Recap for May 16

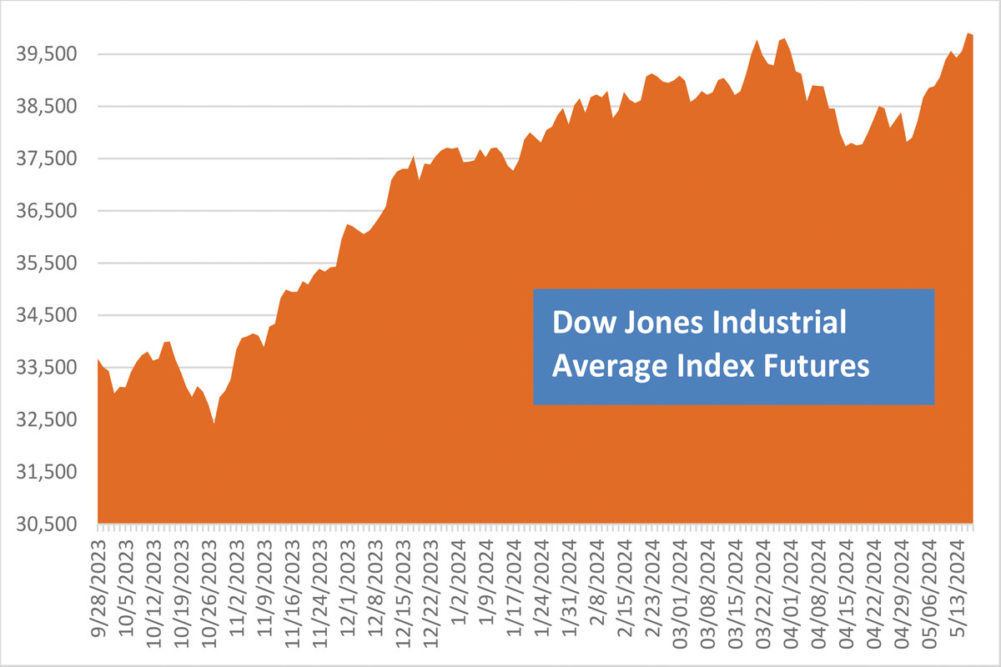

- Major US equity indexes closed lower Thursday, paring gains after climbing early on signs of continuing US economic strength, offsetting the retreat of investor expectations that inflation will cool enough to allow central-bank officials to sharply reduce interest rates this year. The DJIA rose as high as 40,051 before pulling back. It had been 873 days since the index first topped 30,000 points in November 2020. The Dow Jones Industrial Average dropped 38.62 points, or 0.1%, to close at 39,869.38. The Standard & Poor’s 500 eased 11.05 points, or 0.21%, to close at 5,297.1. The Nasdaq Composite fell 44.07 points, or 0.26%, to close at 16,698.32.

- Wheat futures closed lower Thursday on strong Kansas yield and production forecasts from the Hard Winter Wheat Tour, and on lackluster export sales. Soybean futures were mixed but mostly lower after Brazil flooding worries partially offset a National Oilseed Processors Association’s report indicating US soybean crushings dropped to 166.0 million bushels in April, a seven-month low that was below all trade estimates. Weekly export sales near the low end of expectations also pressured corn futures. July corn fell 5½¢ to close at $4.57 a bu. Chicago July wheat dropped 2¢ to close at $6.63¼ per bu. Kansas City July wheat fell 1¾¢ and closed at $6.73¼ per bu. Minneapolis July wheat was down 6¼¢ and closed at $7.20¾ per bu. July soybeans added 2¾¢ to close at $12.16¼ per bu, but all months after August closed lower. July soybean meal dropped $4.40 to close at $365.30 per ton. July soybean oil gained 0.97¢ to close at 44.52¢ a lb.

- US crude oil prices advanced Thursday. The June West Texas Intermediate light, sweet crude future gained 60¢ to close at $79.23 per barrel.

- The US dollar index strengthened on Thursday.

- US gold futures tumbled Thursday. The June contract fell $940 and closed at $2,385.50 per oz.

Recap for May 15

- The three major US equity indexes surged to record highs Wednesday on benign inflation data that bolstered risk sentiment and boosted hopes of interest rate cuts sooner than later. The Dow Jones Industrial Average surged 349.89 points, or 0.88%, to close at 39,908.00. The Standard & Poor’s 500 jumped 61.47 points, or 1.17%, to close at 5,308.15. The Nasdaq Composite advanced 231.21 points, or 1.40%, to close at 16,742.39.

- Wheat and corn futures closed lower Wednesday while the soy complex was mixed with soybean and soymeal futures declining but soy oil futures posting small gains. Chicago July wheat dropped 6¾¢ to close at $6.65¾ per bu. Kansas City July wheat fell 8¼¢ and closed at $6.75 per bu. Minneapolis July wheat was down 6¼¢ and closed at $7.27 per bu. July soybeans eased 1¢ to close at $12.13½ per bu. July soybean meal dropped $1.60 to close at $371.70 per ton. July soybean oil gained 0.15¢ to close at 43.55¢ a lb.

- US crude oil prices advanced Wednesday. The June West Texas Intermediate light, sweet crude future gained $0.61 to close at $78.63 per barrel.

- The US dollar index declined on Wednesday.

- US gold futures rose on Wednesday even as lots of money flowed to riskier investments such as equities. The June contract added $35 and closed at $2,394.90 per oz.

