SAN FRANCISCO — Full Harvest, the business-to-business marketplace for surplus and imperfect produce, has raised $23 million in Series B financing led by TELUS Ventures. New investors Rethink Impact, Citi Impact, Doon Capital, Stardust Equity and Portfolia Food & AgTech Fund participated in the round alongside existing investors Spark Capital, Cultivian Sandbox, Astia Fund, Radicle Growth and others.

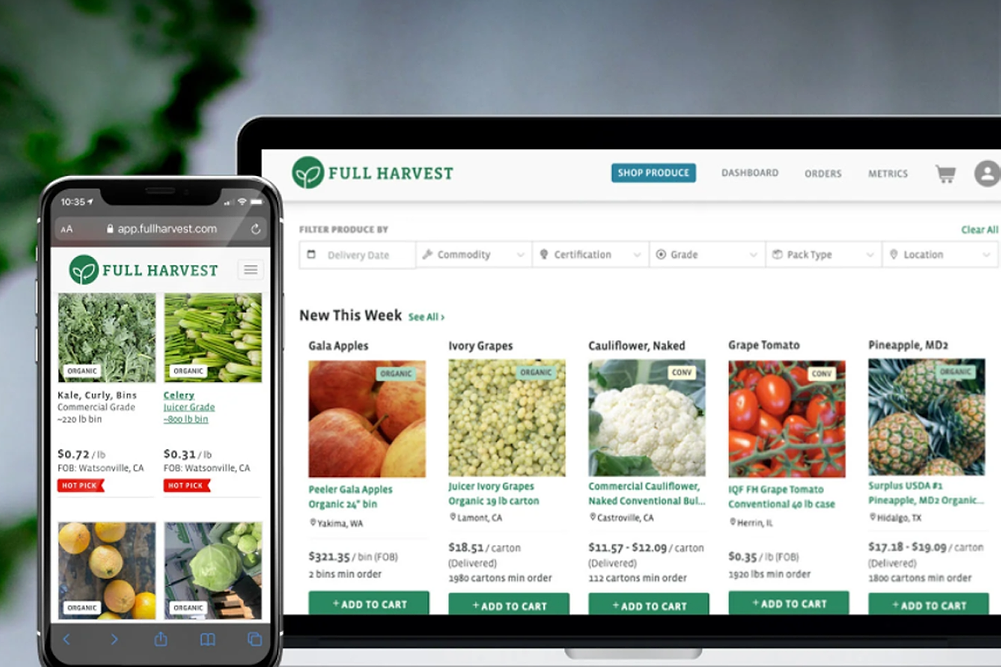

Full Harvest helps brands develop new consumer products and sustainable supply chains to reduce waste while supporting farmers’ livelihoods. The company connects farmers with commercial produce buyers through its online platform and has sold more than 50 million lbs of surplus and imperfect produce to date.

“The importance of building more sustainable businesses has never been more evident, especially for those in the food and beverage space,” said Surbhi Martin, vice president of Greek Yogurt and Functional Nutrition at Danone North America. “By sourcing produce online through Full Harvest and selecting fruit for our products that would otherwise have gone to waste, we are answering the growing consumer demand for more sustainable food options.”

Full Harvest plans to use the funding to build out its online marketplace, advance its data and market insights offerings and expand its technology and product team. Building on the success with Danone and its Two Good Good Save yogurt, Full Harvest will scale the global use of its Verified Rescued Produce standard for on-farm food waste reduction verification.

“Dedicated to empowering ‘full harvests' with zero food waste to support a more sustainable ag ecosystem, we are transforming a fragmented and opaque offline produce supply chain into a flexible, transparent, reliable solution by directly connecting growers with processors and food and beverage brands online,” said Christine Moseley, founder and chief executive officer of Full Harvest. “With the influx of capital, we plan to build on our incredible customer successes and expand into new markets to make the global produce supply chain more efficient and sustainable.”

Jay Crone, investment director at TELUS Ventures, the investment arm of TELUS Corp., has joined the board of Full Harvest and will work with the executive team to expand and optimize its network.

“We are committed to leveraging the power of technology to build a safer, more efficient and sustainable food chain, and our investment in Full Harvest aligns with that mission,” said Mario Mele, vice president of corporate strategy at TELUS Ventures. “With its strong leadership and mission-driven approach, combined with our growing expertise in the AgTech space, Full Harvest is well-positioned to evolve the produce market and drastically reduce food waste by leveraging data and technology to digitize what is still a very analog market. We look forward to helping the team scale the company and transform the industry to the benefit of farmers, buyers and the environment.”