Recap for May 23

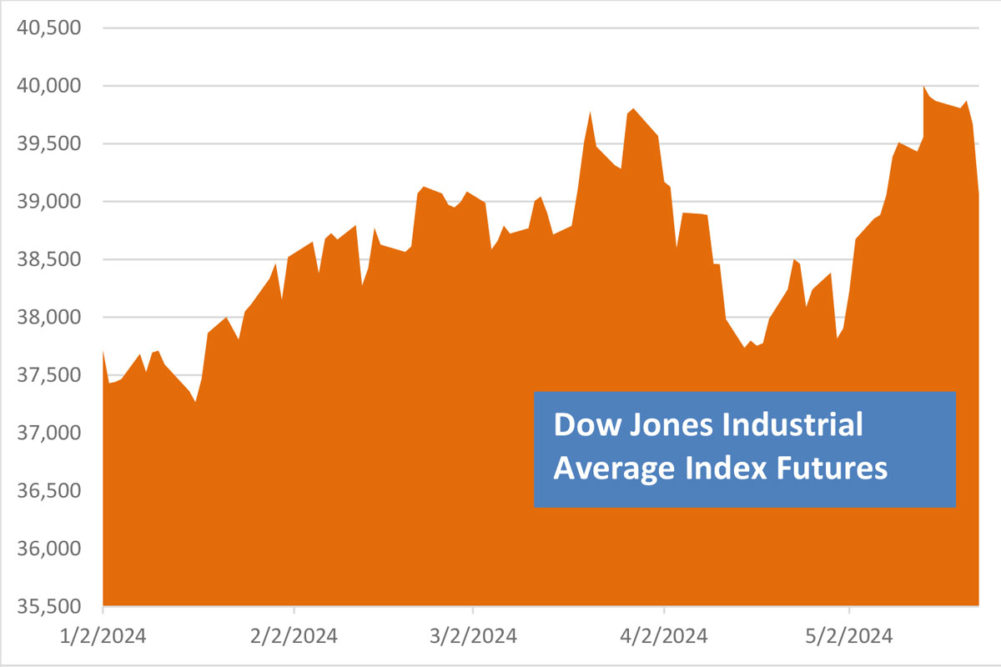

- Large gains in shares of chipmaker Nvidia weren’t enough to stimulate the broader stock market and the three major equity indexes declined for a second day, the DJIA significantly, as investors maintained a risk-off mode. The Dow Jones Industrial Average plummeted 605.78 points, or 1.53%, to close at 39,065.26, its worst one-day percentage drop since March 2023. The Standard & Poor’s 500 dropped 39.17 points, or 0.74%, to close at 5,267.84 with 10 of 11 sectors declining. The Nasdaq Composite shed 65.51 points, or 0.39%, to close at 16,763.03.

- Wheat futures were mixed Thursday with Chicago soft wheat futures extending gains from Wednesday’s 10-month peak but other contracts declining as some analysts said Russian wheat concerns were now fully priced into the market. Soybean futures dipped in technical moves but were underpinned by rain-related crop losses in Argentina and Brazil. Technical trading worked in the other direction for corn futures with additional support from expectations widened wheat-corn spreads will encourage more feeding of the latter to livestock and poultry. July corn added 2¾¢ to close at $4.64 a bu. Chicago July wheat added 5¢ to close at $6.98 per bu; July 2025 and beyond were lower. Kansas City July wheat ascended 11¼¢ and closed at $7.10¾ per bu. Minneapolis July wheat was up 7½¢ and closed at $7.44 per bu; September 2025 and beyond were lower. July soybeans dropped 7¢ to close at $12.39¼ per bu. July soybean meal fell $1.50 to close at $376.70 per ton; October and beyond were higher. July soybean oil slid 0.69¢ to close at 45.19¢ a lb.

- US crude oil prices declined again Thursday. The July West Texas Intermediate light, sweet crude future dropped 70¢ to close at $76.87 per barrel.

- US gold prices continued lower for a third day after notching an all-time high Monday. The June contract shed $55.70 and closed at $2,337.20 per oz.

- The US dollar index edged higher Thursday, a fourth day of gains.

