CHICAGO — Plant-based dairy-type products and the disruption they are causing in the dairy department was a prominent topic of conversation at International Dairy Foods Association’s Dairy Forum 2019 in Orlando, Fla., Jan. 20-23. While ownership of the term “milk” continues to be debated, dairy processors recognize that plant-based products are not going away, and in some categories, such as yogurt, are becoming an important part of their business.

CHICAGO — Plant-based dairy-type products and the disruption they are causing in the dairy department was a prominent topic of conversation at International Dairy Foods Association’s Dairy Forum 2019 in Orlando, Fla., Jan. 20-23. While ownership of the term “milk” continues to be debated, dairy processors recognize that plant-based products are not going away, and in some categories, such as yogurt, are becoming an important part of their business.

“We know that what worked yesterday is not really working today and definitely won’t work tomorrow,” said Michael Dykes, president and chief executive officer of the International Dairy Foods Association, Washington. “Let’s be clear about one thing: Consumers are in charge. They have lots of choices and they want even more choices. And, in many ways, they are less predictable than ever. We need to be in tune with their needs and, as importantly, their wants.”

Beth Ford, president and c.e.o. of Land O’Lakes Inc., Arden Hills, Minn., explained that disruption is an opportunity for innovation.

“We must evolve our approach to win in a rapidly transforming marketplace,” Ms. Ford said. “Today people want to try new things. Entrepreneurs understand the speed of innovation.”

Entrepreneurs do business differently and don’t let corporate structure box them in, she said. They also know when to pull the plug and start over. Large dairy processors need to embrace this new way of doing business.

To better understand the dynamics taking place in the refrigerated yogurt case, Tristan Zuber-Hrobuchak, sales account manager-cultures and enzymes, Chr. Hansen, Milwaukee, shared findings from a proprietary consumer phone survey of 1,000 U.S. adults conducted in September 2018.

“Seventy-six per cent of respondents consume dairy frequently,” she said. “These are the core dairy consumers. Only 4% said they avoid or dislike dairy, while 20% occasionally consume dairy.”

Of the 875 respondents who consume dairy yogurt, half indicated they are consuming much or slightly more today than two years ago, while 35% consume about the same and 15% slightly or much less. This suggests a 35% increase in net consumption and is the baseline the researchers explored.

Among this base, data indicate dairy yogurt consumption is highest among Generation Z, millennials, males and parents, while Generation X, females and households without children are eating less. Respondents who describe themselves as “foodies,” as well as those following a strict diet or watch their diet are also greater consumers of dairy yogurt.

A key finding from the research is that many dairy consumers also often eat non-dairy options. More than half (529) of dairy yogurt consumers in the study choose both.

“Fifty-seven per cent of people who are consuming more dairy yogurt — that core consumer — is also consuming more non-dairy yogurt,” Ms. Zuber-Hrobuchak said. “And, 44% of people consuming less dairy yogurt are also consuming less non-dairy-yogurt.”

The study showed the decline in dairy yogurt sales is being driven by decreased consumption from occasional dairy consumers, rather than a loss of consumers.

“This is not an active erosion away from dairy to something else, but rather a slow incorporation of other items into their diet over time,” Ms. Zuber-Hrobuchak said. “These occasional consumers were never true fans.”

Different varieties, flavors and taste were reasons identified for choosing yogurt, while specific ingredients and diets, along with the perception of being more natural and less processed, were among reasons for selecting non-dairy varieties.

“These consumers are also confused,” Ms. Zuber-Hrobuchak said, “especially when it comes to the role that yogurt plays in health and weight.”

Education, therefore, is an opportunity. Efforts to improve sales may include talking about dairy protein and its superior quality in terms of amino acid profile.

And, while it might sound like smart marketing to develop products that appeal to occasional yogurt consumers, it’s the core dairy consumer who is more likely to grow the category.

“We need to not neglect this (core) group, even if they begin to purchase non-dairy products,” Ms. Zuber-Hrobuchak said. “Dairy has a great story that needs to continue to resonate with the core customers who will likely drive consumption momentum into the future. Innovation is going to be key to the future of the dairy yogurt market. Consumers like to try new varieties and brands. If yogurt can stay ahead of the curve of non-dairy launches, these products will remain the forefront of their minds.”

