Commodity markets are volatile, but your business doesn’t have to be. By combining the right physical procurement strategies with smart financial hedges, your business can do more than just survive volatile markets – it can thrive while navigating a sea of price uncertainty.

2024 is set to be another year of price volatility in the grain and oilseed markets. Corn, canola, and soft red winter wheat carryout should expand year-over-year, but soybeans, spring wheat, and hard red winter wheat are likely to get tighter. High prices will incentivize farmers to plant as many acres as possible, but geopolitical uncertainty and variable weather should keep the markets volatile.

How can food and beverage companies meet or beat budget during years of tight supply and extreme price volatility? In our over 30 years guiding procurement professionals to control commodity costs, we have found these are the key components for an effective price risk management strategy:

1. Value & Time Triggered Purchases

For periodic purchases, combine seasonality, inflation, and historical prices to determine when a commodity is in “value,” or in other words, at the bottom half of its expected trading range. When prices are in value, go to the market and add coverage. If prices are elevated above value the entire period, get coverage but keep it in the near term to only address time-sensitive needs. Commodities eventually revert to the mean, but you do not want to be caught empty-handed if the markets really take off.

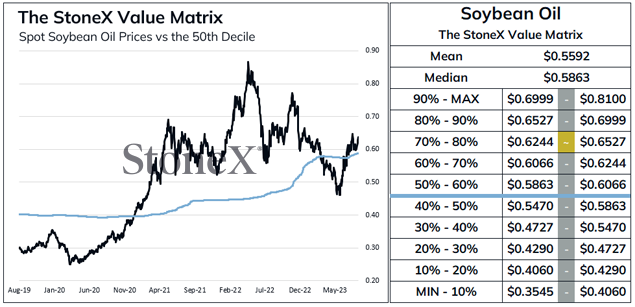

Take soybean oil for example. Below is our Value Matrix, an indicator that takes the last four years of prices and tells us what percentile the current price is in, adjusted for inflation. After spending much of the past two years in historically overvalued territory, soybean oil prices have come back to the 50% decile.

Companies should be trying to buy in the bottom half of prices. Try to limit buying at the upper end of the value matrix as prices rarely live in the 80th to 100th decile for very long.

Source: StoneX Financial Inc., FCM Division

Source: StoneX Financial Inc., FCM Division2. Seasonality & Momentum

You can’t always buy in the bottom half of prices, or in the lower quarter for that matter. Some years just won’t allow for it if we have a bad crop (drought) or geopolitical disturbance (Russia/Ukraine). In that case, use a combination of seasonality and momentum to make timely purchases during the budget year.

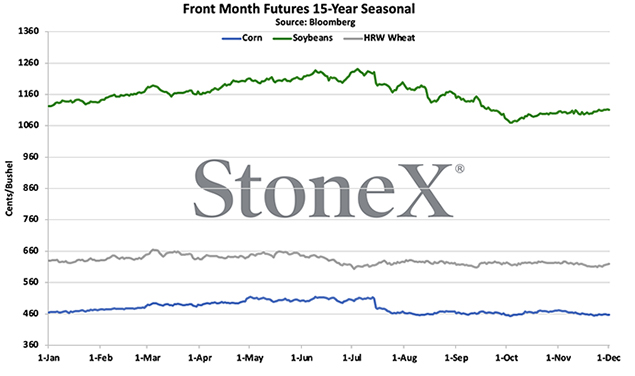

Below is a seasonal chart of corn, wheat and soybeans. Prices tend to rally before a critical event like planting and growing, and then come back down once the market is confident crop development is on track. Prices then tend to decline as we head into harvest before bouncing back as grain is locked in storage and exports pick up due to new crop becoming available on the market. To gauge momentum, you can use a few technical analysis indicators to identify which way the market is moving in the short and long term. Combining the seasonality and technical analysis can direct purchasing decisions in high priced environments.

Source: StoneX Financial Inc., FCM Division

Source: StoneX Financial Inc., FCM Division

3. Minimum / Maximum Pricing

Knowing the maximum price for a commodity that fits your budget can be the cornerstone of a minimum/maximum pricing strategy. With financial tools known as collars, you can create a strategy that caps your upside price, sets a price floor, and allows your price risk to float between the floor and ceiling until you make a physical purchase.

For example, let's say you have exposure to the price of hard red winter (KC) wheat. The price is $8.00 for December futures, and your max budget is $9.00. In this theoretical example, you could buy a $9.00 call and sell a $7.00 put for zero cost (the price paid for the call is equal to the price collected for the put). This allows you to have price insurance on the futures board at $9.00 but also can participate in a price decline to $7.00. This can be a highly effective tool to control prices in a volatile market.

4. Deferred Purchases for Well Supplied Markets

When prices are historically low, you can’t take it for granted. Natural gas is a great example, as its price ranges have swung drastically over the past year. Prices have been anywhere from $2 to $9 over a calendar year. Now that natural gas is trading in a more historical price range, it is a suitable time to add coverage for multiple years in the future. For example, you could go out all the way to December 2027 and start layering energy price hedges over the next four years. Current prices and deferred futures markets are at value levels, and we are only one energy crisis or geopolitical conflict away from sending natural gas soaring.

Putting It All Together

It is important to identify long-term value opportunities for the commodities you need to buy while also effectively managing risk in highly volatile markets. You can achieve these goals by executing a dynamic hedge plan based on the following:

- Set triggers based on time and historical value

- Leverage seasonality and technical analysis to guide pricing decisions outside of value

- Employ dynamic financial tools such as collars to control your price range

- Capitalize on low prices to secure coverage past the current budget year

Putting these all together will help you to control commodity costs in both low- and high-priced environments.

Choosing the Right Partner

You want a firm that knows your industry – and knows your markets. With over 100 years of experience in the commodity markets, StoneX (NASDAQ: SNEX) checks both boxes. We work with your company to maximize purchasing opportunities and manage the inherent price risks. By controlling your commodity costs to the highest standard, StoneX is more than just a financial services company—we are your partner. Together, we can drive your company’s future growth.

|

|