Recap for April 30

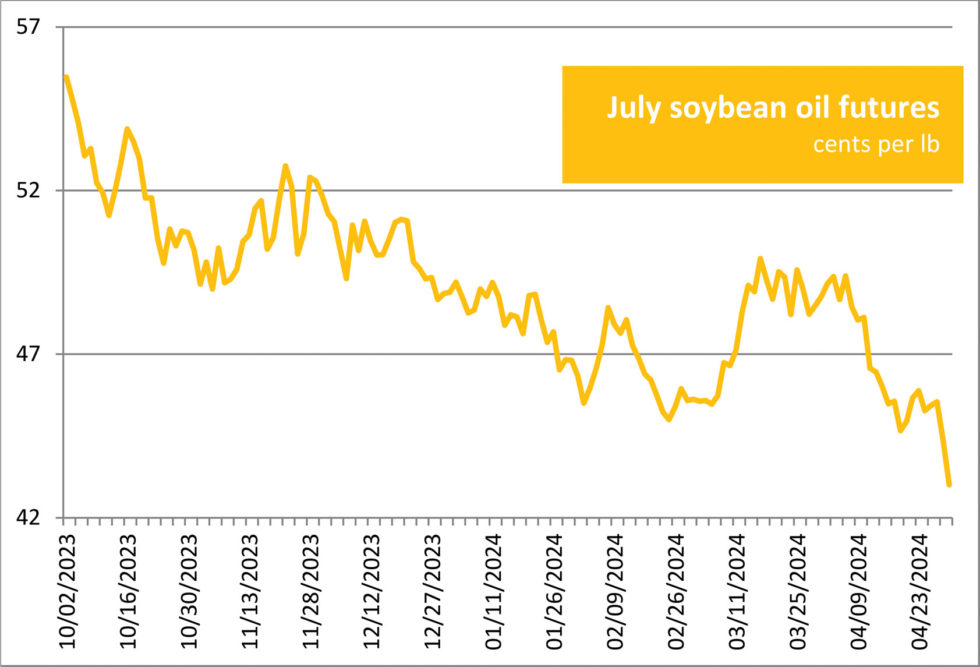

- Soybean oil futures struck contract lows Tuesday, dragging down the whole soy complex amid weak demand and large deliveries against the May futures. The latter affected wheat futures as well in their continued tumble from multi-month highs. Corn futures followed wheat and soybeans lower concurrent with signs of ample global supply. July corn fell 2½¢ to close at $4.46¾ per bu. Chicago July wheat dropped 5¼¢ to close at $6.03¼ per bu; September 2025 and beyond were higher. Kansas City July wheat fell 15¼¢ and closed at $6.35¼ per bu. Minneapolis July wheat pulled back 3½¢ and closed at $7.04¼ per bu. July soybeans shed 19¢ to close at $11.63 per bu. July soybean meal was down $2.40 to close at $351.90 per ton. July soybean oil fell 1.36¢ to close at 43.01¢ a lb.

- US crude oil prices declined again Tuesday. The June West Texas Intermediate light, sweet crude future was down 70¢ to close at $81.93 per barrel.

- Tuesday was a downbeat day to close the worst month of 2024 so far (and the worst since September) for US equity markets. Shares were under pressure from a Labor Department report indicating the employment-cost index rose by a seasonally adjusted 1.2% in the first quarter from the previous three months, and 4.2% from a year earlier, suggesting the Fed’s campaign to cut inflation is likely to endure. The Dow Jones Industrial Average plunged 570.17 points, or 1.49%, to close at 37,815.92. The Standard & Poor’s 500 dropped 80.48 points, or 1.57%, to close at 5,035.69 with all 11 sectors declining. The Nasdaq Composite subtracted 325.26 points, or 2.04%, to close at 15,657.82.

- The US dollar index’s up-down pattern continued Tuesday with a flip to the high side.

- US gold futures plunged Tuesday as the dollar advanced. The June contract shed $54.80 to close at $2,302.90 per oz.

