Recap for April 16

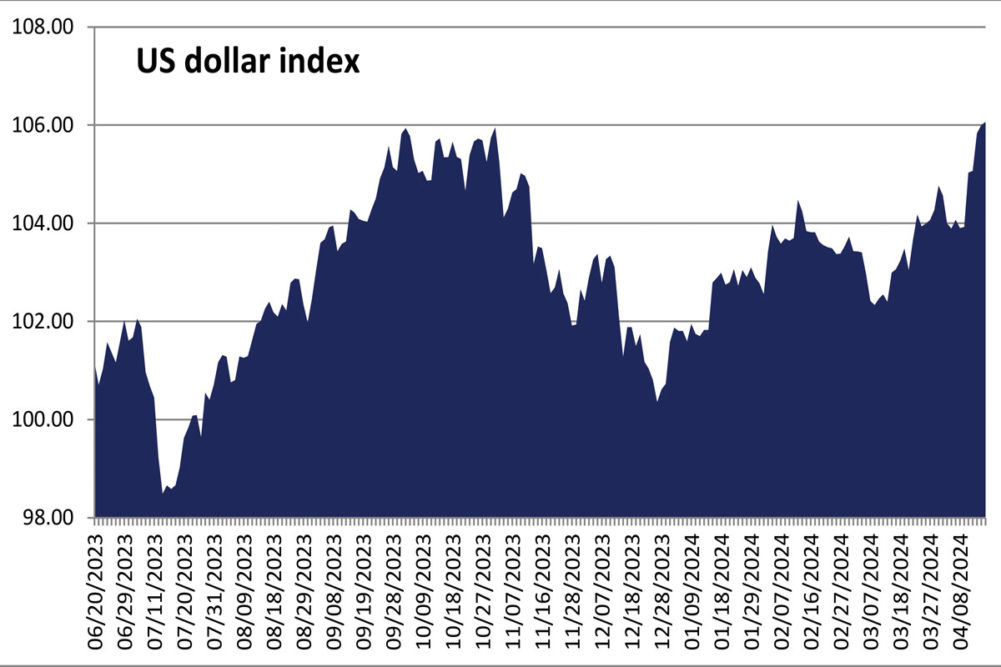

- The US dollar index strengthened Tuesday for a sixth consecutive trading day and touched a five-month high.

- Corn futures posted small losses Tuesday despite bullish trends as traders mulled crop consultant Michael Cordonnier’s 3-million-tonne cut to his Argentine corn production estimate due to corn stunt disease and crop agency Deral’s suggestion of a production cut coming for the corn harvest in Parana state, the second largest corn producer in Brazil due to dry weather and excessive heat. Soybean futures touched a one-month low as the US dollar strengthened and amid stiff competition for export sales from cheaper Brazilian supplies. Wheat futures were mixed, lower in Chicago as the dollar strengthened but mostly higher in KC and Minneapolis after the USDA late Monday rated 55% of the US winter wheat crop in good-to-excellent condition, down from 56% a week earlier and in line with trade expectations. In Kansas, 43% of the crop was rated good-to-excellent, down from 49% a week earlier. May corn eased ½¢ to close at $4.31 per bu. Chicago May wheat pared 2¢ to close at $5.49¾ per bu. Kansas City May wheat advanced 3½¢ and closed at $5.87½ per bu; furthest deferred months were mixed. Minneapolis May wheat added 1¼¢ and closed at $6.38¼ per bu. May soybeans deleted 13¼¢ to close at $11.45 per bu. May soybean meal was down $3.20 to close at $335.3 per ton. May soybean oil dropped 0.56¢ to close at 44.91¢ a lb.

- US gold futures stayed on the high side Tuesday even as the US dollar maintained its upward trend. The April contract added $25 to close at $2,390.80 per oz.

- US equity markets posted mixed closes and Treasury yields hit five-month-highs Tuesday after Federal Reserve chairman Jerome Powell said recent data “indicate that it is likely to take longer than expected to achieve that confidence” and that current policies need “further time to work.” The Dow Jones Industrial Average added 63.86 points, or 0.17%, to close at 37,798.97. The Standard & Poor’s 500 eased 10.41 points, or 0.21%, to close at 5,051.41. The Nasdaq Composite dropped 19.77 points, or 0.12%, to close at 15,865.25.

- US crude oil prices were mixed Tuesday as economic headwinds met support from geopolitical tensions. The May West Texas Intermediate light, sweet crude future fell 5¢ to close at $85.36 per barrel. The June contract also eased while the July and August futures edged higher.

