Recap for April 22

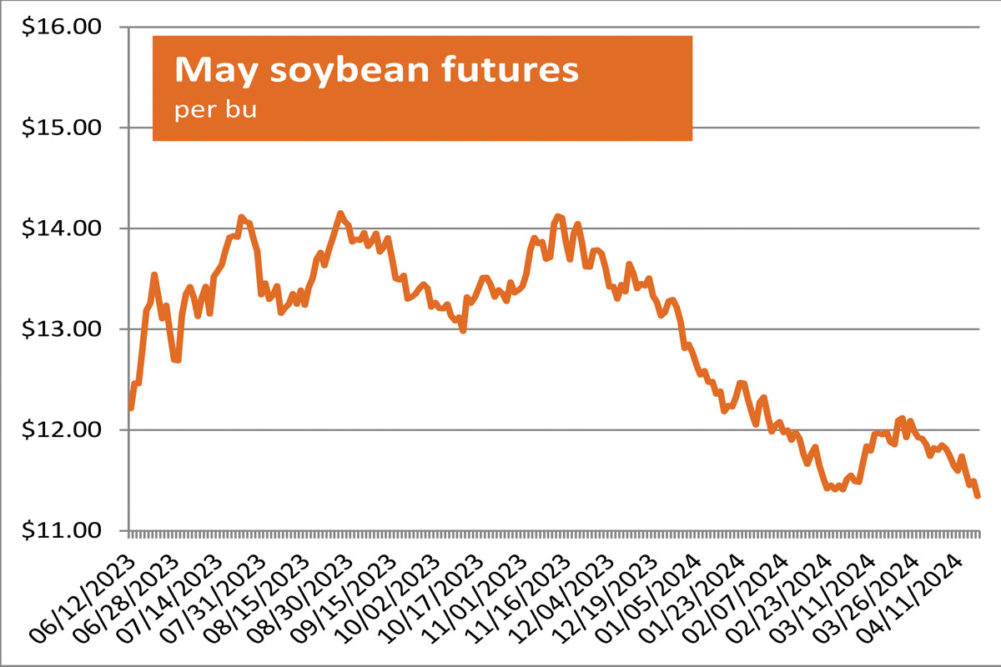

- Dry weather concerns in the US Southern Plains and Russia, plus Black Sea supply concerns after the latter attacked Ukrainian grain infrastructure over the weekend, sent wheat futures higher to sharply higher Monday with winter wheat touching two-month highs. Spillover support from wheat, short-covering and technical trading sent corn futures to three-week highs. Soybean futures firmed alongside wheat and corn with support from short covering and technical trading after dropping to a seven-week low in the previous session. May corn added 6¼¢ to close at $4.39¾ per bu. Chicago May wheat soared 20¢ higher to close at $5.70¼ per bu. Kansas City May wheat jumped 16¢ and closed at $5.97½ per bu. Minneapolis May wheat added 8¾¢ and closed at $6.55¾ per bu. May soybeans advanced 10½¢ to close at $11.61 per bu. May soybean meal was up 60¢ to close at $344.30 per ton. May soybean oil added 0.66¢ to close at 45.04¢ a lb.

- Easing Middle East concerns had investors scaling back safe-haven bets Monday and US gold futures declined. The April contract plummeted $66.20 to close at $2,332.10 per oz.

- US equity indexes closed higher Monday, the market regaining some confidence and bouncing back from last week’s lackluster performance as Middle East tensions ameliorated. The Dow Jones Industrial Average added 253.58 points, or 0.67%, to close at 38,239.98. The Standard & Poor’s 500 added 43.37 points, or 0.87%, to close at 5,010.60. The Nasdaq Composite added 169.3 points, or 1.11%, to close at 15,451.31.

- The US dollar index ultimately closed lower Monday but earlier touched a 34-year peak against the Japanese yen as investors took cues from the Federal Reserve’s apparent interest rate course of higher for longer.

- US crude oil prices dropped Monday. Trader consensus was for little near-term risk from the Middle East conflict. Fundamentals were the focus, and a tightened supply-demand balance was envisaged for the coming months. The expiring May West Texas Intermediate light, sweet crude future shed 29¢ to close at $82.85 per barrel. Th June contract was down 32¢ to close at $81.90 per barrel.