Recap for May 22

- Soybean futures posted gains Wednesday on spillover support from wheat, but the advances were limited by quick planting progress and ample global supplies. Wheat futures briefly went higher on frost and drought concerns in Black Sea wheat, but all classes turned lower by the close as Russian forecasts contained rain in the next 11 to 15 days. Corn futures jumped in the wake of wheat touching the highest premium to corn since 2022 generated ideas producers might feed more corn. Soybean futures also were higher on spillover strength. July corn rose 3¼¢ to close at $4.61¼ a bu. Chicago July wheat dropped 4½¢ to close at $6.93 per bu. Kansas City July wheat slipped 2¢ and closed at $6.99½ per bu. Minneapolis July wheat was down 2¼¢ and closed at $7.36½ per bu. July soybeans jumped 10¢ to close at $12.46¼ per bu. July soybean meal added $5.90 to close at $378.20 per ton. July soybean oil rose 0.07¢ to close at 45.88¢ a lb; the October future was steady and beyond were lower.

- US equity markets pulled lower Wednesday on the release of the minutes from the Federal Reserve meeting three weeks earlier in which governors expressed uncertainty about price pressures and said recent data didn’t generate confidence that inflation was moving toward the central bank’s 2% goal. Some officials mentioned “a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate,” the minutes said. The Dow Jones Industrial Average declined 201.95 points, or 0.51%, to close at 39,671.04. The Standard & Poor’s 500 dropped 14.4 points, or 0.27%, to close at 5,307.01. The Nasdaq Composite dropped 31.08 points, or 0.18%, to close at 16,801.54.

- US crude oil prices declined Wednesday. The July West Texas Intermediate light, sweet crude future dropped $1.09 to close at $77.57 per barrel.

- US gold prices for a second day declined from Monday’s all-time high. The June contract shed $33 and closed at $2,392.90 per oz.

- The US dollar index edged higher for a third day Wednesday.

Recap for May 21

- May’s rally was back on track Tuesday with the three major indexes up 5.4% or more for the month so far and the S&P 500 and Nasdaq hitting record highs. Powering the advances were some investors’ confidence in central bank interest rate cuts this year, along with unexpectedly strong corporate earnings that showed S&P 500 companies as of Friday had grown profits by 5.7% from a year ago. The Dow Jones Industrial Average added 66.22 points, or 0.17%, to close at 39,872.99. The Standard & Poor’s 500 rose 13.28 points, or 0.25%, to close at 5,321.41. The Nasdaq Composite advanced 37.75 points, or 0.22%, to close at 16,832.62.

- Wheat futures posted mixed closes with Minneapolis futures mostly lower and winter wheat mostly building on Monday’s rally. Backing the advances in Kansas City and Chicago was continued concern about frost damage to Russia’s crop after the IKAR agricultural consultancy cut its Russian wheat crop forecast to 83.5 million tonnes from 86 million tonnes and lowered its projection for 2024-25 Russian wheat exports to 45 million tonnes from 47 million tonnes. Soybean futures slipped lower, breaking a three-session rally under pressure from weak soymeal prices and a US planting pace exceeding expectations. Technical trading under pressure from a quick planting pace brought corn futures lower despite US Corn Belt showers that have forced some farmers to replant. July corn fell 2½¢ to close at $4.58 a bu. Chicago July wheat added 8¾¢ to close at $6.97½ per bu. Kansas City July wheat advanced 4¾¢ and closed at $7.01½ per bu; the March 2026 future slipped lower. Minneapolis July wheat was down ½¢ and closed at $7.38¾ per bu; later months were mixed, mostly slipping lower. July soybeans dropped 11¾¢ to close at $12.36¼ per bu. July soybean meal fell $1.80 to close at $372.30 per ton. July soybean oil lost 0.51¢ to close at 45.81¢ a lb.

- US crude oil prices pulled back another 1% Tuesday as lingering inflation threatened to keep interest rates higher for longer and cut into consumer demand at US gas pumps. The Energy Information Administration said retail gasoline prices fell for the fourth consecutive week to $3.58 per gallon on Monday. The expiring June West Texas Intermediate light, sweet crude future fell 54¢ to close at $79.26 per barrel. July was down 64¢ to close at $78.66 per barrel.

