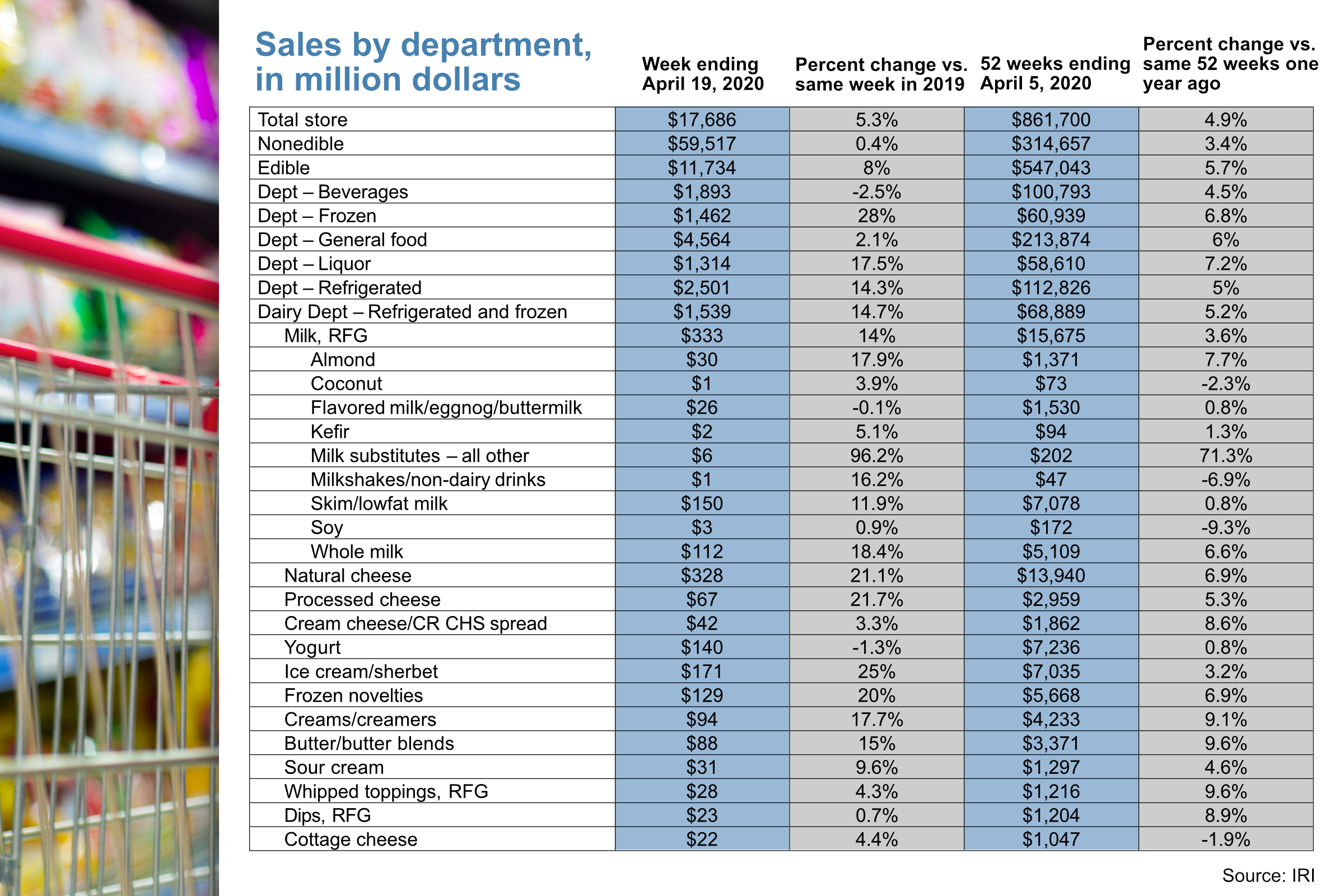

CHICAGO – For the first time in the past two decades fluid milk posted an increase in retail dollar sales for the past 52-week period. It happened the week ended April 5, and has continued. The total refrigerated milk department (dairy and non-dairy, including kefir and value-added flavored milks) showed a 3.6% increase in dollar sales vs. the same 52-week period one year ago, according to Information Resources, Inc. (IRI), Chicago.

CHICAGO – For the first time in the past two decades fluid milk posted an increase in retail dollar sales for the past 52-week period. It happened the week ended April 5, and has continued. The total refrigerated milk department (dairy and non-dairy, including kefir and value-added flavored milks) showed a 3.6% increase in dollar sales vs. the same 52-week period one year ago, according to Information Resources, Inc. (IRI), Chicago.