Recap for April 19

- Wheat futures climbed Friday as rising Middle Eastern tension raised concerns about wheat shipments from that region and from Russia, an Iranian ally. Dry conditions in the US southern Plains added support. Heightened geopolitical tension spurred a round of bargain buying after corn and soybean prices fell to six-week lows. May corn added 6¾¢ to close at $4.33½ per bu. Chicago May wheat added 13½¢ to close at $5.50¼ per bu. Kansas City May wheat added 4¼¢ and closed at $5.81½ per bu. Minneapolis May wheat added 8¼¢ and closed at $6.47 per bu. May soybeans rose 16¼¢ to close at $11.50½ per bu. May soybean meal was up $5.70 to close at $343.70 per ton. May soybean oil added 0.26¢ to close at 44.38¢ a lb.

- US equity markets were mixed Friday. A late-Thursday Israeli strike on Iran led to a brief spike in oil prices and added momentum to a pullback in the S&P 500 and Nasdaq, giving both indexes their longest daily losing streaks in more than a year. For the week, the Nasdaq’s 5.5% weekly decline was its worst such performance since 2022 while the S&P 500 dropped 3.1% and the Dow Jones Industrial Average eked out a tiny weekly gain. The Dow Jones Industrial Average added 211.02 points, or 0.56%, to close at 37,986.4. The Standard & Poor’s 500 dropped 43.89 points, or 0.88%, to close at 4,967.23. The Nasdaq Composite fell 319.49 points, or 2.05%, to close at 15,282.01.

- The US dollar index closed higher Friday for the eighth time in nine trading days.

- US gold futures advanced Friday. The April contract climbed $16.10 to close at $2,398.40 per oz.

- US crude oil prices were higher Friday. The May West Texas Intermediate light, sweet crude future rose 41¢ to close at $83.14 per barrel.

Recap for April 18

- Wheat futures were mostly higher Thursday on Southern Plains dryness, especially in top hard red winter wheat producer Kansas. “Western Kansas has not seen precipitation in over two weeks,” said the weekly US Drought Monitor released April 18. Soybean futures mostly declined, the July contract to a seven-week low under pressure from farmer sales in Brazil and mostly favorable outlooks for US planting. Sluggish demand sent corn futures lower for a fourth straight session, the July contract striking a six-week low. May corn dropped 3½¢ to close at $4.26¾ per bu. Chicago May wheat eased ¼¢ to close at $5.36¾ per bu; all later months edged higher. Kansas City May wheat added 4½¢ and closed at $5.77¼ per bu. Minneapolis May wheat rose 5½¢ and closed at $6.38¾ per bu; March 2025 and beyond were unchanged. May soybeans shed 15¼¢ to close at $11.34¼ per bu. May soybean meal was down 70¢ to close at $338 per ton. May soybean oil fell 0.88¢ to close at 44.12¢ a lb.

- The US dollar index resumed its remarkable ascent Thursday, closing higher for the seventh time in the past eight trading sessions. Support was drawn from investors determining mixed economic data belied a US economy that was on solid ground, suggesting the Fed may push back a rate cut to later this year.

- US crude oil prices were mixed Thursday, holding near three-week lows amid mixed domestic economic news, including Venezuela losing a key US license for exporting, sanctions on Iran and easing Middle East tension. The May West Texas Intermediate light, sweet crude future rose 4¢ to close at $82.73 per barrel, but June, July and August prices eased.

- However, persistent tension in the Middle East was cited for US gold futures’ advance Thursday. The April contract climbed $10.60 to close at $2,382.30 per oz.

- US equity markets were mixed Thursday as investors continued to adjust to the idea the Federal Reserve might not lower interest rates this year. The Dow Jones Industrial Average added 22.07 points, or 0.06%, to close at 37,775.38. The Standard & Poor’s 500 dropped 11.09 points, or 0.22%, to close at 5,011.12 in its fifth-straight daily decline. The Nasdaq Composite fell 81.87 points, or 0.52%, to close at 15,601.5. The DJIA’s 5.1% fall in April has wiped out most of the index’s gains for 2024. The S&P 500 and Nasdaq indices were each down nearly 5% in April to date.

Recap for April 17

- The US dollar index declined Wednesday for the first time in seven trading days as investors consolidated gains following the Federal Reserve indicating the rate-cutting cycle is on hold pending new economic data even as other central banks’ outlooks remained unchanged.

