Recap for May 10

- Wheat futures jumped higher to close the week Friday with winter wheat futures posting large weekly gains after the USDA projected larger supplies, slightly higher domestic use, increased exports and higher stocks in its monthly agricultural supply-and-demand report. Support for wheat also came from Russia’s announcement that some frost-damaged fields will have to be replanted. Corn futures advanced after the USDA’s corn carryover estimate fell below trade expectations. Corn carryover in 2025 were projected at 2.102 billion bus, a six-year high, up from 2.022 billion for 2024, the USDA said. Soybean futures followed corn futures higher despite the USDA projecting US farmers will produce their second biggest soybean harvest ever this year. July corn added 13¼¢ to close at $4.69¾ per bu. Chicago July wheat soared 26¢ higher to close at $6.63½ per bu. Kansas City July wheat added 21½¢ and closed at $6.73¼ per bu. Minneapolis July wheat added 16¼¢ and closed at $7.20 per bu. July soybeans added 10½¢ to close at $12.19 per bu. July soybean meal declined $1 to close at $371.90 per ton. July soybean oil added 1.80¢ to close at 44.44¢ a lb.

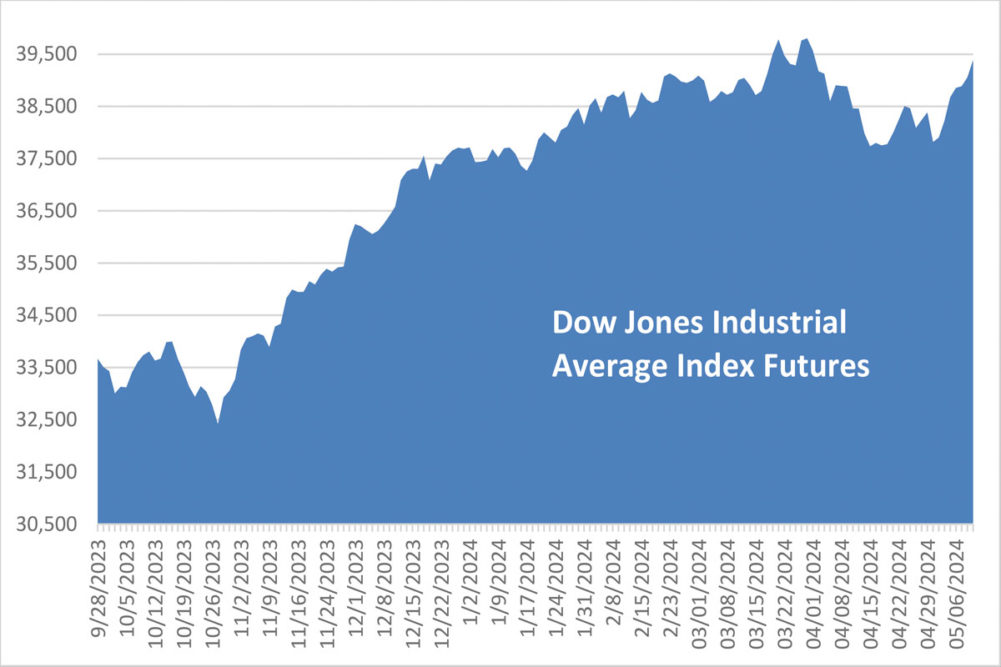

- US equity indexes posted mixed closes Friday with the Nasdaq easing. But weekly gains from all three major indexes helped put them up at least 3.7% so far in May, a sign the April doldrums were firmly in the rearview mirror. The Dow Jones Industrial Average advanced 125.08 points, or 0.32%, to close at 39,512.84. The Standard & Poor’s 500 added 8.6 points, or 0.16%, to close at 5,222.68. The Nasdaq Composite eased 5.4 points, or 0.03%, to close at 16,340.87.