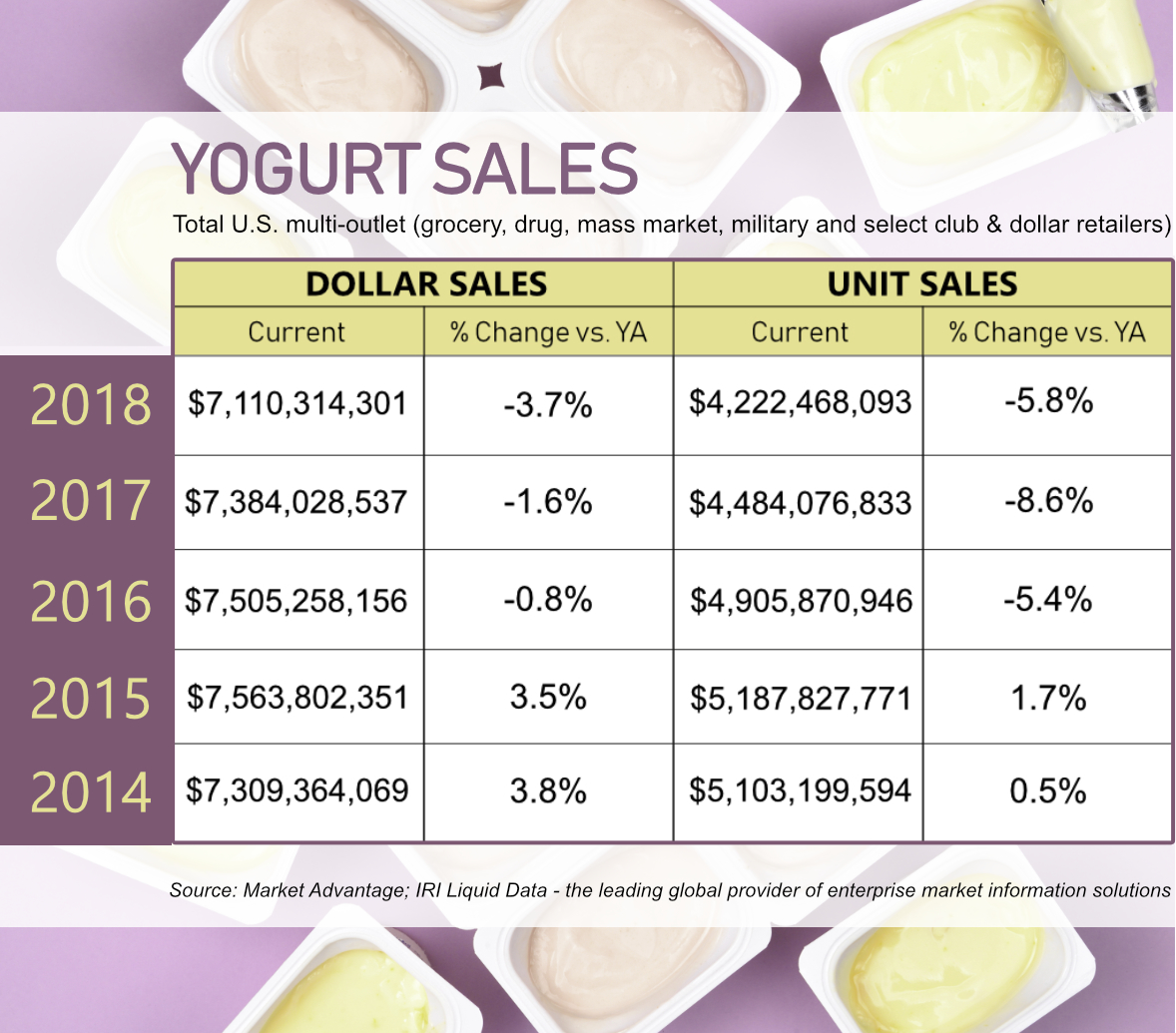

The No. 1 and No. 3 retail yogurt manufacturers — Danone North America, White Plains, N.Y., and Chobani L.L.C., Norwich, N.Y. — now offer dairy and non-dairy options. The non-dairy yogurt segment has only about 1% share of the category, according to I.R.I., Chicago, but the segment is currently showing the greatest growth.

“It’s quickly gaining share,” said Mariano Lozano, c.e.o. of Danone North America, which has long been a player in the segment with WhiteWave’s Silk, So Delicious and Vega brands.

The company is investing in its Dubois, Pa., manufacturing plant, to make it a dedicated dairy-free facility. It will provide capacity for its numerous new non-dairy options.

Good Plants Almondmilk Probiotic Yogurt Alternative from Danone has started to hit supermarket dairy cases. It is described as having 40% fewer calories and 70% less sugar than most almond milk yogurt alternatives.

There are also two new products coming out under the company’s Oikos Greek yogurt brand. Oikos Dairy-Free is made with coconut milk and has a full-flavor. Oikos ProPlant features 10 grams of complete protein obtained through a combination of soy and nuts. The product will be hitting shelves this summer.

Non-Dairy Chobani is a new cultured organic coconut product made using non-G.M.O. ingredients and no artificial flavors, sweeteners or preservatives. Non-Dairy Chobani products also contain no lactose, feature probiotics and are made with 25% less sugar than other non-dairy options, according to the company.

The Non-Dairy Chobani name and packaging represents Chobani’s advocacy for transparency as it pertains to better aligning food standards of identity. The company is advocating for transparency to make a clear distinction between milk-based foods and non-dairy options. Chobani said consumers are more empowered when food companies accurately describe foods and the nutritional benefits they offer.

Many of the products debuting in the refrigerated yogurt case feature lower sugar formulations. Advanced processing and ingredient technologies are making this possible.

Danone’s new Two Good yogurt is made with a patent-pending slow-straining process. The technology removes most of the sugar from the milk before the yogurt is made. Each cup is slow-strained down to two grams of total sugar. The result is a thick, creamy Greek yogurt rich in protein with 85% less sugar than average yogurts.

Mr. Lozano said that as much as lower sugar is a priority, on the opposite end of the spectrum is indulgence, which is also an opportunity. That is exemplified in new Oikos Oh! The indulgent double cream yogurt is made with ingredients and interlaced with decadent amounts of flavorful ingredients.

“And in between, probiotics are a growing opportunity,” he said. “As are clean label kids’ products, protein and plant-based. We know that protein is important across the segments.

“The industry tends to cluster the different products into segments, but consumers don’t. We believe it’s important to have a strong house of brands to address the specific pockets of growth and offer products in all shapes and sizes.”