Recap for April 25

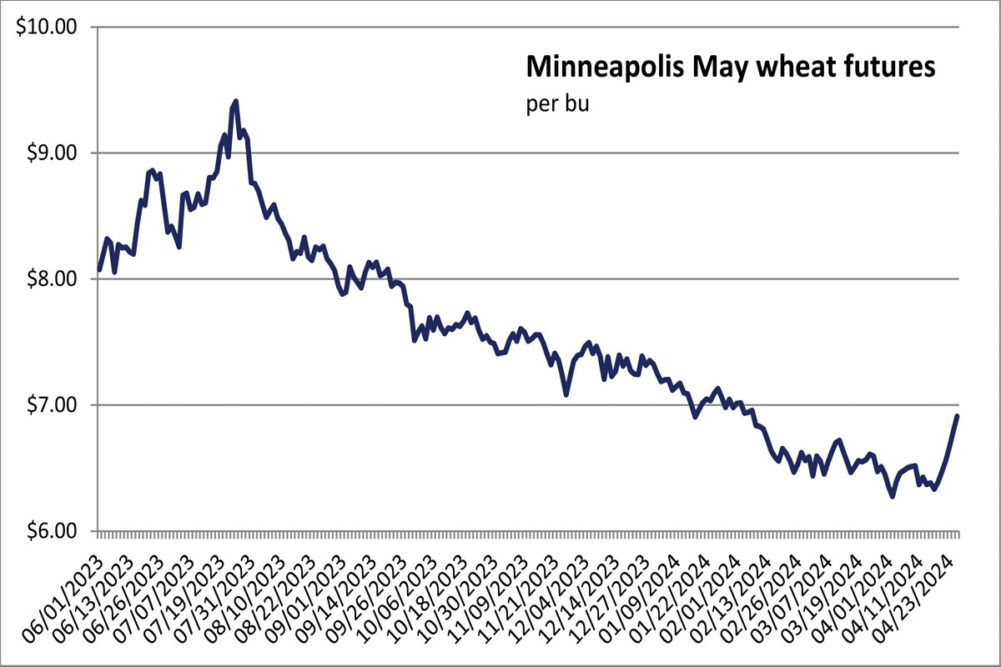

- The rally in wheat futures continued Thursday with the support from dry conditions in the US Plains and in Russia; prices were up 30¢ to nearly 60¢ a bu for the week to date. Soybean futures were mixed, the nearby months dipping on strong export competition from Brazil and deferred months advancing on forecasts for showers that could last through the weekend and delayed planting in the US Midwest. Those same forecasts helped corn futures prices advance. May corn rose 3¼¢ to close at $4.41 per bu. Chicago May wheat added 7¾¢ to close at $6.02¼ per bu. Kansas City May wheat added 7¾¢ and closed at $6.32 per bu. Minneapolis May wheat was up 12¢ and closed at $6.91 per bu. May soybeans fell 3¼¢ to close at $11.62¾ per bu; the August contract and beyond advanced. May soybean meal was down $2.10 to close at $343.90 per ton. May soybean oil added 0.16¢ to close at 44.82¢ a lb.

- The US dollar index weakened Thursday after a Commerce Department report indicated US gross domestic product grew at a 1.6% annualized rate in the first quarter, slower than the 2.4% rate expected by economists. Further pressure stemmed from the report’s indication that underlying inflation as measured by the core personal consumption expenditures price index rose 3.7% in the first quarter, topping pre-report expectations for a 3.4% rise.

- The above-mentioned Commerce Department report drove stocks lower Thursday. Caterpillar and Meta Platforms were two of the day’s biggest losers. The Dow Jones Industrial Average plummeted 375.12 points, or 0.98%, to close at 38,085.8. The Standard & Poor’s 500 shed 23.21 points, or 0.46%, to close at 5,048.42. The Nasdaq Composite dropped 100.99 points, or 0.64%, to close at 15,611.76.