Recap for April 29

- US crude oil prices declined Monday on Middle East ceasefire talks in Cairo and ahead of the US central bank’s May 1 monetary policy review. Investors were tentatively pricing a higher probability that the Fed could hike interest rates by a quarter percentage point this year and next year as inflation and the labor market remain resilient. The June West Texas Intermediate light, sweet crude future was down $1.22 to close at $82.63 per barrel.

- Wheat futures were mixed Monday, declining in Chicago and Kansas City on rainy forecasts for dry global export leader Russia but were higher in Minneapolis. Soy complex futures were mixed with soybeans and soymeal higher as Argentinian oilseed workers went on strike. Corn futures eased on a bearish sentiment generated by falling crude oil prices and winter wheat futures prices. May corn fell ¾¢ to close at $4.39¼ per bu. Chicago May wheat deleted 13¢ to close at $5.90¼ per bu. Kansas City May wheat shed 2½¢ and closed at $6.43¾ per bu. Minneapolis May wheat jumped 18¢ and closed at $7.15¼ per bu. May soybeans added 1¼¢ to close at $11.60¾ per bu. May soybean meal was up $8.30 to close at $348.30 per ton. May soybean oil fell 1.24¢ to close at 43.69¢ a lb.

- US equity markets extended their rallies Monday with help from shares of Tesla, which jumped 15% after Elon Musk got China’s blessing to initiate the drive-assistance service there. The Dow Jones Industrial Average added 146.43 points, or 0.38%, to close at 38,386.09. The Standard & Poor’s 500 added 16.21 points, or 0.32%, to close at 5,116.17. The Nasdaq Composite added 55.18 points, or 0.35%, higher to close at 15,983.08.

- The US dollar index flipped to a downside move Monday, extending the up-down pattern established the previous week.

- US gold futures advanced Monday. The June contract added $10.50 to close at $2,357.70 per oz.

Recap for April 26

- Dry weather concerns sent wheat futures higher Friday, some contracts posting the largest weekly gains since Russia first attacked Ukraine in February 2022. South American competition continued to weigh on US soybean futures Friday although losses were tempered by potential weather delays to US planting. Corn futures declined on profit taking Friday but managed a weekly gain amid weather concerns for planting the US crop. May corn fell 1¢ to close at $4.40 per bu. Chicago May wheat added 1¢ to close at $6.03¼ per bu. Kansas City May wheat added 14¼¢ and closed at $6.46¼ per bu. Minneapolis May wheat was up 6¼¢ and closed at $6.97¼ per bu. May soybeans fell 3¼¢ to close at $11.59½ per bu; later months were mixed. May soybean meal was down $3.90 to close at $340 per ton. May soybean oil added 0.11¢ to close at 44.93¢ a lb.

- US equity markets closed higher Friday in a broad market rally kicked off by rebounding shares of the so-called “Magnificent Seven”: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. The Dow Jones Industrial Average added 153.86 points, or 0.4%, to close at 38,239.66. The Standard & Poor’s 500 added 51.54 points, or 1.02%, to close at 5,099.96. The Nasdaq Composite soared 316.14 points, or 2.03%, higher to close at 15,927.9.

- The US dollar index strengthened Friday.

- US gold futures advanced Friday despite data showing US inflation rose in line with expectations but posted a weekly decline as geopolitical risk premiums eased. The expiring April contract added $5 to close at $2,334.80 per oz. The June contract added $4.70 to close at $2,347.20 per oz.

- US crude oil advanced Friday on Middle East tension. The June West Texas Intermediate light, sweet crude future added 28¢, or 0.55%, to close at $83.85 per barrel.