- US crude oil prices eased Friday after Dallas Federal Reserve President Lorie Logan said it was unclear whether monetary policy was tight enough to bring down inflation to the US central bank’s 2% goal. Also pressuring oil was Atlanta Fed President Raphael Bostic’s comments to Reuters that inflation was likely to slow under current monetary policy, enabling the central bank to begin reducing its policy rate in 2024, albeit perhaps by only a quarter of a percentage point and not until the final months of the year. The June West Texas Intermediate light, sweet crude future fell $1 to close at $78.26 per barrel.

- The US dollar index strengthened Friday.

- US gold futures advanced again Friday. The June contract was up $34.70 higher and closed at $2,375 per oz.

Recap for May 9

- US equity markets climbed Thursday, nearing record highs and knocking out April’s losses. The DJIA reached its longest win streak of 2024 to date as gains by the likes of Caterpillar, Home Depot and Amgen more than offset losses for companies such as Salesforce. The Dow Jones Industrial Average advanced 331.37 points, or 0.85%, to close at 39,387.76. The Standard & Poor’s 500 added 26.41, or 0.51%, to close at 5,214.08. The Nasdaq Composite added 43.51 points, or 0.27%, to close at 16,346.26.

- Wheat futures advanced Thursday after Russia said frost in key grain production regions amounted to a state of emergency. Soybean and corn futures pulled back ahead of fresh supply-and-demand data coming Friday from the USDA. July corn fell 2¢ to close at $4.56½ per bu; later months were mixed. Chicago July wheat added 3½¢ to close at $6.37½ per bu. Kansas City July wheat added 3¼¢ and closed at $6.51¾ per bu. Minneapolis July wheat added 1¢ and closed at $7.03¾ per bu. July soybeans continued lower, dropping 19¼¢ to close at $12.08½ per bu. July soybean meal declined $5.60 to close at $372.90 per ton. July soybean oil dropped 1.15¢ to close at 42.64¢ a lb.

- The US dollar index weakened Thursday.

- US gold futures advanced Thursday. The June contract was $18 higher and closed at $2,340.30 per oz.

- US crude oil prices firmed Thursday on anticipation of a Federal Reserve interest rate cut and supportive inventory data. The Energy Information Administration reported a decline in oil inventories by 1.4 million barrels to 459.5 million barrels, surpassing earlier forecasts that had predicted a decrease of 1.1 million barrels. However, gasoline stocks saw a contrasting increase of 900,000 barrels during the same period, reaching levels of 228 million barrels. The June West Texas Intermediate light, sweet crude future rose 27¢ to close at $79.26 per barrel.

Recap for May 8

- Trader positioning ahead of major US Department of Agricultural reports set to be released this Friday was a primary driver behind declining agricultural commodity futures, overriding supporting factors of persistent flooding in Brazil. Also pressuring was improved weather forecasts for wheat-growing regions in both the United States and Russia. July corn dropped 8½¢ to close at $4.58½ per bu. Chicago July wheat deleted 8¾¢ to close at $6.34 per bu. Kansas City July wheat shed 15½¢ and closed at $6.48½ per bu. Minneapolis July wheat fell 16¼¢ and closed at $7.02¾ per bu. July soybeans tumbled 18¾¢ to close at $12.27¾ per bu. July soybean meal gave back $4.70 to close at $378.50 per ton. July soybean oil dropped 0.71¢ to close at 43.79¢ a lb.

- The US dollar index strengthened again Wednesday.

- US equity markets closed mixed again Wednesday. A tech sell-off provided pressure to the tech-heavy Nasdaq Composite. Offsetting support came as the majority of US companies are showing profit growth in their first-quarter earnings reports. The Dow Jones Industrial Average jumped up 172.13 points, or 0.44%, to close at 39,056.39. The Standard & Poor’s 500 slipped 0.03 point, less than 0.01%, to close at 5,187.63. The Nasdaq Composite dropped 29.80 points, or 0.18%, to close at 16,302.76.