- US gold prices pulled lower from Monday’s all-time high but remained at the $2,400-per-oz level Tuesday on mixed ideas for the Federal Reserve’s interest rate path and on safe-haven interest. The June contract subtracted $12.60 and closed at $2,425.90 per oz.

- The US dollar index edged higher against the euro Tuesday but was flat against most other currencies after Federal Reserve Governor Christopher Waller, speaking at the Peterson Institute for International Economics in Washington, said he would be comfortable supporting an easing in the central bank’s stance of monetary policy if he were to see several more months of good inflation data.

Recap for May 20

- US gold futures rose to an all-time high Monday on increased expectations for a September interest rate cut, increased holdings in China’s central bank, and elevated risk aversion after Iranian officials were killed in a helicopter crash over the weekend. The June contract added $21.10, or 0.9%, and closed at $2,438.50 per oz, pulling back slightly after touching a record-high $2,449.89 per oz earlier in the session.

- US equity markets posted mixed closes again Monday, the DJIA declining ahead of major earnings reports, the S&P 500 trading at record levels before pulling back slightly, and the Nasdaq, led by accelerating shares of tech stocks, posting a record high. The Dow Jones Industrial Average fell 196.82 points, or 0.49%, to close at 39,806.77. The Standard & Poor’s 500 edged up 4.86 points, or 0.09%, to close at 5,308.13. The Nasdaq Composite added 108.91 points, or 0.65%, to close at 16,794.87.

- US wheat futures soared Monday on ramped-up Black Sea supply concerns amid widespread crop loss due to frost in Russia and worries that northern and eastern regions of Ukraine also may be affected. Corn futures also rose as recent weather proved unfavorable to seeding the 2024 crop. Brazilian flooding also fueled worries about crop losses and sent US soybeans higher Monday. July corn rose 8¢ to close at $4.60½ a bu. Chicago July wheat soared 37½¢ to close at $6.88¾ per bu. Kansas City July wheat jumped 35¢ and closed at $6.96¾ per bu. Minneapolis July wheat was up 27¾¢ and closed at $7.39¼ per bu. July soybeans added 20¢ to close at $12.48 per bu. July soybean meal added $5.30 to close at $374.10 per ton. July soybean oil gained 1.05¢ to close at 46.32¢ a lb.

- US crude oil prices pulled back 1% Monday after two top Federal Reserve officials indicated they would need to see more signs of declining inflation before the central bank begins to reverse its recent campaign of interest rate hikes. The June West Texas Intermediate light, sweet crude future fell 26¢ to close at $79.80 per barrel.

- The US dollar index edged higher Monday as investors awaited further rate-cut clues from the Federal Reserve.

Recap for May 17

- US equity markets posted mixed closes Friday. The DJIA continued higher on renewed hopes for a Federal Reserve interest rate cut this year, closing above 40,000 for the first time ever. The Dow Jones Industrial Average added 134.21 points, or 0.34%, to close at 40,003.59. The Standard & Poor’s 500 added 6.17 points, or 0.12%, to close at 5,303.27. The Nasdaq Composite fell 12.35 points, or 0.07%, to close at 16,685.97.

- Improving US weather forecasts weighed on corn Friday. Soybeans continued higher as more rain in Brazil ramped up concerns about flooding leading to crop losses. Wheat was under pressure a day after the hard winter wheat tour projected better-than-average yields in Kansas. July corn fell 4½¢ to close at $4.52½ a bu. Chicago July wheat dropped 12¢ to close at $6.51¼ per bu. Kansas City July wheat fell 11½¢ and closed at $6.61¾ per bu. Minneapolis July wheat was down 9¼¢ and closed at $7.11½ per bu. July soybeans added 11¾¢ to close at $12.28 per bu, but later months were mixed. July soybean meal added $1.10 to close at $368.80 per ton; later months were mixed. July soybean oil gained 0.75¢ to close at 45.27¢ a lb.

- US crude oil prices advanced again Friday. The June West Texas Intermediate light, sweet crude future gained 83¢ to close at $80.06 per barrel.

- The US dollar index weakened Friday.

- US gold futures climbed. The June contract added $31.90 and closed at $2,417.40 per oz.