KANSAS CITY — The US Department of Agriculture’s March 31 Prospective Plantings report brought some surprises but may ultimately yield to weather as the primary final planting factor this spring.

The USDA said farmers intend to plant 91,996,000 acres to corn in 2023, up 4% from last year, 87,505,000 acres to soybeans, up 0.1%, and 49,855,000 acres to all wheat, up 9%, including winter wheat, up 13%, durum, up 9% and spring wheat other than durum, down 2.4%. Area planted to cotton, which often can be planted to soybeans instead, was forecast down 18% from 2022.

The USDA’s corn, all wheat, winter wheat and durum forecasts were above the average of pre-report trade expectations while soybeans and spring wheat other than durum were below the average. The general “feel” of the report from analysts was that most forecasts had a bullish tone for corn, soybeans and wheat.

“The numbers themselves, I wouldn’t say it was a shocker of a report, but most certainly a bullish lean that participants weren’t anticipating,” said Brian Harris, owner of Global Risk Management. “People are shifting focus to short-term weather forecasts, and the OPEC production announcement has put a bullish tint back into the markets.”

The Organization of Petroleum Exporting Countries over the weekend of April 1-2 announced a surprise cut in crude oil production, sending crude oil prices higher and lending bullish support to soybeans (biodiesel) and corn (ethanol).

Steve Freed, vice president of grain research, ADM Investor Services, called the USDA report bullish for corn (especially nearby) and bullish for soybeans (especially new crop), noting there are “plenty of nearby beans in Brazil.” He noted that US weather and commodity funds’ net short position in wheat futures both were bullish for wheat.

Brazil is harvesting a forecast record-large soybean crop, which will keep export markets supplied nearby, but the small gain in US planted soybean area indicates tighter supplies in the 2023-24 marketing year as the world (mainly China) turns to the United States for supplies between Brazil’s harvests.

Robert Bresnahan, president of Trillateral, Inc., called the report bullish for new-crop corn, bullish for new crop soybeans and neutral for new-crop winter wheat, with weather especially a factor in the latter.

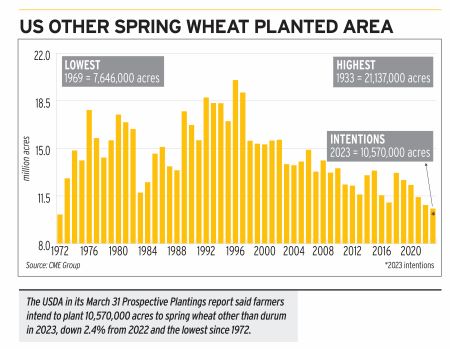

The greatest surprise in the report perhaps was the planted area for spring wheat other than durum, projected at 10,570,000 acres, down 265,000 acres, or 2.4%, from 2022 and the lowest since 1972 if realized. Expected planted area in the top three other spring wheat states of North Dakota, Montana and Minnesota was down a combined 270,000 acres, partially offset by an increase of 40,000 acres in Idaho.

It should be noted that final planted area can change in the coming weeks. Forecasts in the Prospective Plantings report are based on probability surveys of about 73,000 farm operators during the first two weeks of March before any seeds are in the ground in most major growing states.

Since fertilizer, crop rotation and other agronomic factors along with pricing ideas mostly are set by the time the surveys are conducted, weather becomes the primary force that can change final planted area.

“What’s going to be important for the markets now is how weather plays out and if we do see some switching from corn to soybeans, a function of this big snowpack across a lot of the northern tier — a potential for flooding to wash out earlier corn planting,” Mr. Harris said. “The problem with that is the farmer just loves to plant corn and the technology is so good these days that if it’s not a significant issue for the northern tier then we can get all of that crop in a very short time.”

Weather delays typically are most significant for corn, which has the longest growing season. Farmers in the Upper Midwest and northern parts of the Corn Belt are dealing with cold, wet conditions. Many in the South, where planting has been underway for some time, also are facing wet conditions.

The report also revised the area planted to winter wheat, which was initially estimated in the USDA’s Jan. 12 Winter Wheat and Canola Seedings report. Winter wheat planted for harvest in 2023 was estimated at 37,505,000 acres, up 13% from 2022, up 2% from the January estimate and the highest since 2015, “as growers look to capitalize on strong prices,” the USDA said. But again, weather comes into play.

The heart of the hard red winter wheat growing region, including Kansas and the surrounding states or areas of Nebraska, eastern Colorado and the Oklahoma and Texas panhandles, are in the grip of drought. In its assessment of the March 28 US Drought Monitor, the USDA said winter wheat production in drought areas were 100% in Nebraska, 91% in Kansas, 88% in Colorado and 73% in Texas (Oklahoma isn’t included in the Drought Monitor), with 47% of Kansas wheat area in exceptional drought, the most severe rating.

Despite higher hard red winter wheat planted area, the area for harvest could be down considerably as farmers “abandon” acreage and take insurance payments due to poor harvest prospects.

“Weather leans bullish for the wheat complex,” Mr. Bresnahan said. “The US soft red winter wheat belt was the wettest since 1979, and the hard red winter wheat belt the second driest. Without needed rain by the last half of April, the hard red winter wheat crop will be in trouble.”