KANSAS CITY — Americans are consuming dairy foods at a rate never seen before, according to the US Department of Agriculture’s Economic Research Service. For some categories, this was true even before the COVID-19 pandemic.

New data on annualized per capita consumption identify butter, cheese and yogurt as the key drivers of dairy’s growth, which reached a record high in 2019. Other categories, namely fluid milk, which had been declining significantly during the past two decades, experienced a boom in retail sales during stay-at-home orders and show no signs of going back into a decline.

“Since USDA began tracking per capita dairy consumption in the 1970s, the trend has continued upward for five straight decades, increasing 21% since 1975,” said Michael Dykes, president and chief executive officer of the International Dairy Foods Association, Washington. “While Americans have always turned to dairy products as fresh, nutritious staples in their diets, they also value the versatility of dairy in new, delicious and more accessible products.

“Thanks to its continued innovation and ingenuity, the dairy industry is poised to continue to grow and deliver nutritious products for Americans.”

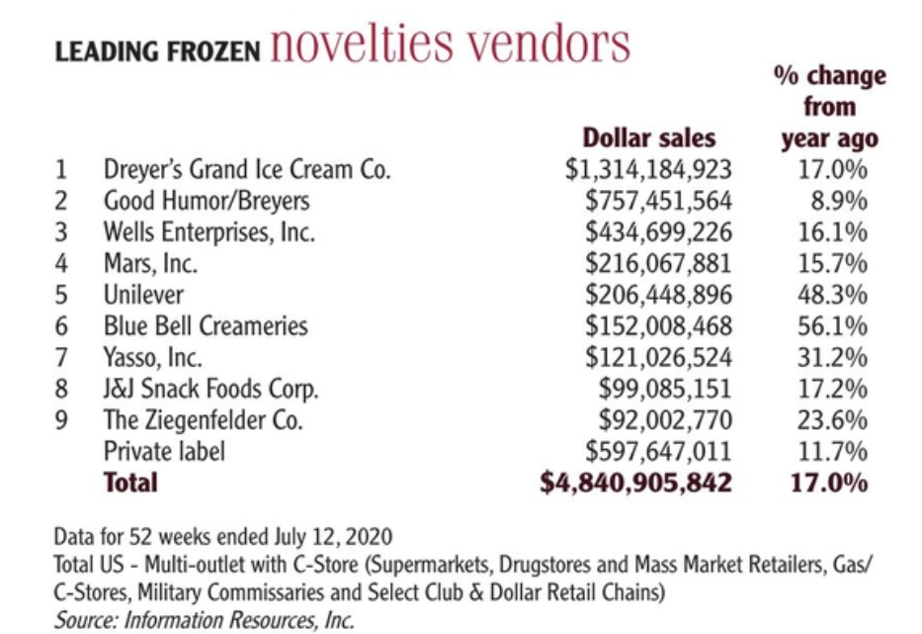

In the past decade alone, domestic per capita consumption of cheese is up 19%; per capita butter consumption is up 24%; and per capita yogurt consumption is up 7%. Ice cream per capita consumption also rebounded in 2019, increasing by a half-percent over 2018. Overall, ERS data show American dairy per capita consumption across products consistently increasing each year, with 2019 up 6% over the past five years, 10% over the past 15 years and 16% over the past 30 years.

“The product mix in most demand by consumers is changing,” Mr. Dykes said. “We eat more dairy than we drink these days, and dairy on the whole continues to grow.”