- US gold futures broke a three-day losing streak Thursday. The April contract nearing expiration added $5.30 to close at $2,329.80 per oz. The June contract added $4.10 to close at $2,342.50 per oz.

- US crude oil advanced Thursday on supply disruption worries amid airstrikes in Gaza. Also supporting was Treasury Secretary Janet Yellen’s comments that US economic growth was likely stronger than suggested by weaker-than-expected quarterly data. The June West Texas Intermediate light, sweet crude future added 76¢, or 0.9%, to close at $83.57 per barrel.

Recap for April 24

- Wheat futures continued to rally Wednesday, some contracts striking three-month highs on continued concerns about lack of moisture in US and Russia wheat growing areas and the latter country’s Black Sea-region grain infrastructure attacks. Soybean futures traded choppily and traded higher most of the day and closed mixed amid short-covering and signs wet weather could hamper planting. Corn futures dropped against a backdrop of unwinding short positions, export competition from Brazil and easing crude oil prices. May corn fell 5¼¢ to close at $4.37¾ per bu. Chicago May wheat added 9½¢ to close at $5.94½ per bu. Kansas City May wheat jumped 15½¢ and closed at $6.24¼ per bu. Minneapolis May wheat added 12½¢ and closed at $6.79 per bu. May soybeans fell 1½¢ to close at $11.66 per bu; later months were mixed. May soybean meal was 80¢ higher to close at $346 per ton. May soybean oil dropped 0.65¢ to close at 44.66¢ a lb.

- US equity indexes posted mixed closes Wednesday. Tesla shares jumped 12% despite Tuesday’s earnings report revealing a difficult quarter for the electric car maker after Elon Musk spoke of making less-expensive products. Texas Instruments’ 5.6% jump helped boost some semiconductor stocks. The Dow Jones Industrial Average subtracted 42.77 points, or 0.11%, to close at 38,460.92. The Standard & Poor’s 500 edged up 1.08 points, or 0.02%, to close at 5,071.63. The Nasdaq Composite added 16.11 points, or 0.1%, to close at 15,712.75.

- The US dollar index strengthened Wednesday.

- US gold futures weakened for a third session Wednesday, but the loss paled in comparison to Monday’s $66 decline. The April contract was down $3.20 to close at $2,324.50 per oz.

- US crude oil prices fell back Wednesday on easing Middle East conflict concerns and slowing US business activity with losses limited by declining US crude oil inventories. The June West Texas Intermediate light, sweet crude future shed 55¢ to close at $82.81 per barrel.

Recap for April 23

- Wheat futures climbed Tuesday, Chicago soft red winter wheat surging to a two-month high as a decline in US winter wheat conditions renewed focus on weather risks to Northern Hemisphere crops. Corn and soybeans also edged up slightly on US spring planting risks. Corn planting progress was slightly better than expected but heavy rain was forecast in key areas. May corn added 3¼¢ to close at $4.43 per bu. Chicago May wheat jumped 14¾¢ to close at $5.85 per bu. Kansas City May wheat advanced 11¼¢ and closed at $6.08¾ per bu. Minneapolis May wheat added 10¾¢ and closed at $6.66½ per bu. May soybeans were up 6½¢ to close at $11.67½ per bu. May soybean meal was 90¢ higher to close at $345.20 per ton. May soybean oil added 0.27¢ to close at 45.31¢ a lb.

- US gold futures declined again Tuesday. The April contract was down $4.50 to close at $2,327.70 per oz.

- US equity markets advanced Tuesday on the backs of big technology company shares, which climbed ahead of a plethora of major earnings reports amid stabilization in Treasurys and oil prices. The Dow Jones Industrial Average added 263.71 points, or 0.69%, to close at 38,503.69. The Standard & Poor’s 500 added 59.95 points, or 1.2%, to close at 5,070.55. The Nasdaq Composite added 245.33 points, or 1.59%, to close at 15,696.54.

- The US dollar index closed lower Tuesday.

- US crude oil prices advanced Tuesday. The June West Texas Intermediate light, sweet crude future added $1.46 to close at $83.36 per barrel.

