Recap for May 8

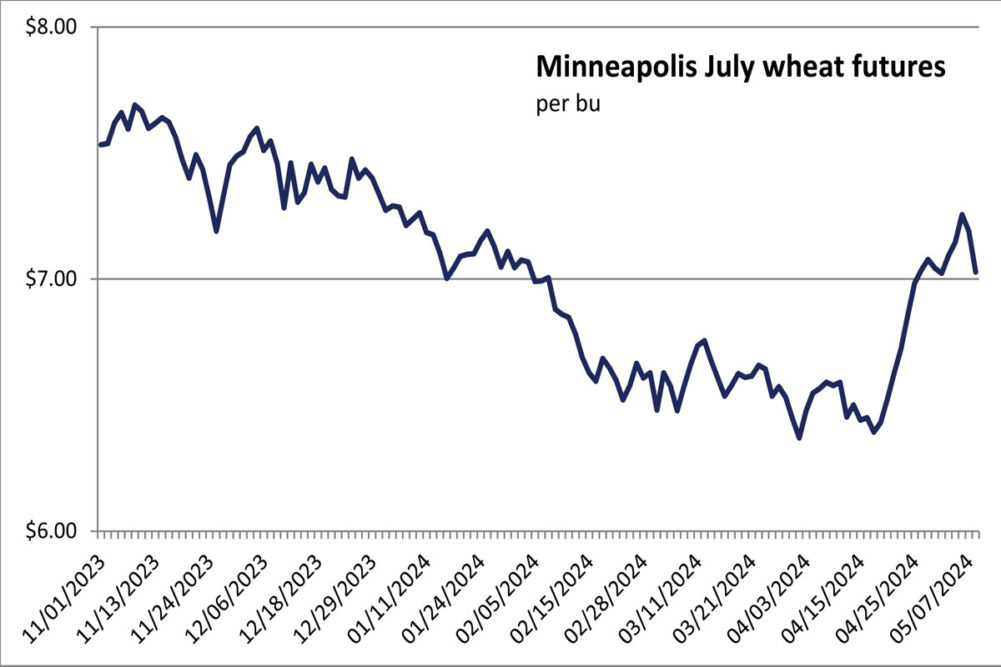

- Trader positioning ahead of major US Department of Agricultural reports set to be released this Friday was a primary driver behind declining agricultural commodity futures, overriding supporting factors of persistent flooding in Brazil. Also pressuring was improved weather forecasts for wheat-growing regions in both the United States and Russia. July corn dropped 8½¢ to close at $4.58½ per bu. Chicago July wheat deleted 8¾¢ to close at $6.34 per bu. Kansas City July wheat shed 15½¢ and closed at $6.48½ per bu. Minneapolis July wheat fell 16¼¢ and closed at $7.02¾ per bu. July soybeans tumbled 18¾¢ to close at $12.27¾ per bu. July soybean meal gave back $4.70 to close at $378.50 per ton. July soybean oil dropped 0.71¢ to close at 43.79¢ a lb.

- The US dollar index strengthened again Wednesday.

- US equity markets closed mixed again Wednesday. A tech sell-off provided pressure to the tech-heavy Nasdaq Composite. Offsetting support came as the majority of US companies are showing profit growth in their first-quarter earnings reports. The Dow Jones Industrial Average jumped up 172.13 points, or 0.44%, to close at 39,056.39. The Standard & Poor’s 500 slipped 0.03 point, less than 0.01%, to close at 5,187.63. The Nasdaq Composite dropped 29.80 points, or 0.18%, to close at 16,302.76.

- US gold futures declined a second straight day Wednesday. The June contract was $1.90 lower to close at $2,322.30 per oz.

- US crude oil prices firmed Wednesday. The June West Texas Intermediate light, sweet crude future rose 61¢ to close at $78.99 per barrel.

Recap for May 7

- Wheat futures retreated Tuesday from multi-month highs as crop weather forecasts improved in Russia and after the USDA late Monday said US winter wheat conditions improved slightly. Corn futures touched a four-month high on volatile Midwest and South American weather before retreating and closing lower following wheat with farmers selling old crop supplies into the rally. Soybean futures were mixed Tuesday with new crop futures firming but old crop down on profit taking and spillover pressure from wheat. July corn fell 2¢ to close at $4.67 per bu. Chicago July wheat gave back 6¢ to close at $6.42¾ per bu. Kansas City July wheat shed 11¼¢ and closed at $6.64 per bu. Minneapolis July wheat deleted 6½¢ and closed at $7.19 per bu; later months were mixed. July soybeans eased 2¼¢ to close at $12.46½ per bu; later months were mixed. July soybean meal fell $4.40 to close at $383.20 per ton; later months were mixed. July soybean oil added 0.66¢ to close at 44.50¢ a lb.

- The US dollar index strengthened Tuesday.

- US equity markets were mixed Tuesday. The S&P 500 built on its recent rally amid a plethora of earnings reports. Shares of Tesla, Palantir Technologies, Celsius and Disney all declined. The Dow Jones Industrial Average edged up 31.99 points, or 0.08%, to close at 38,884.26. The Standard & Poor’s 500 added 6.96 points, or 0.13%, to close at 5,187.7. The Nasdaq Composite dropped 16.69 points, or 0.1%, to close at 16,332.56.

- US gold futures receded on Tuesday. The June contract shed $7 to close at $2,324.20 per oz.

- US crude oil prices pulled back Tuesday. The June West Texas Intermediate light, sweet crude future was down 10¢ to close at $78.38 per barrel.