Recap for April 25

- The rally in wheat futures continued Thursday with the support from dry conditions in the US Plains and in Russia; prices were up 30¢ to nearly 60¢ a bu for the week to date. Soybean futures were mixed, the nearby months dipping on strong export competition from Brazil and deferred months advancing on forecasts for showers that could last through the weekend and delayed planting in the US Midwest. Those same forecasts helped corn futures prices advance. May corn rose 3¼¢ to close at $4.41 per bu. Chicago May wheat added 7¾¢ to close at $6.02¼ per bu. Kansas City May wheat added 7¾¢ and closed at $6.32 per bu. Minneapolis May wheat was up 12¢ and closed at $6.91 per bu. May soybeans fell 3¼¢ to close at $11.62¾ per bu; the August contract and beyond advanced. May soybean meal was down $2.10 to close at $343.90 per ton. May soybean oil added 0.16¢ to close at 44.82¢ a lb.

- The US dollar index weakened Thursday after a Commerce Department report indicated US gross domestic product grew at a 1.6% annualized rate in the first quarter, slower than the 2.4% rate expected by economists. Further pressure stemmed from the report’s indication that underlying inflation as measured by the core personal consumption expenditures price index rose 3.7% in the first quarter, topping pre-report expectations for a 3.4% rise.

- The above-mentioned Commerce Department report drove stocks lower Thursday. Caterpillar and Meta Platforms were two of the day’s biggest losers. The Dow Jones Industrial Average plummeted 375.12 points, or 0.98%, to close at 38,085.8. The Standard & Poor’s 500 shed 23.21 points, or 0.46%, to close at 5,048.42. The Nasdaq Composite dropped 100.99 points, or 0.64%, to close at 15,611.76.

- US gold futures broke a three-day losing streak Thursday. The April contract nearing expiration added $5.30 to close at $2,329.80 per oz. The June contract added $4.10 to close at $2,342.50 per oz.

- US crude oil advanced Thursday on supply disruption worries amid airstrikes in Gaza. Also supporting was Treasury Secretary Janet Yellen’s comments that US economic growth was likely stronger than suggested by weaker-than-expected quarterly data. The June West Texas Intermediate light, sweet crude future added 76¢, or 0.9%, to close at $83.57 per barrel.

Recap for April 24

- Wheat futures continued to rally Wednesday, some contracts striking three-month highs on continued concerns about lack of moisture in US and Russia wheat growing areas and the latter country’s Black Sea-region grain infrastructure attacks. Soybean futures traded choppily and traded higher most of the day and closed mixed amid short-covering and signs wet weather could hamper planting. Corn futures dropped against a backdrop of unwinding short positions, export competition from Brazil and easing crude oil prices. May corn fell 5¼¢ to close at $4.37¾ per bu. Chicago May wheat added 9½¢ to close at $5.94½ per bu. Kansas City May wheat jumped 15½¢ and closed at $6.24¼ per bu. Minneapolis May wheat added 12½¢ and closed at $6.79 per bu. May soybeans fell 1½¢ to close at $11.66 per bu; later months were mixed. May soybean meal was 80¢ higher to close at $346 per ton. May soybean oil dropped 0.65¢ to close at 44.66¢ a lb.

- US equity indexes posted mixed closes Wednesday. Tesla shares jumped 12% despite Tuesday’s earnings report revealing a difficult quarter for the electric car maker after Elon Musk spoke of making less-expensive products. Texas Instruments’ 5.6% jump helped boost some semiconductor stocks. The Dow Jones Industrial Average subtracted 42.77 points, or 0.11%, to close at 38,460.92. The Standard & Poor’s 500 edged up 1.08 points, or 0.02%, to close at 5,071.63. The Nasdaq Composite added 16.11 points, or 0.1%, to close at 15,712.75.

- The US dollar index strengthened Wednesday.

- US gold futures weakened for a third session Wednesday, but the loss paled in comparison to Monday’s $66 decline. The April contract was down $3.20 to close at $2,324.50 per oz.

- US crude oil prices fell back Wednesday on easing Middle East conflict concerns and slowing US business activity with losses limited by declining US crude oil inventories. The June West Texas Intermediate light, sweet crude future shed 55¢ to close at $82.81 per barrel.