WASHINGTON — Chicago and Kansas City wheat futures hit fresh contract lows March 11 with corn and soybean futures also under pressure from a combination of ample domestic and global supplies and ongoing uncertainty about a trade deal between the United States and China on which the U.S. soybean market has much at stake. Ideas that farmers plan to switch en masse out of soybeans in favor of corn during the spring planting season is not a certainty due in large part to weather.

WASHINGTON — Chicago and Kansas City wheat futures hit fresh contract lows March 11 with corn and soybean futures also under pressure from a combination of ample domestic and global supplies and ongoing uncertainty about a trade deal between the United States and China on which the U.S. soybean market has much at stake. Ideas that farmers plan to switch en masse out of soybeans in favor of corn during the spring planting season is not a certainty due in large part to weather.

The U.S. Department of Agriculture, in its March 8 World Agricultural Supply and Demand Estimates report, forecast 2019 carryover of U.S. corn at 1,835 million bus, of wheat at 1,055 million bus and of soybeans at a record 900 million bus. Though corn and wheat carryover were down from 2018, both were raised from the U.S.D.A.’s February forecast in part due to 2018-19 export forecasts that were lowered from February. The soybean export forecast left unchanged (despite trade issues) from February. Both corn and wheat were above the full range of trade expectations while soybeans were about as expected.

Globally, the U.S.D.A. on March 8 raised from February its forecasts for 2018-19 ending stocks (carryover) of wheat and soybeans, with both above the average of trade expectations, but lowered its forecast for corn, which was below the trade average. Global ending stocks for corn and wheat are forecast below year-ago levels and for soybeans above. In general, global supplies of all three commodities are seen as ample, with corn perhaps being the least bearish.

But the domestic and global corn situation may change dramatically over the course of the year if farmers plant as much corn as some analysts expect due to the uncertainty surrounding soybeans.

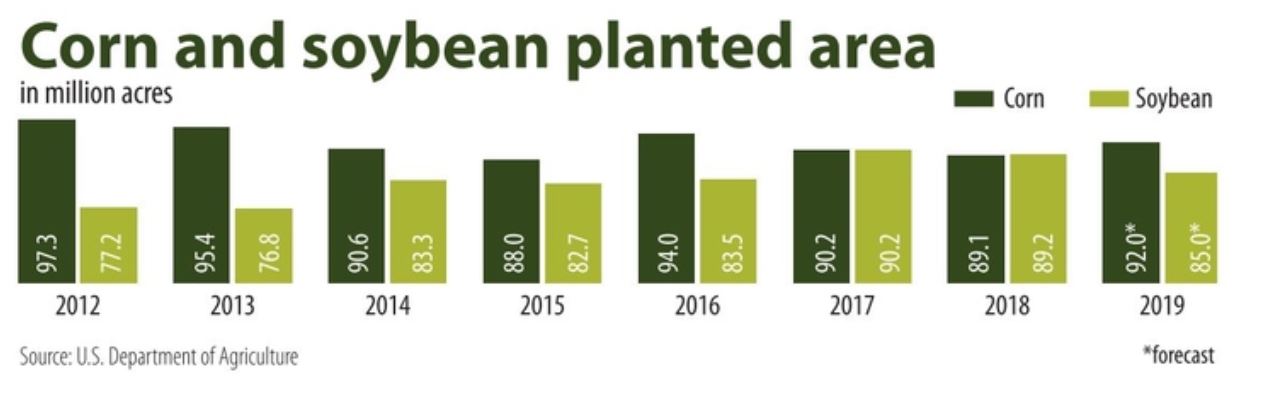

IEG Vantage (formerly Informa Economics) last week forecast 2019 U.S. corn plantings at 91.771 million acres, up from its prior forecast of 91.591 million acres and 89.129 million in 2018, which was the lowest in eight years. The consultancy forecast 2019 soybean plantings at 85.494 million acres, down from its prior forecast of 86.044 million acres and 89.196 million in 2018. Soybean acreage last year was the second highest ever, topped only by 90.162 million acres in 2017.

Allendale, Inc., a Chicago-based commodity broker and analysis firm, last week forecast corn plantings at 91.475 million acres and soybean plantings at 84.263 million acres.

The U.S.D.A. at its annual Agricultural Outlook Forum in late February projected 2019 corn planted area at 92 million acres and soybean area at 85 million acres.

But some analysts aren’t as certain that the switch between corn and soybeans will be as great as many expect. One factor noted recently by Arlan Suderman, chief commodities economist at INTL FCStone, was that many farmers are locked into a crop rotation pattern that limits switching. He forecast 2019 corn planted area at 91.2 million acres and soybean area at 85.7 million acres.

“Soybeans need to drastically cut acreage, and we don’t see that happening,” Mr. Suderman said.

Stephen Nicholson, senior analyst at Rabo Agrifinance, recently said he expects farmers to plant about 5 million fewer acres of soybeans and 2 million more acres of corn, but he noted plantings could change significantly since a lot of fieldwork didn’t get done because of wet conditions last fall and many areas still are wet.

Wet, cold conditions across many major corn and soybean areas (as well as other crops), and expected flooding in the Upper Midwest and along major rivers, are expected to delay corn planting, which will cut into yield prospects. If the delays are significant, farmers may be forced to plant other crops that have shorter growing seasons, and that typically is soybeans.

The U.S.D.A. March 29 Prospective Plantings report will be one of the most anticipated in years.