Recap for May 29

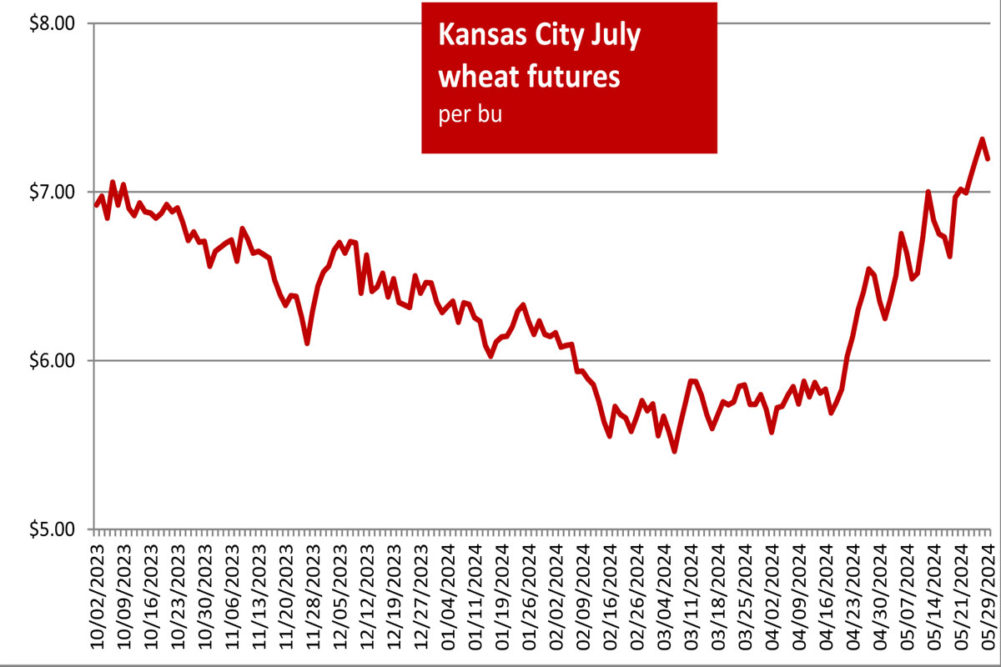

- Wheat futures, aside from deferred Chicago soft wheat contracts, were lower Wednesday as traders pondered the potential effect on drought- and frost-damaged crops in the Black Sea region from weather charts intimating rain could reach parts of drought-plagued southern Russia and Ukraine accompanied by high temperatures that could curb the benefits of additional precipitation. The downturn in soybean prices continued Wednesday in technical trading amid plentiful South American supplies and the USDA’s indication soybean planting was 68% complete, ahead of analysts’ expectations of 66% and ahead of the five-year average of 63%. Corn futures dipped low under spillover pressure from wheat, the USDA’s report showing the crop was 83% planted as of Sunday, in line with trade expectations and ahead of the five-year average, and expectations for a dry planting window could last into the end of the week in Midwest. July corn fell 7¼¢ to close at $4.55¼ a bu; December 2025 and beyond ticked higher. Chicago July wheat declined 7½¢ to close at $6.92¾ per bu; July 2025 and beyond were higher. Kansas City July wheat lost 11½¢ and closed at $7.19¾ per bu. Minneapolis July wheat deleted 5½¢ and closed at $7.52 per bu. July soybeans fell 15½¢ to close at $12.14 per bu. July soybean meal dropped $7.50 to close at $369.10 per ton. July soybean oil advanced 0.36¢ to close at 45.88¢ a lb.

- US equity markets faltered Wednesday after the benchmark 10-year Treasury yield rose to 4.623%, from 4.542% Tuesday, its highest level since April 30. The Dow Jones Industrial Average tumbled 411.32 points, or 1.06%, to close at 38,441.54. The Standard & Poor’s 500 fell 39.09 points, or 0.74%, to close at 5,266.95 with all 11 sectors posting declines. The Nasdaq Composite shed 99.30 points, or 0.58%, to close at 16,920.58.

- US crude oil prices declined about 1% Wednesday on concerns that US gasoline demand and weak economic data could cause the Federal Reserve to keep interest rates higher for longer. The July West Texas Intermediate light, sweet crude future fell 60¢ to close at $79.23 per barrel.