- US soybean futures climbed Wednesday in a bargain-buying bounce off an earlier six-week low. Weak demand and strong export competition globally weighed on wheat and Chicago soft wheat futures struck a one-month low. A lack of fresh bullish news in the early days of seeding the 2024 crop helped corn futures ease. May corn eased ¾¢ to close at $4.30¼ per bu. Chicago May wheat dropped 12¾¢ to close at $5.37 per bu. Kansas City May wheat declined 14¾¢ and closed at $5.72¾ per bu. Minneapolis May wheat fell 5¢ and closed at $6.33¼ per bu. May soybeans climbed 4½¢ to close at $11.49½ per bu. May soybean meal was up $3.40 to close at $338.70 per ton. May soybean oil edged up 0.09¢ to close at 45¢ a lb; October and beyond were lower.

- US gold futures slipped lower Wednesday. The April contract fell $19.10 to close at $2,371.70 per oz.

- US equity markets posted lower closes Wednesday, marking a four-day losing streak for the S&P 500, its longest since the first week of 2024. That index rose in early trading before closing lower for a third day in a row, the longest such streak of reversals since 2022, the Wall Street Journal said. CME Group’s FedWatch tool gave a 16% likelihood of a Federal Reserve rate cut in June, sharply down from 55% a month ago. The Dow Jones Industrial Average slipped 45.66 points, or 0.12%, to close at 37,753.31. The Standard & Poor’s 500 dropped 29.2 points, or 0.58%, to close at 5,022.21. The Nasdaq Composite fell 181.88 points, or 1.15%, to close at 15,683.37.

- US crude oil prices settled 3% lower Wednesday after an Energy Information Administration report indicated US crude inventories rose by 2.7 million barrels to 460 million barrels last week, nearly double analysts’ expectations. The May West Texas Intermediate light, sweet crude future fell $2.67 to close at $82.69 per barrel.

Recap for April 16

- The US dollar index strengthened Tuesday for a sixth consecutive trading day and touched a five-month high.

- Corn futures posted small losses Tuesday despite bullish trends as traders mulled crop consultant Michael Cordonnier’s 3-million-tonne cut to his Argentine corn production estimate due to corn stunt disease and crop agency Deral’s suggestion of a production cut coming for the corn harvest in Parana state, the second largest corn producer in Brazil due to dry weather and excessive heat. Soybean futures touched a one-month low as the US dollar strengthened and amid stiff competition for export sales from cheaper Brazilian supplies. Wheat futures were mixed, lower in Chicago as the dollar strengthened but mostly higher in KC and Minneapolis after the USDA late Monday rated 55% of the US winter wheat crop in good-to-excellent condition, down from 56% a week earlier and in line with trade expectations. In Kansas, 43% of the crop was rated good-to-excellent, down from 49% a week earlier. May corn eased ½¢ to close at $4.31 per bu. Chicago May wheat pared 2¢ to close at $5.49¾ per bu. Kansas City May wheat advanced 3½¢ and closed at $5.87½ per bu; furthest deferred months were mixed. Minneapolis May wheat added 1¼¢ and closed at $6.38¼ per bu. May soybeans deleted 13¼¢ to close at $11.45 per bu. May soybean meal was down $3.20 to close at $335.3 per ton. May soybean oil dropped 0.56¢ to close at 44.91¢ a lb.

- US gold futures stayed on the high side Tuesday even as the US dollar maintained its upward trend. The April contract added $25 to close at $2,390.80 per oz.

- US equity markets posted mixed closes and Treasury yields hit five-month-highs Tuesday after Federal Reserve chairman Jerome Powell said recent data “indicate that it is likely to take longer than expected to achieve that confidence” and that current policies need “further time to work.” The Dow Jones Industrial Average added 63.86 points, or 0.17%, to close at 37,798.97. The Standard & Poor’s 500 eased 10.41 points, or 0.21%, to close at 5,051.41. The Nasdaq Composite dropped 19.77 points, or 0.12%, to close at 15,865.25.

- US crude oil prices were mixed Tuesday as economic headwinds met support from geopolitical tensions. The May West Texas Intermediate light, sweet crude future fell 5¢ to close at $85.36 per barrel. The June contract also eased while the July and August futures edged higher.