Recap for April 22

- Dry weather concerns in the US Southern Plains and Russia, plus Black Sea supply concerns after the latter attacked Ukrainian grain infrastructure over the weekend, sent wheat futures higher to sharply higher Monday with winter wheat touching two-month highs. Spillover support from wheat, short-covering and technical trading sent corn futures to three-week highs. Soybean futures firmed alongside wheat and corn with support from short covering and technical trading after dropping to a seven-week low in the previous session. May corn added 6¼¢ to close at $4.39¾ per bu. Chicago May wheat soared 20¢ higher to close at $5.70¼ per bu. Kansas City May wheat jumped 16¢ and closed at $5.97½ per bu. Minneapolis May wheat added 8¾¢ and closed at $6.55¾ per bu. May soybeans advanced 10½¢ to close at $11.61 per bu. May soybean meal was up 60¢ to close at $344.30 per ton. May soybean oil added 0.66¢ to close at 45.04¢ a lb.

- Easing Middle East concerns had investors scaling back safe-haven bets Monday and US gold futures declined. The April contract plummeted $66.20 to close at $2,332.10 per oz.

- US equity indexes closed higher Monday, the market regaining some confidence and bouncing back from last week’s lackluster performance as Middle East tensions ameliorated. The Dow Jones Industrial Average added 253.58 points, or 0.67%, to close at 38,239.98. The Standard & Poor’s 500 added 43.37 points, or 0.87%, to close at 5,010.60. The Nasdaq Composite added 169.3 points, or 1.11%, to close at 15,451.31.

- The US dollar index ultimately closed lower Monday but earlier touched a 34-year peak against the Japanese yen as investors took cues from the Federal Reserve’s apparent interest rate course of higher for longer.

- US crude oil prices dropped Monday. Trader consensus was for little near-term risk from the Middle East conflict. Fundamentals were the focus, and a tightened supply-demand balance was envisaged for the coming months. The expiring May West Texas Intermediate light, sweet crude future shed 29¢ to close at $82.85 per barrel. Th June contract was down 32¢ to close at $81.90 per barrel.

Recap for April 19

- Wheat futures climbed Friday as rising Middle Eastern tension raised concerns about wheat shipments from that region and from Russia, an Iranian ally. Dry conditions in the US southern Plains added support. Heightened geopolitical tension spurred a round of bargain buying after corn and soybean prices fell to six-week lows. May corn added 6¾¢ to close at $4.33½ per bu. Chicago May wheat added 13½¢ to close at $5.50¼ per bu. Kansas City May wheat added 4¼¢ and closed at $5.81½ per bu. Minneapolis May wheat added 8¼¢ and closed at $6.47 per bu. May soybeans rose 16¼¢ to close at $11.50½ per bu. May soybean meal was up $5.70 to close at $343.70 per ton. May soybean oil added 0.26¢ to close at 44.38¢ a lb.

- US equity markets were mixed Friday. A late-Thursday Israeli strike on Iran led to a brief spike in oil prices and added momentum to a pullback in the S&P 500 and Nasdaq, giving both indexes their longest daily losing streaks in more than a year. For the week, the Nasdaq’s 5.5% weekly decline was its worst such performance since 2022 while the S&P 500 dropped 3.1% and the Dow Jones Industrial Average eked out a tiny weekly gain. The Dow Jones Industrial Average added 211.02 points, or 0.56%, to close at 37,986.4. The Standard & Poor’s 500 dropped 43.89 points, or 0.88%, to close at 4,967.23. The Nasdaq Composite fell 319.49 points, or 2.05%, to close at 15,282.01.

- The US dollar index closed higher Friday for the eighth time in nine trading days.

- US gold futures advanced Friday. The April contract climbed $16.10 to close at $2,398.40 per oz.

- US crude oil prices were higher Friday. The May West Texas Intermediate light, sweet crude future rose 41¢ to close at $83.14 per barrel.