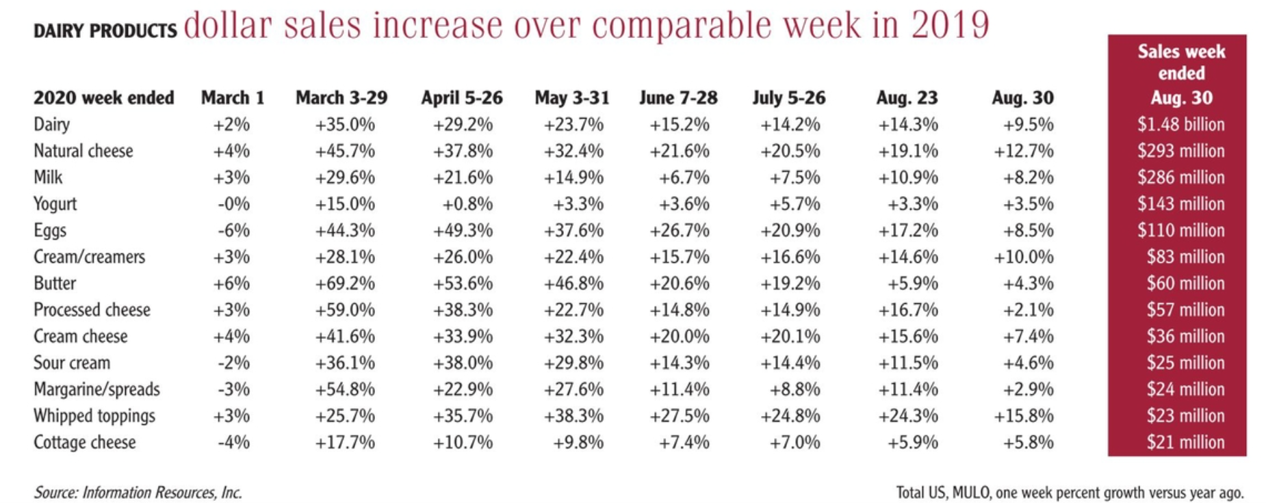

That “eat” trend continues, but drinking milk and cooking more with all types of dairy had all dairy foods categories experiencing double-digit sales increases starting in mid-March, as compared to the same period in 2019. The dairy industry is committed to keeping up the momentum with education and innovation.

“To continue to still see everyday demand push sales above year-ago levels for dairy is quite an accomplishment,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association, Madison, Wis., in early September 2020, approximately six months after US stay-at-home orders were executed.

Since March 15, the IDDBA has been tracking retail sales with Information Resources, Inc., Chicago, and 210 Analytics LLC, San Antonio.

“I think it is fair to say that we are starting to look at the new normal,” Mr. Johnson said. “Retail sales appear to be holding at about 10% above 2019 levels with great consistency.”

Abrielle Backhaus, research coordinator with the IDDBA, added, “Dairy sales are settling into a very nice sales pattern. Cheese has been a pandemic powerhouse. Creams, creamers and whipped toppings continue to see double-digit gains with many coffee breaks having moved to at-home. With people continuing to work from home, this incremental occasion remains an opportunity for dairy.”

The virtual school experience, which has breakfast, lunch and snacks being consumed in the home, likely will also keep retail dairy sales strong, in particular milk, cheese and yogurt, and even ice cream.

The dairy industry is embracing this opportunity to connect with younger consumers and educate them on the nutritional benefits of dairy foods. In fact, the emergence of milk as a surprising social media superstar of the stay-at-home months inspired MilkPEP — the group that represents America’s milk companies — to bring the iconic “got milk?” tagline back into the spotlight.

“I’ve been so inspired by how people have creatively embraced milk this year,” said Yin Woon Rani, CEO of MilkPEP. “From whipping Dalgona coffee to running a mile with a glass of milk in-hand, today’s TikTok-ers are finding more ways to connect with milk.”

Indeed, when Americans were faced with tough times, they bought more milk, and not just during the initial stock-up phases of the pandemic. Milk is an “essential” for home meals. Parents buy milk because they trust it for its nutrition, versatility and taste. In fact, 72% of moms said that milk was their No. 1 must-have as the stay-at-home orders hit, above staples like bread, eggs and vegetables, according to MilkPEP/Radius Illumination research among 201 moms between March 17 and April 19.

To better understand the new norm of dairy retail sales and consumer use, Midwest Dairy, St. Paul, Minn., included a live consumer focus group during its third annual Dairy Experience Forum on July 15. While panelists shared perceptions surrounding health benefits, animal care and sustainability, they also shared enthusiasm for dairy and habits that showcased opportunities for the dairy industry. Among these were increased yogurt consumption, exploring new cheeses and cooking with dairy foods, such as buttermilk and sour cream.

Further, based on the results of a survey commissioned by Midwest Dairy, consumers indicated they plan to increase their yogurt usage in the post-pandemic world. This is likely due to the healthful halo of yogurt, as the probiotic cultures they contain are associated with boosting immunity.

“Dairy drivers are the same as before — taste, health, comfort and

familiarity — but have increased in importance in the eyes of consumers,” said Molly Pelzer, CEO of Midwest Dairy. “This year’s challenges have provided opportunities for dairy processors to explore consumer insights and innovate to keep dairy foods in the home refrigerator and on the dinner table.”

Allen Merrill, chairman of Midwest Dairy, said, “The dairy community now has the opportunity to tap into this expanded market share and build upon consumers’ enthusiasm for the category. We can do this by focusing future innovation on products that meet consumers’ needs for taste, affordability, nutrition, convenience and accessibility.”

Right now, however, getting new products into the supermarket is challenging. Data from IRI show that the number of stock-keeping units were down by 2.7% for dairy during the week of Aug. 30 versus the same week in 2019. This is all about opening up space for fast-moving staples.

“The other big change taking place is that growth percentages differ when looking at dollar versus volume sales,” said Anne-Marie Roerink, president of 210 Analytics. “With the exception of yogurt, dollar gains trended ahead of volume gains for the week ending Aug. 30 versus year ago. This tends to point to inflation, at least on a per-oz basis, though the volume and dollar gaps are significantly smaller than they have been. In addition to pricing levels coming down, this could mark a bit of a turn to smaller serving sizes, as some offices and schools have reopened for in-person activities.”