Recap for April 15

- Crude oil declines and a strengthening US dollar weighed on grain and oilseed futures Monday. Favorable planting weather in forecasts added additional pressure to corn futures. Those forecasts, plus the National Oilseed Processors Association report indicating 196.406 million bus of soybeans were crushed in March — below the average of analyst expectations for 197.787 million bus — still was up 5.5% from February, up 5.7% from a year ago and a record high, which pressured prices lower. Spillover corn and soybean weakness pushed on wheat futures. May corn fell 4¢ to close at $4.31½ per bu. Chicago May wheat dropped 4¼¢ to close at $5.51¾ per bu. Kansas City May wheat declined 5¾¢ and closed at $5.84 per bu. Minneapolis May wheat also subtracted 5¾¢ and closed at $6.37 per bu. May soybeans shed 15¾¢ to close at $11.58¼ per bu. May soybean meal was down $5.90 to close at $338.50 per ton. May soybean oil dropped 0.42¢ to close at 45.47¢ a lb.

- The US dollar index strengthened Monday.

- US gold futures were higher Monday despite the stronger dollar. The April contract added $9.60 to close at $2,365.80 per oz.

- US equity markets extended their slump Monday. Share prices initially climbed after Iran’s well-telegraphed attack on Israel resulted in minimal damage. Concerns about Israel’s response and the potential for conflict escalation then turned prices lower. Meanwhile, a Commerce Department report indicated US retail sales rose a seasonally adjusted 0.7% in March compared with a month earlier, which caused bond yields to jump higher as traders scaled back bets on the path and severity of Federal Reserve rate cuts. The Dow Jones Industrial Average dropped 248.13 points, or 0.65%, to close at 37,735.11. The Standard & Poor’s 500 shed 61.59 points, or 1.2%, to close at 5,061.82. The Nasdaq Composite dropped 290.08 points, or 1.79%, to close at 15,885.02.

- US crude oil prices declined. The May West Texas Intermediate light, sweet crude future fell 25¢ to close at $85.41 per barrel.

Recap for April 12

- US gold futures soared above $2,400 per ounce and touched a record high on Friday before retreating. Growing Middle Eastern tensions prompted investors to seek refuge in safe-haven assets such as gold, helping the precious metal to a fourth week of gains. The April contract added $1.40 to close at $2,356.20 per oz.

- The US dollar index on Friday jumped to its highest level since November as investors sought a safe haven amid geopolitical strife in the Middle East and increasing divergence in monetary policy between the Federal Reserve and other major central banks.

- After a down day for US stock prices, the Dow industrials index notched its worst week since March 2023. Bank, energy and real-estate shares were among the biggest losers in market weakness attributed to inflation worries and geopolitical uncertainty. The Dow Jones Industrial Average plummeted 475.84 points, or 1.24%, to close at 37,983.24. The Standard & Poor’s 500 shed 75.65 points, or 1.46%, to close at 5,123.41. The Nasdaq Composite was down 267.10 points, or 1.62%, to close at 16,175.09.

- US crude oil prices advanced about 1% Friday, nearing a six-month high on concern that Iran, the third-largest producer among the Organization of the Petroleum Exporting Countries cartel, might retaliate for a suspected Israeli attack on Iran’s embassy in Damascus four days earlier. The May West Texas Intermediate light, sweet crude future added 64¢ to close at $85.66 per barrel.

- Soybean futures rebounded Friday, a day after striking a one-month low after the USDA left its estimate for Brazil’s soybean crop unchanged in contrast to Brazilian crop agency Conab reducing its projection to 146.5 million tonnes. Corn futures were higher a day after the USDA cut its forecast for Argentina's corn crop by 1 million tonnes to 55 million tonnes and two days after Argentina’s Rosario Grain Exchange slashed its outlook by 6.5 million tonnes to 50.5 million tonnes. Spillover support from corn and soybeans drove most wheat futures contracts higher Friday. May corn added 6½¢ to close at $4.35½ per bu. Chicago May wheat climbed 4¼¢ to close at $5.56 per bu. Kansas City May wheat ascended 6½¢ and closed at $5.89¾ per bu. Minneapolis May wheat rose 5¾¢ and closed at $6.42¾ per bu. May soybeans jumped 14¾¢ to close at $11.74¾ per bu. May soybean meal was up $8.80 to close at $344.40 per ton. May soybean oil dipped 0.13¢ to close at 45.89¢ a lb.

Recap for April 11

- Soybean futures declined after the USDA in its monthly World Agricultural Supply and Demand Estimates report estimated domestic soybean stocks at the high end of traders’ expectations and pegged Brazilian soybean production at 155 million tonnes versus the 146.522 million tonnes projected by Brazilian crop agency Conab. Corn futures declined Thursday after the USDA lowered its corn stock estimates to 2.122 billion bus from 2.172 billion bus in March, which would still be a five-year high and projected the Brazilian corn harvest at 124 million tonnes versus Conab’s 110.964-million-tonne forecast. Wheat futures declined after the USDA raised its forecast for June 1, 2024, all-wheat ending stocks by 25 million bus. May corn subtracted 5½¢ to close at $4.28¾ per bu. Chicago May wheat deleted 6¾¢ to close at $5.51¾ per bu. Kansas City May wheat dropped 11¼¢ and closed at $5.83¼ per bu. Minneapolis May wheat fell 14¾¢ and closed at $6.37 per bu. May soybeans were down 5½¢ to close at $11.59¼ per bu. May soybean meal advanced $4.70 to close at $335.60 per ton. May soybean oil fell 1.58¢ to close at 46.02¢ a lb.