Recap for May 6

- Weather with the potential to cut into yields in countries that compete with the US for export business helped corn, soybean and wheat futures climb Monday. Wheat futures shot higher with winter wheat futures posting the widest gains on crop weather problems in Russia including dryness and frost. IKAR last week cut its production estimate for Russia, the world’s largest wheat exporter. Soybean futures reached a four-month peak on a deteriorating harvest in Brazil’s Rio Grande do Sul state, where torrential rains flooded fields with about a quarter of beans left to harvest. The deluge also may reduce the state’s corn volumes and further clip South American supply after downgrades to estimates of Argentina’s crop. US corn futures reached the highest point since January. July corn added 8¾¢ to close at $4.49 per bu. Chicago July wheat added 26¼¢ to close at $6.48¾ per bu. Kansas City July wheat added 25¢ and closed at $6.75¼ per bu. Minneapolis July wheat advanced 11¢ and closed at $7.25½ per bu. July soybeans soared 33¾¢ to close at $12.48¾ per bu. July soybean meal was up $15.40 to close at $387.60 per ton. July soybean oil added 0.76¢ to close at 43.84¢ a lb.

- The US dollar index edged slightly higher to open the week.

- US equity markets extended Friday’s rally ahead of a jam-packed earnings report week to include Disney, Uber and Airbnb. The Dow Jones Industrial Average added 176.59 points, or 0.46%, to close at 38,852.27. The Standard & Poor’s 500 advanced 52.95 points, or 1.03%, to close at 5,180.74. The Nasdaq Composite ascended 192.92 points, or 1.19%, to close at 16,349.25.

- US gold futures climbed Monday. The June contract jumped $22.60 to close at $2,331.20 per oz.

- After last week posting the steepest weekly loss in four months, US crude oil prices advanced Monday as a Middle East ceasefire proved elusive. The June West Texas Intermediate light, sweet crude future was up 37¢ to close at $78.48 per barrel.

Recap for May 3

- Soybean futures continued higher Friday as remaining unharvested soybean crop was impacted by flooding in Brazil’s Rio Grande do Sul state. The floods also supported corn futures, as did threats of disease and labor strike resumption in Argentina. Rainy Russian forecasts were rolled back Friday and wheat futures responded by jumping higher. Kansas City and Chicago posted substantial gains and Minneapolis wheat was up modestly. July corn added ½¢ to close at $4.60¼ per bu. Chicago July wheat jumped 18¼¢ to close at $6.22½ per bu. Kansas City July wheat added 13¾¢ and closed at $6.50¼ per bu. Minneapolis July wheat advanced 5¼¢ and closed at $7.14½ per bu. July soybeans jumped 16¢ to close at $12.15 per bu. July soybean meal was up $7.30 to close at $372.20 per ton. July soybean oil eased 0.16¢ to close at 43.08¢ a lb.

- The US dollar index weakened Friday after a Labor Department report indicated US employers added a seasonally adjusted 175,000 jobs in April, far fewer than in March and below the 240,000 economists had expected.

- US equity markets surged Friday and powered to weekly gains as the Labor report kept alive slim hopes for a Federal Reserve interest rate cut in the late summer. A plethora of good earnings reports pulled shares higher, as did Apple’s announcement of a $110 billion share buyback plan. The Dow Jones Industrial Average rocketed higher by 450.02 points, or 1.18%, to close at 38,675.68, its best day in more than a month. The Standard & Poor’s 500 advanced 63.59 points, or 1.26%, to close at 5,127.79. The Nasdaq Composite soared 315.37 points, or 1.99%, to close at 16,156.33.

- US gold futures eased Friday to a one-month low. Analysts said the decline extended a correction from April’s rally. The June contract fell $1 to close at $2,308.60 per oz.

- US crude oil prices declined Friday and posted the steepest weekly loss in three months on uncertainty generated by the jobs report and the Fed’s inflation-fighting course. The June West Texas Intermediate light, sweet crude future was down 84¢ to close at $78.11 per barrel.

Recap for May 2

- Soybean futures leapt higher as floods hit Brazil's Rio Grande Do Sul state, putting the soybean crop at risk there. Wheat futures climbed on weather risks in the US Plains and Eastern Europe’s Black Sea region, but gains were limited as the Russian crop showed favorable early development. Brazil’s floods also supported corn futures, which received a boost from Ukraine’s deputy agriculture minister projecting a 25% decline in exports for 2024-25. July corn added 9¢ to close at $4.59¾ per bu. Chicago July wheat added 5¢ to close at $6.04¼ per bu. Kansas City July wheat added 11½¢ and closed at $6.36½ per bu. Minneapolis July wheat rose 7¢ and closed at $7.09¼ per bu. July soybeans soared 28¾¢ to close at $11.99 per bu. July soybean meal was up $15.90 to close at $364.90 per ton. July soybean oil eased 0.02¢ to close at 43.24¢ a lb; January 2025 and beyond were steady to slightly higher.

- US crude oil prices were mixed Wednesday. The June West Texas Intermediate light, sweet crude future was down 5¢ to close at $78.95 per barrel while all forward contracts were 4¢ to 15¢ higher.

- Ahead of a key Labor Department report that will give a fresh measure of the US economy, rising shares of large US technology firms helped the three major stock indexes post gains Thursday. The Dow Jones Industrial Average advanced 322.37 points, or 0.85%, to close at 38,225.66. The Standard & Poor’s 500 added 45.81 points, or 0.91%, to close at 5,064.20. The Nasdaq Composite jumped 235.48 points, or 1.51%, to close at 15,840.96.

- The US dollar index weakened Thursday.

- US gold futures also declined. The June contract gave back $1.40 to close at $2,309.60 per oz.