Whole milk, a category that had been faring well for some brands in recent years, was up 6.6%. Nonfat and low-fat milk, which had been declining categories for most brands, was up 0.8% in dollar sales. Many varieties of non-dairy options are showing growth, too; however, they have been on a positive trajectory for some time.

“Gallon milk is the quintessential in-the-home product,” said Alan Reed, executive director of the Chicagoland Food & Beverage Network, Chicago. “When consumers were mostly eating at home (many years ago), milk sales were strong. Once again, we are eating at home. It was a slow and steady increase in eating out over time but coming back to the family dinner table happened practically overnight, hence the jump in numbers.”

Nick Praznowski, director of Bader Rutter The Intel Distillery, Chicago, said, “It’s a cereal and milk mentality of ‘I can do that.’”

Prior to stay-at-home orders, children were often fed a granola bar or smoothie on the ride to school. Now there’s time — plenty of time. Pouring a bowl of cereal and milk is something most children can do for themselves. It is also interactive eating and consumes some time. It keeps the children busy while parents work remotely.

It is more than cereal and milk. It is also flour, yeast and pasta.

“There’s a lot of cooking from scratch,” said John Crawford, vice president, client insights-dairy at IRI. “Quite a bit of milk goes into recipes. The same with cheese.”

Natural cheese dollar sales were up 6.9% for the past 52-week period ended April 5. Processed cheese dollar sales were up 5.3% during this same time frame.

“Like fluid milk, processed cheese had been a declining category for years,” Mr. Crawford said. “But now it’s back in style because it makes a quick grilled cheese sandwich with bowl of tomato soup, with the latter requiring milk.”

Yogurt is the only dairy category that is showing a decline in sales during the stay-at-home order. It is likely due to the single-serve nature and portability attribute. Yogurt was what many grabbed while running out the door for dashboard dining.

Yogurt drinks are down even more than yogurt cups. Baby and tot products continue to do well, as well as snack size formats for younger children.

Cottage cheese has been doing well since the stay-at-home orders were issued, but is yet to come out of the red for 52-week dollar sales performance. Cottage cheese is an affordable, high-protein snack, with many marketers offering it in convenient individual portions in sweet and savory flavors.

Kemps, St. Paul, Minn., a subsidiary of Dairy Farmers of America, Kansas City, is a leading player in the cottage cheese category with an array of multi-serve and single-serve products in varied flavors. Near the beginning of the stay-at-home order, the company continued with its plans to roll out Kemps  Bold Cottage Cheese, a four-variety line of 7.3-oz single-serve cups, much larger than most single-serve cups that range from 4 to 6 ozs. The new line is targeted to the male consumer looking for protein without sugar and who is interested in bold flavors. Options are bacon cheddar (with bacon bits and cheddar cheese), bacon ranch (with cheddar cheese and zesty ranch seasoning), chipotle (with tangy, smoky chipotle seasoning) and jalapeño cheddar (with cheddar cheese and jalapeño pepper bits).

Bold Cottage Cheese, a four-variety line of 7.3-oz single-serve cups, much larger than most single-serve cups that range from 4 to 6 ozs. The new line is targeted to the male consumer looking for protein without sugar and who is interested in bold flavors. Options are bacon cheddar (with bacon bits and cheddar cheese), bacon ranch (with cheddar cheese and zesty ranch seasoning), chipotle (with tangy, smoky chipotle seasoning) and jalapeño cheddar (with cheddar cheese and jalapeño pepper bits).

“Sour cream and cream cheese are both experiencing strong growth,” Mr. Crawford said. “When people are sheltered at home, they learn to cook. Will this continue? It all depends on how quickly the country opens back up, as well as the unemployment rate and recession.

“If the economy does not come back, cooking at home will continue. Value-added products sold at a premium will suffer. This is across the board, not just dairy.”

Shoppers will look for more bang for the buck. Many dairy products fit that bill, including that oldie but goodie, the gallon of white milk.

“As of April 23, more than 20% of the population is unemployed,” Mr. Crawford said. “Starting on April 25, some states started loosening their stay-at-home orders and opened some businesses. Other states will wait for case increases to stabilize and start to consistently decline. They will also look at the opened states to see how they fare upon reopening.”

Reopening may continue or the United States may relapse into a stay-at-home society, he said. This will influence the future of retail dairy sales. If coffee shops — a significant user of fluid milk and cream — don’t pick up in sales, and schools don’t resume in the fall, retail milk sales should continue to grow.

“When restaurants do open, will people come and how quickly? That’s an unknown,” Mr. Crawford said. “Will the necessity of cooking (and working) at home lead to a long-term home meal revival?

“A slow recovery will result in the economy looking like 2008, or worse. But Americans are resilient and do have the real ability to forget and move on. Eventually the country will likely return to the way things were before coronavirus. We just do not know when that will be.”