- US gold futures declined a second straight day Wednesday. The June contract was $1.90 lower to close at $2,322.30 per oz.

- US crude oil prices firmed Wednesday. The June West Texas Intermediate light, sweet crude future rose 61¢ to close at $78.99 per barrel.

Recap for May 7

- Wheat futures retreated Tuesday from multi-month highs as crop weather forecasts improved in Russia and after the USDA late Monday said US winter wheat conditions improved slightly. Corn futures touched a four-month high on volatile Midwest and South American weather before retreating and closing lower following wheat with farmers selling old crop supplies into the rally. Soybean futures were mixed Tuesday with new crop futures firming but old crop down on profit taking and spillover pressure from wheat. July corn fell 2¢ to close at $4.67 per bu. Chicago July wheat gave back 6¢ to close at $6.42¾ per bu. Kansas City July wheat shed 11¼¢ and closed at $6.64 per bu. Minneapolis July wheat deleted 6½¢ and closed at $7.19 per bu; later months were mixed. July soybeans eased 2¼¢ to close at $12.46½ per bu; later months were mixed. July soybean meal fell $4.40 to close at $383.20 per ton; later months were mixed. July soybean oil added 0.66¢ to close at 44.50¢ a lb.

- The US dollar index strengthened Tuesday.

- US equity markets were mixed Tuesday. The S&P 500 built on its recent rally amid a plethora of earnings reports. Shares of Tesla, Palantir Technologies, Celsius and Disney all declined. The Dow Jones Industrial Average edged up 31.99 points, or 0.08%, to close at 38,884.26. The Standard & Poor’s 500 added 6.96 points, or 0.13%, to close at 5,187.7. The Nasdaq Composite dropped 16.69 points, or 0.1%, to close at 16,332.56.

- US gold futures receded on Tuesday. The June contract shed $7 to close at $2,324.20 per oz.

- US crude oil prices pulled back Tuesday. The June West Texas Intermediate light, sweet crude future was down 10¢ to close at $78.38 per barrel.

Recap for May 6

- Weather with the potential to cut into yields in countries that compete with the US for export business helped corn, soybean and wheat futures climb Monday. Wheat futures shot higher with winter wheat futures posting the widest gains on crop weather problems in Russia including dryness and frost. IKAR last week cut its production estimate for Russia, the world’s largest wheat exporter. Soybean futures reached a four-month peak on a deteriorating harvest in Brazil’s Rio Grande do Sul state, where torrential rains flooded fields with about a quarter of beans left to harvest. The deluge also may reduce the state’s corn volumes and further clip South American supply after downgrades to estimates of Argentina’s crop. US corn futures reached the highest point since January. July corn added 8¾¢ to close at $4.49 per bu. Chicago July wheat added 26¼¢ to close at $6.48¾ per bu. Kansas City July wheat added 25¢ and closed at $6.75¼ per bu. Minneapolis July wheat advanced 11¢ and closed at $7.25½ per bu. July soybeans soared 33¾¢ to close at $12.48¾ per bu. July soybean meal was up $15.40 to close at $387.60 per ton. July soybean oil added 0.76¢ to close at 43.84¢ a lb.

- The US dollar index edged slightly higher to open the week.

- US equity markets extended Friday’s rally ahead of a jam-packed earnings report week to include Disney, Uber and Airbnb. The Dow Jones Industrial Average added 176.59 points, or 0.46%, to close at 38,852.27. The Standard & Poor’s 500 advanced 52.95 points, or 1.03%, to close at 5,180.74. The Nasdaq Composite ascended 192.92 points, or 1.19%, to close at 16,349.25.

- US gold futures climbed Monday. The June contract jumped $22.60 to close at $2,331.20 per oz.

- After last week posting the steepest weekly loss in four months, US crude oil prices advanced Monday as a Middle East ceasefire proved elusive. The June West Texas Intermediate light, sweet crude future was up 37¢ to close at $78.48 per barrel.