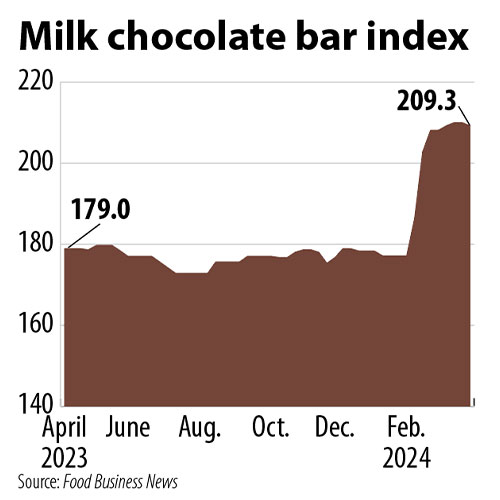

KANSAS CITY — Don’t bother telling cocoa buyers inflation is easing. On March 28, ICE cocoa futures for May were at $9,766 per tonne, or over three times as high as $2,933 per tonne a year ago.

Poor crops in West Africa mean food and beverage companies will deal with high cocoa prices for a while. Short-term options to help ease the price pain include ingredients that reduce the need for cocoa in applications. Longer term, cocoa plantations may invest in pre-harvest strategies to increase yield.

Reducing cocoa butter levels in applications is one option.

“Chocolate’s rheology has a big impact on the smoothness, viscosity and texture of the final product,” said Seyma Özonuk, applications manager team lead for confectionery and industrial bakery at Palsgaard, Juelsminde, Denmark. “Cocoa butter helps create a ‘normal’ rheology that allows manufacturers to create high-quality chocolate with a nice, smooth texture. If you want to cut down on the amount of cocoa butter you use, you need to replace its functional properties.”

Rheology is the study of flow behavior. Formulators have used lecithin since the 1930s to achieve a more normal rheology, but potential drawbacks for lecithin are an unpleasant taste and odor and, in white chocolate, discoloration, Özonuk said. Palsgaard offers sunflower-based AMP 4455 and rapeseed-based AMP 4458 that are neutral in terms of taste, odor and color, she said. They are ammonium phosphatide chocolate emulsifiers.

“AMP is an innovation that cuts costs without the need for any additional investment,” she said. “You might pay less upfront for lecithin, but switching to AMP will give you bigger savings overall, especially given the current cocoa butter prices.

“At the same dosage as lecithin, AMP might allow manufacturers to reduce cocoa butter usage by a further 3%. Cocoa butter costs are currently around $10. That means a medium-sized manufacturer producing 10,000 tons of chocolate a year would save 300 tons of cocoa butter with a total saving of around $3 million.”

The amount of cocoa butter reduced will vary by application.

“For example, in the chocolate used to coat a wafer or a bar, there needs to be a high level of fat to adjust the desired grammage and desired coating thickness,” Özonuk said. “The high fat levels in these applications mean there is room for big reductions, so the cocoa butter might be cut by as much as 4%. In solid chocolates, though, the fat content tends to be low so there’s less scope for reductions. Even so, if sales volumes are high, a reduction of just 0.5% of cocoa butter can mean substantial savings.”

Chicago-based Blommer Chocolate Co. may offer recommendations for appropriate usage levels at the start of a project or make line assessments later in the process, said Marie Loewen, applications manager, R&D.

“One thing to keep in mind is that cocoa butter is typically the most expensive part of a chocolate formula,” she said. “Since that is the main ingredient making it thinner (and therefore less coverage), a more expensive chocolate may have less cost-in-use.”

Not all chocolate or cocoa powder are equal, said Heidi Liu, product line manager at Blommer Chocolate.

“One cocoa or chocolate could have a much stronger chocolate taste impact than another, depending on the bean origin, roasting, and processing method, and formulation,” she said. “Thus, it’s critical to obtain a good understanding of the customer’s goals and targets in each application and help them choose the right ingredients to hit the sensory, nutritional and functionality targets.”

She gave an example of a chocolate cake using a lower amount of a stronger-tasting cocoa powder to reduce cost in use while achieving the same sensory target. Another example would be a chocolate-covered pretzel using a vegetable oil-based confectionery coating to replace a cocoa butter-based coating.

Consider caramel

Caramel color has been shown to reduce cocoa in applications, too.

“It will depend on the type of cocoa (alkaline, Dutch red, standard) used, but reductions could be up to 45%,” said Jackie Blunk, applications chemist for Sethness Roquette and based in Clinton, Iowa.

Class 1 and Class IV powder caramel colors are used most often when replacing cocoa, she said. Caramel color also may impart flavor characteristics that may prove beneficial.

When reducing cocoa levels, flavors may be needed, said Ken Legendre, R&D team leader for Sethness Roquette.

“In baking applications, flour can be added to make up the difference in usage between caramel color and cocoa,” he said. “Additionally, texturizers may be needed to complete the transition from cocoa to caramel color.”

Pre-harvest investments

The International Cocoa Organization on Feb. 29 anticipated global cocoa supply in the 2023-24 season to decrease by nearly 11% to 4.449 million tonnes when compared to the 2022-23 season.

Pre-harvest investments may benefit yield, and thus supply.

Barry Callebaut, Zurich, published a report on the 2021-22 cocoa agronomic season. Through research conducted by Agri-Logic in partnership with IDH and the Rainforest Alliance, data were collected and analyzed by surveying 561 farmers in 12 regions of the Ivory Coast. Almost two-thirds of cocoa in the world is produced in the Ivory Coast and Ghana, according to Barry Callebaut.

Fairtrade International considers a yield of 800 kilograms per hectare to be a sustainable yield. Based on the findings of Agri-Logic, less than 10% of the surveyed farmers produced yields of 800 kilograms or more per hectare in 2021-22, which was not enough for a living income. About 60% produced less than 600 kilograms per hectare.

Low investments in pre-harvest labor and inputs were linked to lower yields. Pre-harvest activities include pruning, fertilizing, spraying and collecting diseased pods. Farmers who produced yields within the highest 20% of the samples (producing over 650 kilograms per hectare as an example) invested three to five times more labor hours in pruning than farmers in the bottom 60% of yield distribution.

About 82% of surveyed farmers in 2021-22 used insecticides while 18% used fungicides and 6% used herbicides. The report recommended targeted use of fungicides to prevent black pod disease.