KANSAS CITY — Continually increasing milk production, large stocks of cheese and many dry products, and global competition are expected to keep pressure on milk and dairy product prices in 2018. Strong demand is seen providing support for butter and cheese prices while dry product prices remain in the doldrums.

KANSAS CITY — Continually increasing milk production, large stocks of cheese and many dry products, and global competition are expected to keep pressure on milk and dairy product prices in 2018. Strong demand is seen providing support for butter and cheese prices while dry product prices remain in the doldrums.

Milk production generally reaches a record high every year as the population increases. The U.S. Department of Agriculture in March forecast 2018 U.S. milk production at 219 billion lbs, up 1.6% from 2017 based on a slight increase in the dairy herd at 9,415,000 head, up 0.2%, and higher milk per cow at 23,255 lbs, up 1.4%. The U.S.D.A. in March raised its 2018 milk production forecast from February based on “more rapid growth in milk per cow in the first half of the year.”

U.S. milk production in February was estimated at 17 million lbs, up 1.8% from February 2017, the U.S.D.A. said in its latest Milk Production report. Milk per cow was up 24 lbs from a year ago, and there were 45,000 more dairy cows than in February 2017.

Average milk and dairy product prices for 2018 were forecast lower than in 2017, with the drop in dry products expected to be much sharper than for cheese and butter.

The U.S.D.A. forecast the average all milk price to range from $15.75 to $16.35 a cwt in 2018, with the midpoint of $16.05 a cwt down 9% from 2017. Class 3 milk, used to make most cheeses (and whey, which is a byproduct of the cheese making process) was forecast to average $14.30 to $14.90 a cwt, down 10% from 2017, with Class 4 milk, used for butter and other dry products, forecast at $13.25 to $13.95 a cwt, also down 10%.

Butter prices in 2018 were forecast to average $2.25½ a lb, down 3.2% from 2017, and average cheddar cheese prices were forecast at $1.57½ a lb, down 3.6%. The U.S.D.A. in March raised from February its forecast for 2018 butter and cheese prices.

Butter prices in 2018 were forecast to average $2.25½ a lb, down 3.2% from 2017, and average cheddar cheese prices were forecast at $1.57½ a lb, down 3.6%. The U.S.D.A. in March raised from February its forecast for 2018 butter and cheese prices.

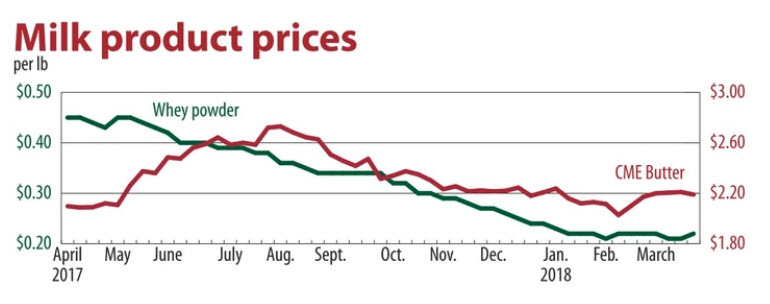

The CME Group butter price as of March 23 was $2.19 a lb, up 4.4% from a year earlier. Cheddar barrels were $1.51 a lb, up 9%, and cheddar blocks were $1.54½ a lb, up 7%.

Stocks of natural cheese in refrigerated warehouses on Feb. 28 totaled 1,314 million lbs, up 7% from a year earlier and record high for the month, the U.S.D.A. said in its latest Cold Storage report. Feb. 28 butter stocks, meanwhile, were 277 million lbs, up 3% from last year but far from the 1992 record of 625 million lbs. Heavy stocks of cheese may have limited gains but were largely offset by continued good demand.

In contrast, dry whey prices in 2018 were forecast to average 28c a lb, down 37% from 2017, and nonfat dry milk was forecast at 72½c a lb, down 16%. The U.S.D.A. in March lowered it forecast 2018 N.D.M. price based on continued large supplies, but left its dry whey forecast unchanged.

Dry whey prices on March 23 were 22c to 27c a lb, down 50% from a year earlier. Prices for low/medium N.D.M. were 69c to 74c a lb in the Central and East and 66c to 73c a lb in the west as of March 23, down about 15% to 20% from a year earlier.

Dry whey prices on March 23 were 22c to 27c a lb, down 50% from a year earlier. Prices for low/medium N.D.M. were 69c to 74c a lb in the Central and East and 66c to 73c a lb in the west as of March 23, down about 15% to 20% from a year earlier.

Stocks of most dry dairy products were heavy at the end of February, which is the most recent data available from the U.S.D.A. N.D.M. stocks were up 50% from a year earlier, while February production was up 5% and shipments were down 10%. Dry whey stocks were up 29% from February 2017, and production was up 9%.

Despite various and ongoing trade issues with Mexico, Canada and China, all major dairy product trading partners with the United States (with Mexico by far the largest buyer of U.S. dairy products), and active competition from global dairy producers like New Zealand and the European Union, the U.S.D.A. expects dairy product exports to increase in 2018.

“It appears that U.S. domestic prices have been competitive with foreign export prices,” the U.S.D.A. said, noting that February prices in Oceania and Western Europe were above U.S. values for butter, cheese and milk powder. In March, the U.S.D.A. raised from February its forecasts for dairy product exports and lowered its forecasts for imports. For the year, the U.S.D.A. expects milkfat (butter and cheese) exports to rise 3% and skim solids (dry products) exports to increase 5% from 2018.