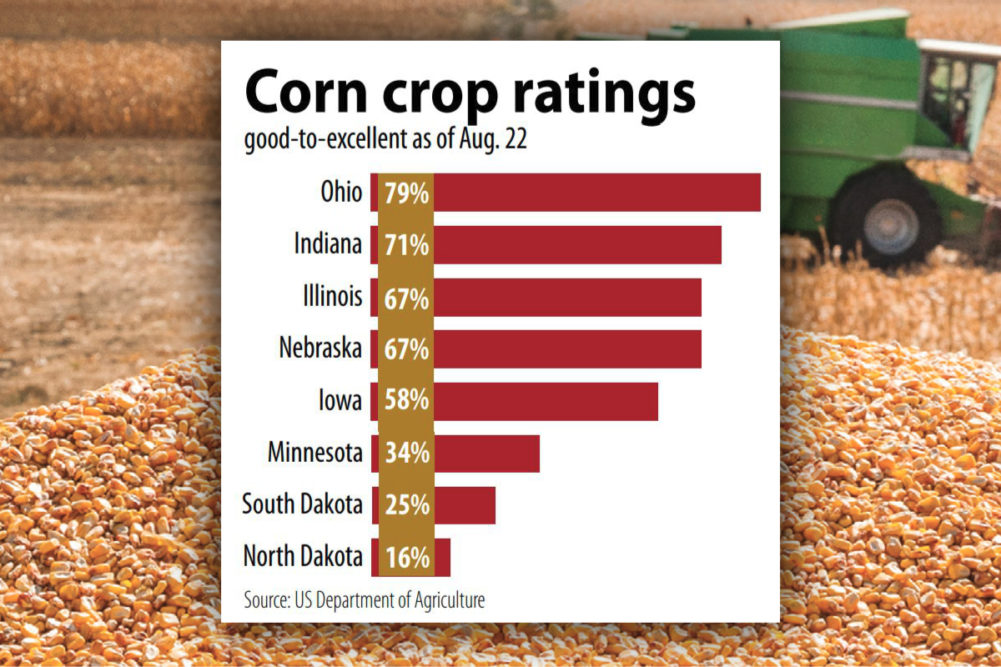

The USDA lowered its good-to-excellent ratings for both corn and soybeans as of Aug. 22. The good-to-excellent rating for corn was 60%, down from 62% a week earlier and 64% a year ago, and for soybeans was 56%, down from 57% the prior week and 69% a year earlier. There were distinct differences between ratings, with numbers in the eastern Corn Belt (including Illinois, Indiana and Ohio) above the 18-state aggregate and numbers in the Upper Midwest (Minnesota, North and South Dakota) well below with North Dakota the most dire.

Futures prices of major commodities (corn, wheat, soybeans) have fluctuated as would be expected during a weather market, sometimes down sharply one day when rain falls in a key area then up sharply the next day on a forecast for dry weather the next week. While still up sharply from a year ago, corn, wheat and soybean prices are off their highs, and analysts tend to expect further pressure on corn and soybean prices during the harvest period. The high prices also have tended to temper domestic and export demand, partially offsetting tight supply situations for most grains.

While drought has been the most severe in the West where most fruit, vegetable and nut crops are produced, many production forecasts are not as low as expected as many crops are irrigated. However, with water levels dropping and some lakes and reservoirs at historically low levels, there are growing concerns about water for irrigation in 2022 unless rainfall and winter snowpack can replenish water supplies.

Most corn, soybeans and wheat are growing east of the Rocky Mountains and are not irrigated, depending on the vagaries of seasonal weather, both in the United States and globally, some areas of which also have had weather challenges this year.