CHICAGO — Whole milk, lactose free, and low or no added sugars are some of the attributes fueling growth of flavored milk. Despite news to the contrary, not all fluid milk sales are down.

Increased consumption of bottled water, along with the plethora of beverages making a variety of claims — from energy to weight loss to anti-aging — have taken a toll on gallon white milk sales. Factor in the drop in cereal sales and a decline in the number of households with children eating meals around the dinner table, and it’s easier to understand why total milk sales are down, said Paul Ziemnisky, executive vice-president of global innovation, Dairy Management Inc. (D.M.I.), Rosemont, Ill., which manages the national dairy checkoff.

Fluid milk retail sales have been declining for the past few decades, but may be stabilizing at retail. In the 52 weeks ended Aug. 11, total milk dollar sales of $13.8 billion were down 0.7%, compared to the previous 52-week period, a much smaller decline than in years past, according to Information Resources, Inc. (I.R.I.), Chicago. Value-added formulations, such as higher-protein and lactose-free, both white and flavored, experienced growth.

Flavored milk retail dollar sales were up 1.3% to $1,146.3 million for the same period. Chicago-based Fairlife, the No. 2 flavored milk brand, which is a higher-protein, lactose-free concept, had $104.2 million in sales, up 26%. It is behind No. 1 brand Dean’s, of Dean Foods, Dallas, which was down 13% ($140.7 million), I.R.I. said.

Prairie Farms, Edwardsville, Ill., (14% growth to $60 million) and Kemps, Minneapolis, (14% growth to $24.1 million), which is owned by Dairy Farmers of America Inc. (D.F.A.), Kansas City, Kas., both experienced noteworthy growth. Much may be attributed to their limited-edition and seasonal flavors, which create an urgency to purchase and explore.

Adding flavor is a continuing area of innovation in fluid milk, Mr. Ziemnisky said. This includes at retail and food service.

D.M.I.’s food scientists helped McDonald’s Corp., Chicago, develop a reduced-sugar, low-fat chocolate milk that will start being offered nationwide January 2020. The new formulation has 25% less sugar than the chain’s previous chocolate milk and is no longer a fat-free product. The increase to 1% milkfat improves the flavor and mouthfeel and assists with the decrease in added sugars.

The new lower-sugar chocolate milk may be welcomed by parents of children over five years old, who often start discovering sodas and other non-nutritional beverages at this age. It is recommended younger children drink the 1% low-fat white milk on McDonald’s menu, heeding the Sept. 18, 2019, recommendations by medical and nutrition organizations stating children under one year should be fed breast milk/infant formula and water, and after, up to five years old, should consume only cow’s milk and water. They cautioned against an array of beverages, including those with added sugars and caffeine, as well as plant-based/non-dairy milks that provide no unique nutritional value.

“The experts conclude cow’s milk — whole, low fat and skim milk — offers a host of essential nutrients that young kids need to be healthy, while recommending parents strictly limit or eliminate all other beverages,” said Cary Frye, senior vice-president of regulatory affairs, International Dairy Foods Association, Washington. “Dairy milk is a super food for kids, providing many of the essential nutrients that only milk can provide, including protein, calcium, vitamin D and potassium. In fact, research shows milk is the No. 1 source of protein in the diets of children ages 2 to 11.”

This presents an opportunity to develop flavored milks without any added sugars. That is what Dallas-based Borden Dairy Co. is offering in its new Borden Kid Builder milk. Available in chocolate and strawberry flavors, an 8-oz serving of the no-sugar-added enriched 2% fat milk contains 50% more protein and calcium than regular milk.

This presents an opportunity to develop flavored milks without any added sugars. That is what Dallas-based Borden Dairy Co. is offering in its new Borden Kid Builder milk. Available in chocolate and strawberry flavors, an 8-oz serving of the no-sugar-added enriched 2% fat milk contains 50% more protein and calcium than regular milk.