- The US dollar index reversed course and strengthened on Wednesday on higher bond yields ahead of Friday’s release of the US core personal consumption expenditures price index report, the Federal Reserve's preferred measure of inflation. Expectations are for it to hold steady on a monthly basis.

- The stronger dollar, higher bond yields and hawkish comments from a central bank leader weighed on market sentiment ahead of Friday’s inflation data report. All helped pressure US gold prices Wednesday. The June contract was down $15.30 and closed at $2,341.20 per oz.

Recap for May 28

- Soybean futures fell Tuesday, dragged lower by weakening soybean meal prices as South American export competitors flashed ample supplies at cheaper prices. Wheat futures mostly continued higher on Black Sea crop damage after dry weather and bitter frosts have hit major southern Russian wheat-growing regions. Corn received spillover support from wheat, but that wasn’t enough to offset pressure from good planting weather in forecasts. July corn fell 2¼¢ to close at $4.62½ a bu. Chicago July wheat added 3¢ to close at $7.00¼ per bu. Kansas City July wheat jumped 10¢ and closed at $7.31¼ per bu. Minneapolis July wheat added 4¾¢ and closed at $7.57½ per bu. July soybeans fell 18½¢ to close at $12.29½ per bu. July soybean meal dropped $9.90 to close at $376.60 per ton. July soybean oil advanced 0.57¢ to close at 45.52¢ a lb.

- Another day of gains for chip maker Nvidia, riding high off last week’s blockbuster earnings report, helped boost an otherwise lackluster day for US stocks that left the three major indexes with mixed closes Tuesday. The Dow Jones Industrial Average fell 216.73 points, or 0.55%, to close at 38,852.86. The Standard & Poor’s 500 ticked up 1.32 points, or 0.02%, to close at 5,306.04. The Nasdaq Composite climbed 99.09 points, or 0.59%, to close at 17,019.88.

- US crude oil prices advanced Tuesday. The July West Texas Intermediate light, sweet crude future added $2.11 to close at $79.83 per barrel.

- US gold prices jumped higher Tuesday. The June contract was up $22 and closed at $2,356.50 per oz.

- The US dollar index weakened Tuesday.

Recap for May 24

- Soybean futures rose at the end of the week on spillover support from rising soymeal spot basis increases at export terminals, which were attributed to solid demand and tight supplies. Wheat futures resumed their sharp rallies from early in the week Friday, aside from the July and September Chicago contracts, which eased. Futures were up 7% in the week, mostly on crop problems globally in Russia, Ukraine, France, the UK and the EU. Corn futures were slightly higher as traders monitored planting progress after earlier rain delays and adjusted positions ahead of the holiday weekend. July corn added ¾¢ to close at $4.64¾ a bu. Chicago July wheat fell ¾¢ to close at $6.97¼ per bu but the December contract and beyond edged higher. Kansas City July wheat jumped 10½¢ and closed at $7.21¼ per bu. Minneapolis July wheat was up 8¾¢ and closed at $7.52¾ per bu. July soybeans added 8¾¢ to close at $12.48 per bu. July soybean meal climbed $9.80 to close at $386.50 per ton. July soybean oil subtracted 0.24¢ to close at 44.95¢ a lb.

- Positive earnings from Deckers, Intuit and Ross Stores helped power US equity indexes higher to close the week. The broad S&P 500 and tech-focused Nasdaq pulled out fifth-straight weeks of gains while the DJIA snapped a weekly win streak begun in mid-April after a rocky week of trading. The Dow Jones Industrial Average edged up 4.33 points, or 0.01%, to close at 39,069.59. The Standard & Poor’s 500 added 36.88 points, or 0.7%, to close at 5,304.72. The Nasdaq Composite climbed 184.76 points, or 1.1%, to close at 16,920.79.

- US crude oil prices rose Friday but posted weekly losses on concerns strong US economic data would keep interest rates higher for longer and cut into fuel demand. The July West Texas Intermediate light, sweet crude future added 85¢ to close at $77.72 per barrel.