- The US dollar index rose moderately Thursday after trading choppily throughout the session and initially declining after a Labor Department showed the Producer Price Index rose 0.2% from February to March, compared with a 0.3% increase expected by economists consulted by Reuters.

- US gold futures firmed Thursday amid enduring geopolitical strife and as the softer-than-expected Producer Price Index data raised hopes for US interest rate cuts this year. The April contract added $25.20 to close at $2,354.80 per oz.

- US stocks market indexes were mixed Thursday. A rebound in shares of tech companies pushed the Nasdaq to a fresh record high and the S&P 500 edged higher. The DJIA eased a day after Wednesday’s hotter-than-expected Consumer Price Index reading added concerns about the Federal Reserve’s path of rate cuts this year. The Dow Jones Industrial Average eased 2.43 points, or 0.01%, to close at 38,459.08. The Standard & Poor’s 500 added 38.42 points, or 0.74%, to close at 5,199.06. The Nasdaq Composite jumped 271.84 points, or 1.68%, to close at 16,442.2.

- US crude oil prices declined Thursday as persistent inflation dimmed hopes for a near-term US interest rate cut, but prices remained at six-month highs on worries Iran might attack Israeli interests. The May West Texas Intermediate light, sweet crude future dropped $1.19 to close at $85.02 per barrel.

Recap for April 10

- The US dollar index closed at its highest level since November Wednesday and at its highest levels in 34 years versus the Japanese yen. Behind the strength was a report indicating the US Consumer Price Index (CPI) rose 0.4% in March compared with the 0.3% increase expected by economists polled by Reuters. Year-over-year the CPI increased 3.5% versus forecasts of 3.4% growth. Excluding the volatile food and energy components, core inflation grew 0.4% month-on-month in March, compared with expectations of a 0.3% advance. Annually, it gained 3.8%, versus the estimated 3.7% increase. The hotter-than-expected inflation report caused traders to pull back on bets the Federal Reserve will enact an interest rate cut in June.

- US stocks declined broadly Wednesday after the US inflation report. Ten of 11 S&P 500 sectors closed lower in the worst day for the index since June 2022. Public Storage, American Tower, Home Depot, United Health and Microsoft were among the biggest losers. The Dow Jones Industrial Average sank 422.16 points, or 1.09%, to close at 38,461.51. The Standard & Poor’s 500 dipped 49.27 points, or 0.95%, to close at 5,160.64. The Nasdaq Composite shed 136.28 points, or 0.84%, to close at 16,170.36.

- Soybean futures set one-month lows in Wednesday’s trading and closed just above session lows amid stiff export sales competition from Brazil a day ahead of the USDA’s monthly supply-and-demand report that was expected to show 2023-24 US soybean ending stocks at 317 million bus compared with 315 million in March, and weekly export sales data in which analysts expected 2023-24 soybean sales of 200,000 to 600,000 tonnes. Corn futures advanced the day before the reports that are expected to show 2023-24 US corn ending stocks at 2.102 billion bus, down from 2.172 billion last month, and 2023-24 corn export sales of 750,000 to 1.3 million tonnes in the week ended April 4. Dryness concerns in the US Southern Plains and in the Black Sea region, plus Russia-Ukraine war effects on grain exports, served to offset a strengthening US dollar and lift US wheat futures across the board with Kansas City posting the widest gains. May corn added 3¢ to close at $4.34¼ per bu. Chicago May wheat edged up ¾¢ to close at $5.58½ per bu. Kansas City May wheat jumped 17½¢ and closed at $5.94½ per bu. Minneapolis May wheat added ½¢ and closed at $6.51¾ per bu; September 2025 and beyond declined. May soybeans were down 9¾¢ to close at $11.64¾ per bu. May soybean meal was down $4.70 to close at $330.90 per ton. May soybean oil added 0.08¢ to close at 47.60¢ a lb.

- US crude oil prices shot up nearly a $1 per barrel Wednesday on fears Middle Eastern ceasefire talks might stall after an Israeli airstrike on Gaza killed three sons of a leader of Hamas, a designated terrorist organization. The May West Texas Intermediate light, sweet crude future jumped 98¢ to close at $86.21 per barrel.

- US gold futures slipped from record-high levels Wednesday after the stronger-than-expected inflation report boosted the US dollar and firmed Treasury yields. The April contract fell $13.90 to close at $2,329.60 per oz.