Ingenuity Brands, San Francisco, embraces flavored milk — in the form of a yogurt drink — as a delivery vehicle of nutrients for proper growth and development. Earlier this year the company introduced the Brainiac Kids brand, which included whole milk drinkable yogurt enhanced with such nutrients as omega-3 fatty acids and choline. The beverage contains half the sugar of the leading children’s yogurt drink.

The largest segment of flavored milk growth is in the higher-protein and lower-sugar categories, Mr. Ziemnisky said. He confirmed Fairlife is the driver of the segments and believes several new entrants will further grow sales.

This includes Seattle-based Darigold, which earlier this year introduced FIT milk, an ultra-filtered, lactose-free, high-protein milk containing 75% more protein and 40% less sugar than regular 2% milk. An 8-oz serving of the chocolate variety contains a total of 14 grams of protein and 14 grams of sugar, with 8 grams of added sugars.

Danone North America, White Plains, N.Y., offers a reduced-fat chocolate option under its Horizon Organic High Protein banner. The product is more about the organic protein attribute, with an 8-oz serving delivering 12 grams of protein, which is achieved through the addition of organic milk protein concentrate. A serving also contains 22 grams of sugar, with 12 grams of added sugars.

Premium concepts and flavors

While value-added nutrition appeals to today’s health- and wellness-seeking shoppers, there’s still the “yum” factor to consider. There is a lot of deliciousness in premium flavored milks. Prairie Farms is bringing new single-serve 14-oz whole milk flavors to the marketplace. Designed for longer shelf life and visual appeal, the line includes chocolate malt, strawberry, chocolate peanut butter and salted caramel flavors.

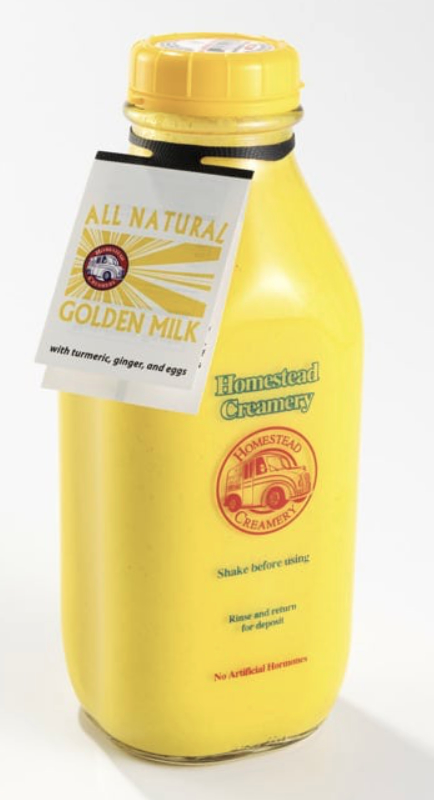

“Local brands, like Shatto in Kansas City, Homestead Creamery in Atlanta and Danzeisen Dairy in Phoenix, continue to bring micro-local, premium flavored milk news to the category with flavors such as root beer, cookies and cream, and coffee,” Mr. Ziemnisky said. “Newer concepts have started addressing health and wellness, such as Homestead’s golden milk, which is formulated with turmeric and delivers anti-inflammatory and immunity benefits.”

Many of the premium concepts are targeted to adults who appreciate the taste and nutrition of flavored milk but are put off by products with cartoon characters and children’s themes. That is what you find in Boston-based start-up Slate, which markets shelf-stable chocolate milk formulated and marketed for adults. The new canned product is made using ultrafiltration to eliminate lactose and reduce total sugars while concentrating dairy proteins. Slate made its debut in three varieties: chocolate, dark chocolate and mocha, with the latter naturally caffeinated by coffee. All varieties contain 75% less sugar and 50% more protein than regular chocolate milk. Monk fruit keeps sugar and calorie content low. In marketing materials, Slate suggests reintroducing chocolate milk to consumers with a clean slate, with less sugar, no lactose and more protein.

