CHICAGO – Strong growth in dollar and unit sales and improved profitability represent powerful validation of a focused strategy pursued in recent years by Mondelez International Inc., said Dirk Van de Put, chairman and chief executive officer.

Mr. Van de Put offered an update on the business in a Nov. 1 call with investment analysts in connection with third quarter financial results. The company’s sales and adjusted earnings per share both rose about 16% from a year earlier.

“We continue to reshape our portfolio to focus on our core categories of chocolate, biscuits and baked snacks with the successful divestiture of our developed market gum business, generating additional reinvestment opportunities,” he said.

This sentiment also was supported by consumer response in an uncertain economic environment, he said.

“Consumers continue to choose our trusted and beloved brands, despite significant pricing due to ongoing inflation,” Mr. Van de Put said. “More broadly, we view our strong performance in the third quarter as evidence that our long-term strategy continues to pay off. Since launching our growth plan in 2018, we have consistently delivered gross profit dollar growth, which allowed for a virtuous cycle of yearly increasing high-return investments. We remain confident that this strategy will continue to consistently deliver attractive growth.”

Net income of Mondelez International in the three months ended Sept. 30 was $984 million, equal to 72¢ per share on the common stock, up 85% from $532 million, or 39¢ per share, in the third quarter last year. Net sales were $9.03 billion, up 16% from $7.76 billion in January-September 2022. Adjusted net income per share was up about 16%.

The jump in net income was attributed by Mondelez to several factors including a gain on marketable securities, lapping prior-year inventory step-up charges and mark-to-market effects. Partial offsets were higher acquisition integration costs, higher intangible asset impairment charges and other factors.

Gross profit margins at Mondelez surged 5%, to 38.7% from 33.7%. While net sales in the quarter increased $1.3 billion, cost of sales rose by only $385 million. Adjusted gross profit margin in constant currency widened by 120 basis points due to pricing, lower manufacturing costs and favorable product mix. Manufacturing costs were lower, driven by productivity gains, but raw material and transportation costs were higher.

Updating its financial guidance for the balance of the year, Mondelez said it expects organic sales growth of 14% to 15%, versus its prior outlook of 12% plus. Adjusted earnings per share growth is now forecast at 16%, versus the prior guidance of 12% plus.

Commenting on the outlook, Luca Zaramella, chief financial officer, said ingredient costs continue to rise.

“Pricing contribution will be clearly less important than this year, but we still see pricing contributing more than an average year, particularly as we need to price for cocoa, sugar and other commodities,” he said.

Operating income of the North America business of Mondelez in the third quarter was $611 million, up 31% from $465 million last year.

Sales were $2.85 billion, up 14% from $2.5 billion. Organic sales growth was 11.4%. The adjusted operating margin in North America in the third quarter was 21.5%, up from 19.7% the year before.

Accounting for the sales increase in North America, volume and mix contributed 4.6 percentage points of growth while pricing accounted for 6.8 points.

Scanner data show weakness in the biscuit category in North America, but Mr. Van de Put said the decrease reflects migration of lower-income families to non-measured club stores.

“Our total US biscuits volume was up more than 3% in Q3, showcasing the continued strength of our brands and investments in both measured and non-measured channels,” he said. “We are seeing particularly strong growth in unmeasured channels like club stores, e-commerce and food service.”

Meanwhile, Oreo remains a powerhouse brand for Mondelez, Mr. Van de Put said.

“Oreo continues to grow its strong position as the world's favorite cookie, and its share performance here in North America has grown nicely,” Mr. Van de Put said. “Our recent partnership with Super Mario Brothers executed both online and in-store is just one example of the many creative campaigns that leverage personalization and local relevance to reinforce the brand’s playfield persona. Along with continuous reinvestment in our brands, we are also investing in growth channels. For example, our belVita business is up nearly a full share point in the US club channel, driven by growing shopper interest in convenience, tasty and better-for-you options for morning snacking on the go.”

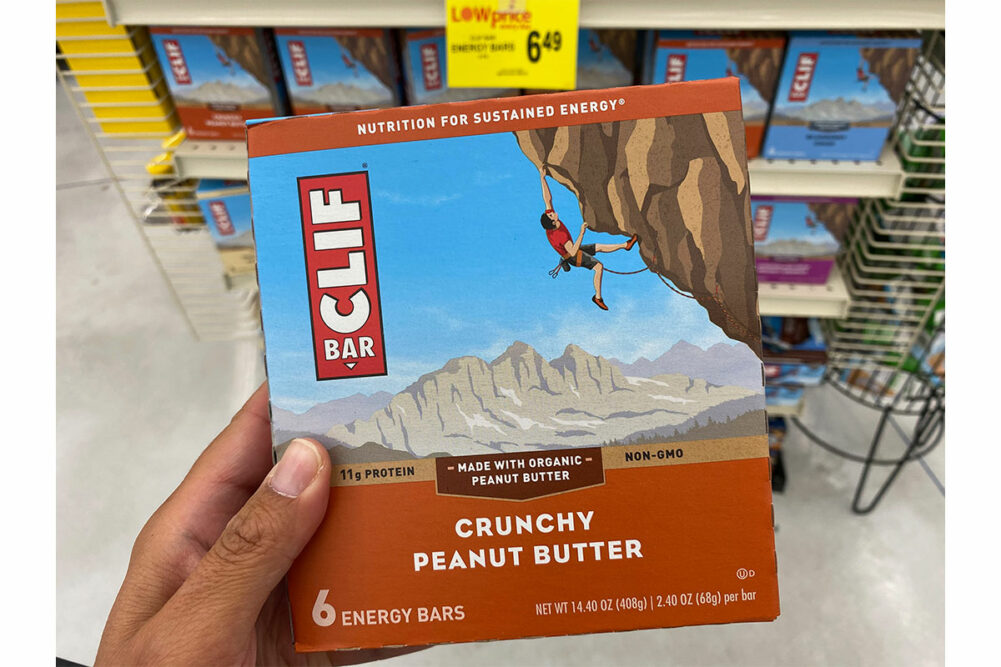

Mr. Van de Put said the recently constituted Mondelez snack bar business are poised to reach $1.2 billion in revenue in 2023.

“We believe there is significant runway ahead, led by the strong and growing brands of Clif Bar, Grenade and Perfect Snacks,” he said.

For Clif, he said the brand is performing well and has growth opportunities ahead via broader distribution, expansion into new formats and increased geographic reach. The brand has generated double-digit sales growth this year.

“The Clif Kid Zbar has been a particular standout,” he said. “Zbar is a delicious organic non-GMO soft-baked, whole grain energy snack for kids with zero trans fat or artificial flavors. Zbar is growing at twice the rate of the total bars category with consumption dollar growth up 19% versus last year.”

Performing well in the sports nutrition space, Grenade also has exceeded management expectations, Mr. Van de Put said. The business has doubled in size in the two years since acquisition. He said Perfect Snacks has strengthened its position as the top selling refrigerated protein bar in the United States.

Year-to-date net income at Mondelez was $4.01 billion, or $2.94 per share, up 88% from $2.13 billion, or $1.55 per share in 2022. Net sales were $26.7 billion, up 17% from $22.8 billion in January-September 2022.