Recap for May 14

- On Tuesday, wheat futures gave back some of the prior day’s gains but were still above last week’s highs. Pressure came as traders processed the latest weekly USDA crop progress report, released after the market closed on Monday, which affirmed winter wheat conditions were still at four-year highs. Traders awaited field updates from wheat scouts on this year’s Wheat Quality Council Hard Winter Wheat tour, which kicked off early Tuesday morning. Soybean futures were lower as the market reacted to the Biden administration’s decision not to include used cooking oil on the recent list of tariff increases on Chinese goods. Nearby corn futures slid on spillover pressure from wheat and soybeans. July corn declined 5¢ to close at $4.67½ per bu, but later months were mixed. Chicago July wheat dropped 14½¢ to close at $6.72½ per bu. Kansas City July wheat fell 16¾¢ and closed at $6.83¼ per bu. Minneapolis July wheat was down 5¢ and closed at $7.33¼ per bu. July soybeans lost 5¢ to close at $12.14½ per bu. July soybean meal gained $6.80 to close at $373.30 per ton. July soybean oil tumbled 1.75¢ to close at 43.40¢ a lb.

- US equity indexes settled higher Tuesday, with Nasdaq notching a fresh record high. Shares jumped higher after the Biden administration announced new tariffs on Chinese goods. The Dow Jones Industrial Average added 126.60 points, or 0.32%, to close at 39,558.11. The Standard & Poor’s 500 advanced 25.26 points, or 0.48%, to close at 5,246.68. The Nasdaq Composite jumped 122.94 points, or 0.75%, to close at 16,511.18.

- US crude oil prices fell Tuesday. The June West Texas Intermediate light, sweet crude future declined $1.10 to close at $78.02 per barrel.

- The US dollar index declined on Tuesday.

- US gold futures rose on Tuesday. The June contract added $16.90 and closed at $2,359.90 per oz.

Recap for May 13

- Wheat futures on Monday extended last week’s rally, with Chicago wheat futures touching nine-month highs, on continued concerns about wheat crop losses in top-exporter Russia due to frost damage and dry weather. Corn and soybean futures also were higher on spillover support from wheat as well as concerns about delayed planting in the United States and flooding in southern Brazil. July corn added 2¾¢ to close at $4.72½ per bu, but later months were mixed. Chicago July wheat jumped 23½¢ higher to close at $6.87 per bu. Kansas City July wheat soared 26¾¢ and closed at $7 per bu. Minneapolis July wheat advanced 18¼¢ and closed at $7.38¼ per bu. July soybeans ticked up ½¢ to close at $12.19½ per bu. July soybean meal declined $5.40 to close at $366.50 per ton. July soybean oil added 0.71¢ to close at 45.15¢ a lb.

- US equity indexes closed mixed again on Monday as investors wrestled with the possibility of interest rates cut amid relentlessly sticky inflation. The Dow Jones Industrial Average gave back 81.33 points, or 0.21%, to close at 39,431.51. The Standard & Poor’s 500 edged down 1.26 points, or 0.02%, to close at 5,221.42. The Nasdaq Composite added 47.37 points, or 0.29%, to close at 16,388.24.

- US crude oil prices rose Monday. The June West Texas Intermediate light, sweet crude future added $0.86 to close at $79.12 per barrel.

- The US dollar index eased on Monday.

- US gold futures tumbled Monday. The June contract fell $32 and closed at $2,343 per oz.

Recap for May 10

- Wheat futures jumped higher to close the week Friday with winter wheat futures posting large weekly gains after the USDA projected larger supplies, slightly higher domestic use, increased exports and higher stocks in its monthly agricultural supply-and-demand report. Support for wheat also came from Russia’s announcement that some frost-damaged fields will have to be replanted. Corn futures advanced after the USDA’s corn carryover estimate fell below trade expectations. Corn carryover in 2025 were projected at 2.102 billion bus, a six-year high, up from 2.022 billion for 2024, the USDA said. Soybean futures followed corn futures higher despite the USDA projecting US farmers will produce their second biggest soybean harvest ever this year. July corn added 13¼¢ to close at $4.69¾ per bu. Chicago July wheat soared 26¢ higher to close at $6.63½ per bu. Kansas City July wheat added 21½¢ and closed at $6.73¼ per bu. Minneapolis July wheat added 16¼¢ and closed at $7.20 per bu. July soybeans added 10½¢ to close at $12.19 per bu. July soybean meal declined $1 to close at $371.90 per ton. July soybean oil added 1.80¢ to close at 44.44¢ a lb.

- US equity indexes posted mixed closes Friday with the Nasdaq easing. But weekly gains from all three major indexes helped put them up at least 3.7% so far in May, a sign the April doldrums were firmly in the rearview mirror. The Dow Jones Industrial Average advanced 125.08 points, or 0.32%, to close at 39,512.84. The Standard & Poor’s 500 added 8.6 points, or 0.16%, to close at 5,222.68. The Nasdaq Composite eased 5.4 points, or 0.03%, to close at 16,340.87.

- US crude oil prices eased Friday after Dallas Federal Reserve President Lorie Logan said it was unclear whether monetary policy was tight enough to bring down inflation to the US central bank’s 2% goal. Also pressuring oil was Atlanta Fed President Raphael Bostic’s comments to Reuters that inflation was likely to slow under current monetary policy, enabling the central bank to begin reducing its policy rate in 2024, albeit perhaps by only a quarter of a percentage point and not until the final months of the year. The June West Texas Intermediate light, sweet crude future fell $1 to close at $78.26 per barrel.

- The US dollar index strengthened Friday.

- US gold futures advanced again Friday. The June contract was up $34.70 higher and closed at $2,375 per oz.