Many of the premium concepts are targeted to adults who appreciate the taste and nutrition of flavored milk but are put off by products with cartoon characters and children’s themes. That is what you find in Boston-based start-up Slate, which markets shelf-stable chocolate milk formulated and marketed for adults. The new canned product is made using ultrafiltration to eliminate lactose and reduce total sugars while concentrating dairy proteins. Slate made its debut in three varieties: chocolate, dark chocolate and mocha, with the latter naturally caffeinated by coffee. All varieties contain 75% less sugar and 50% more protein than regular chocolate milk. Monk fruit keeps sugar and calorie content low. In marketing materials, Slate suggests reintroducing chocolate milk to consumers with a clean slate, with less sugar, no lactose and more protein.

Many milk processors offer uniquely flavored premium milks as limited-edition products. Some are centered around a sports team, a regional event or even local ingredients. Shatto Milk, for example, produced only 10,000 pint bottles of raspberry milk at the end of spring, while The Farmer’s Cow, Bozrah, Conn., used local blueberries to produce its limited-edition blueberry milk.

Kemps has long been a partner of the Green Bay Packers, offering limited-edition themed products during the football season. This past year the regional dairy offered Packers Lemon Cream low-fat milk in pint plastic bottles.

Prairie Farms is known for offering holiday-themed flavored milks. In the spring there are varieties such as Easter eggnog and strawberry crème. This winter, the cooperative added chocolate custard to its list of fall- and winter-themed flavors, which includes chocolate mint, custard, eggnog, maple pecan, pumpkin spice and sugar cookie.

“Simple ingredients combined with fresh milk deliver a chocolate custard that’s sure to delight for the holidays,” said Prairie Farms corporate chef Rob Lagerlöf, the architect behind the lineup. “I’ve taken recipes handed down through generations and combined them with my culinary training to create delicious new flavors for everyone to enjoy.”

For the 2019 State Fair of Texas, Borden Dairy introduced three limited-edition fair-inspired flavors of milk: banana taffy, blueberry cobbler and cotton candy. In addition to being sampled at the fair, 16-oz bottles were available at select retailers in Alabama, Louisiana, Mississippi and Texas.

“We are excited to return to the fair and give our neighbors a glimpse into the Borden innovation lab to sample some unique new milk flavors,” said Joe DePetrillo, chief marketing officer. “The company is focusing on innovation driven by consumer insights, and these flavors were actually selected through a voting process among Borden’s social media fans this summer.”

Large companies also are capitalizing on the premium flavored milk trend. Nestle USA, Rosslyn, Va., now offers Snickers and Twix milks. The new 14-oz plastic bottles allow consumers to drink a candy bar. The Snickers variety has bold, nutty notes mixed with chocolate and caramel flavors, while the Twix variety features chocolate, caramel and cookie flavors.

Large companies also are capitalizing on the premium flavored milk trend. Nestle USA, Rosslyn, Va., now offers Snickers and Twix milks. The new 14-oz plastic bottles allow consumers to drink a candy bar. The Snickers variety has bold, nutty notes mixed with chocolate and caramel flavors, while the Twix variety features chocolate, caramel and cookie flavors.

Coffee and tea — cold-brew and traditional — also are used to flavor milk but often are marketed more as coffee and tea beverages rather than flavored milks. The lattes are available as ready-to-drink single-serve and multi-serve products and are sold in glass and plastic bottles, as well as cans and even cartons. While best consumed cold, many are processed and packaged to be shelf stable, allowing for longer shelf life and extended distribution.

The cream that goes into coffee and tea is flavored, too, and it is processed the same way as milk. It simply has a higher fat content. It also happened to be another one of those growth pockets in the milk category. Chicago-based Mintel projects U.S. refrigerated creamers to reach $7.8 billion by 2023.

This past summer, Starbucks Corp., Seattle, and Nestle introduced Starbucks Creamers, the fourth product platform developed since the companies formed a global coffee alliance in August 2018. Both companies saw creamers as a growth opportunity and leveraged Nestle’s more than 50-year expertise in the creamer category and Starbucks nearly 50-year heritage and coffee house flavors, resulting in three dairy creamer flavors: caramel, cinnamon dolce and white chocolate.