- US gold prices were lower Friday and posted their worst week in 5½ months as hopes of Federal Reserve interest rate cuts moderated. The June contract shed $2.70 and closed at $2,334.50 per oz.

- The US dollar index slipped lower against most major currencies Friday, as traders booked profits following four strengthening sessions. Still, support from strong US economic data that has prompted markets to dial back expectations for interest rate cuts, meant the dollar was situated nicely for further advances.

Recap for May 23

- Large gains in shares of chipmaker Nvidia weren’t enough to stimulate the broader stock market and the three major equity indexes declined for a second day, the DJIA significantly, as investors maintained a risk-off mode. The Dow Jones Industrial Average plummeted 605.78 points, or 1.53%, to close at 39,065.26, its worst one-day percentage drop since March 2023. The Standard & Poor’s 500 dropped 39.17 points, or 0.74%, to close at 5,267.84 with 10 of 11 sectors declining. The Nasdaq Composite shed 65.51 points, or 0.39%, to close at 16,763.03.

- Wheat futures were mixed Thursday with Chicago soft wheat futures extending gains from Wednesday’s 10-month peak but other contracts declining as some analysts said Russian wheat concerns were now fully priced into the market. Soybean futures dipped in technical moves but were underpinned by rain-related crop losses in Argentina and Brazil. Technical trading worked in the other direction for corn futures with additional support from expectations widened wheat-corn spreads will encourage more feeding of the latter to livestock and poultry. July corn added 2¾¢ to close at $4.64 a bu. Chicago July wheat added 5¢ to close at $6.98 per bu; July 2025 and beyond were lower. Kansas City July wheat ascended 11¼¢ and closed at $7.10¾ per bu. Minneapolis July wheat was up 7½¢ and closed at $7.44 per bu; September 2025 and beyond were lower. July soybeans dropped 7¢ to close at $12.39¼ per bu. July soybean meal fell $1.50 to close at $376.70 per ton; October and beyond were higher. July soybean oil slid 0.69¢ to close at 45.19¢ a lb.

- US crude oil prices declined again Thursday. The July West Texas Intermediate light, sweet crude future dropped 70¢ to close at $76.87 per barrel.

- US gold prices continued lower for a third day after notching an all-time high Monday. The June contract shed $55.70 and closed at $2,337.20 per oz.

- The US dollar index edged higher Thursday, a fourth day of gains.

Recap for May 22

- Soybean futures posted gains Wednesday on spillover support from wheat, but the advances were limited by quick planting progress and ample global supplies. Wheat futures briefly went higher on frost and drought concerns in Black Sea wheat, but all classes turned lower by the close as Russian forecasts contained rain in the next 11 to 15 days. Corn futures jumped in the wake of wheat touching the highest premium to corn since 2022 generated ideas producers might feed more corn. Soybean futures also were higher on spillover strength. July corn rose 3¼¢ to close at $4.61¼ a bu. Chicago July wheat dropped 4½¢ to close at $6.93 per bu. Kansas City July wheat slipped 2¢ and closed at $6.99½ per bu. Minneapolis July wheat was down 2¼¢ and closed at $7.36½ per bu. July soybeans jumped 10¢ to close at $12.46¼ per bu. July soybean meal added $5.90 to close at $378.20 per ton. July soybean oil rose 0.07¢ to close at 45.88¢ a lb; the October future was steady and beyond were lower.

- US equity markets pulled lower Wednesday on the release of the minutes from the Federal Reserve meeting three weeks earlier in which governors expressed uncertainty about price pressures and said recent data didn’t generate confidence that inflation was moving toward the central bank’s 2% goal. Some officials mentioned “a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate,” the minutes said. The Dow Jones Industrial Average declined 201.95 points, or 0.51%, to close at 39,671.04. The Standard & Poor’s 500 dropped 14.4 points, or 0.27%, to close at 5,307.01. The Nasdaq Composite dropped 31.08 points, or 0.18%, to close at 16,801.54.

- US crude oil prices declined Wednesday. The July West Texas Intermediate light, sweet crude future dropped $1.09 to close at $77.57 per barrel.

- US gold prices for a second day declined from Monday’s all-time high. The June contract shed $33 and closed at $2,392.90 per oz.

- The US dollar index edged higher for a third day Wednesday.